Are you a student looking to buy a new car? If so, you’re probably wondering what the best loan options are. Well, you’ve come to the right place! In this article, we’ll be discussing the different loan options available to help you get the car of your dreams. From low interest rates to flexible repayment terms, there’s something for everyone. So, whether you’re 18 years old or a bit older, you’ll be sure to find the right loan option for you. Let’s get started!

Understanding the Different Types of Loans Available

I’m a 18-year-old college student and I’m trying to decide the best loan option for buying a new car. I’m doing my research and learning about the different types of loans available. There’s the traditional auto loan, which is generally easier to get and tailored for car purchases. There’s also leasing, which can have lower monthly payments but you don’t own the car at the end. Then there’s refinancing, which can help lower monthly payments but may take longer to get approved. Finally, there’s a loan from a private lender, which may have less strict requirements but could come with higher interest rates. Understanding all of these loan options can help me make the best decision for my budget and lifestyle.

The Pros and Cons of Taking Out an Auto Loan

When it comes to taking out an auto loan, there are pros and cons to consider. On the plus side, it allows you to purchase a car even if you don’t have the cash for it upfront. You also have the flexibility to choose your car and customize the loan to fit your budget. On the downside, taking out a loan means you’ll pay interest, which can add up over time. You’ll also be responsible for making monthly payments on time, or you could face penalties. Ultimately, taking out an auto loan is a big decision, and it’s important to do your research and shop around for the best loan option for you.

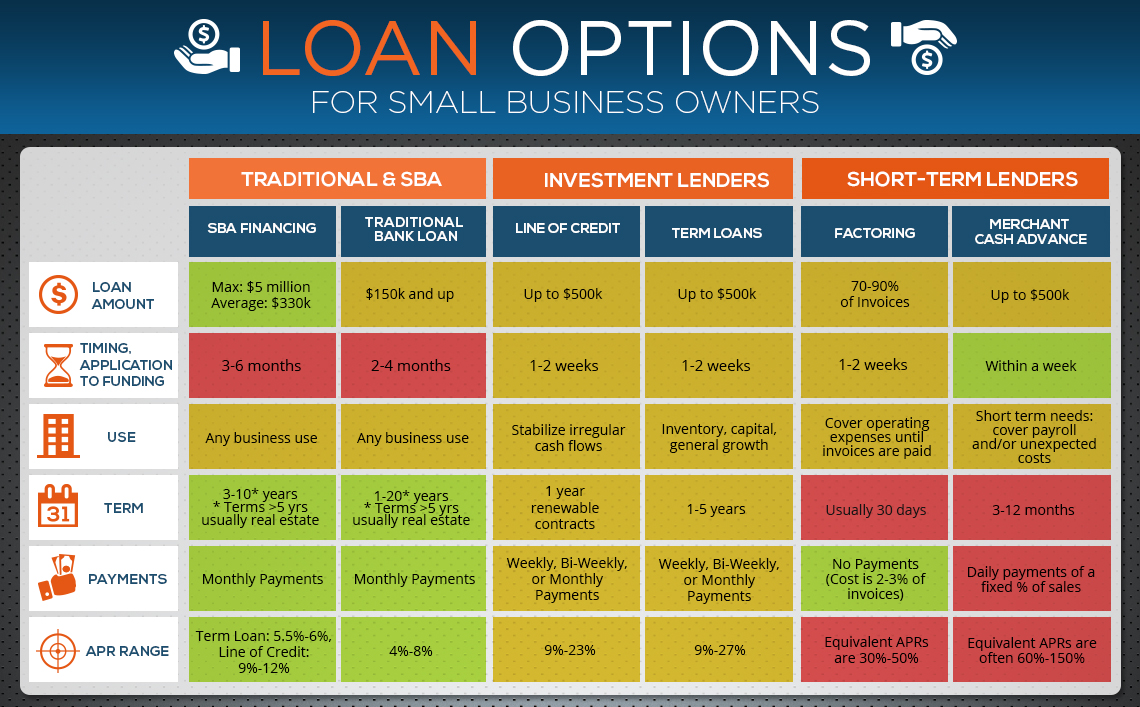

How to Compare Loan Rates and Terms

Comparing loan rates and terms can be overwhelming, but it’s essential to find the best loan option for buying a new car. Shopping around for the best rates is key, so don’t be afraid to look at multiple lenders. Check the annual percentage rate (APR) and the loan term length, as these will have a huge impact on the price you pay. Remember to factor in any additional fees, such as origination fees and pre-payment penalties, to get the full picture. Do your research to make sure you find a loan that meets your needs and fits your budget.

Tips for Getting the Best Loan Terms

When it comes to getting the best loan terms on a new car, it’s important to do your research and shop around. Start by looking at your local credit union or bank to see what rates they offer. You can also check online lenders like LightStream, which provide competitive rates and flexible terms. Make sure to compare loan options based on your credit score and the length of the loan. It’s also important to pay attention to any fees that may be associated with the loan. Finally, be sure to read the fine print carefully to make sure you understand the terms and conditions of the loan.

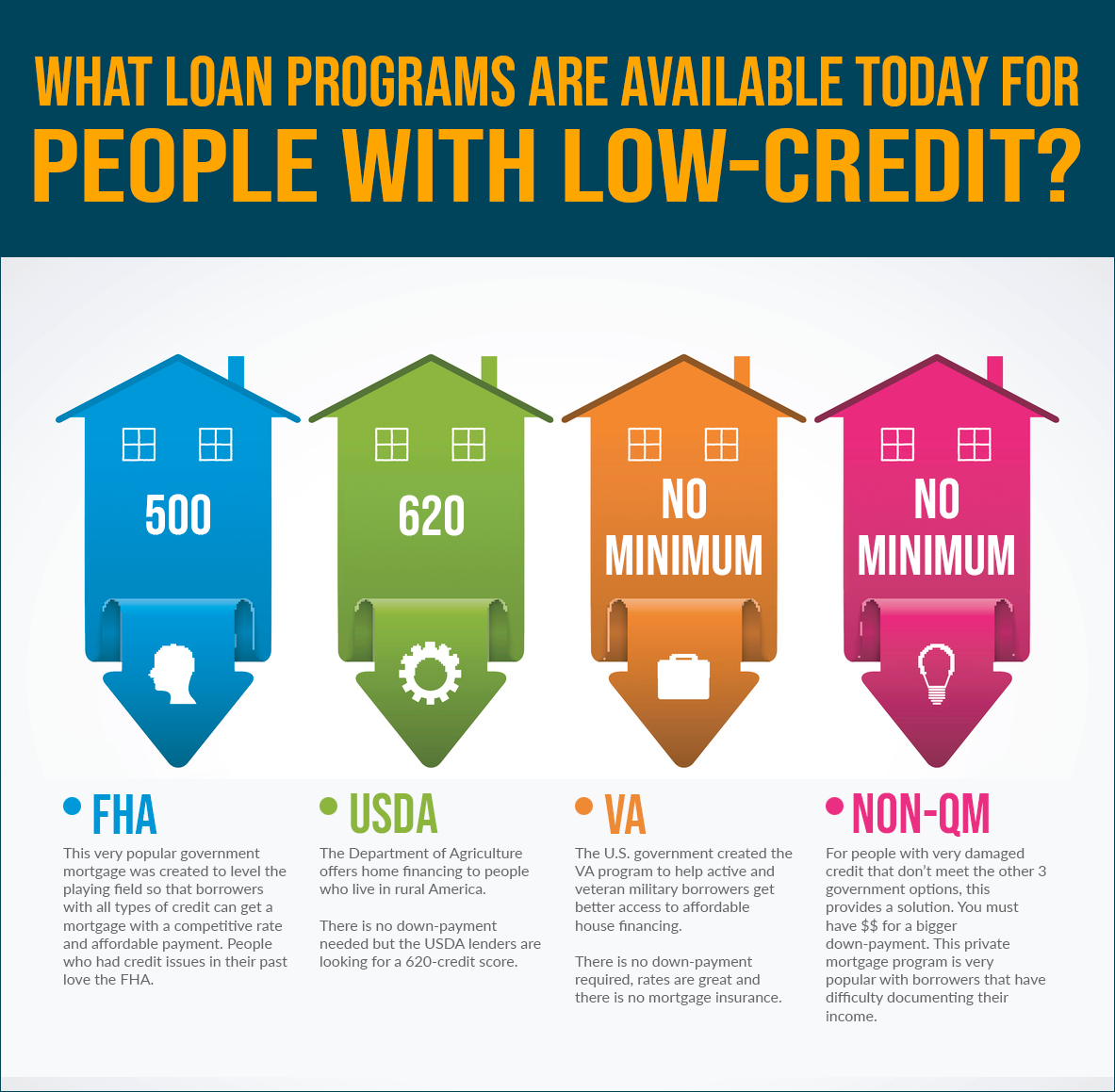

What to Do If You Have Bad Credit and Need to Buy a Car

If you’re 18 and have bad credit, don’t worry! You can still get a loan to buy a car. It may take some time to find the right lender, but it is possible. One option is to try to get a co-signer to help you get a loan. This person would need to have good credit and be willing to take on the responsibility of the loan if you are unable to pay it back. Another option is to look for lenders who specialize in bad credit loans. These lenders may be able to offer you a loan with higher interest rates, but it could still be a great way to get a car. You should also look into car dealerships who specialize in helping people with bad credit. They often have deals and discounts for those with poor credit.