Negotiating with your bank is a great way to get a better loan deal. Whether you’re an 18 year old student looking to finance college tuition or just want to save money on your existing loan, understanding how to negotiate can help you get the best deal for your money. In this article, I’ll share some tips and tricks on how to negotiate with your bank to get the best loan deal possible.

Understand Your Financial Situation and Create a Plan

As an 18-year-old, I’m starting to understand my financial situation more. I’m beginning to create a plan for my finances, learning how to budget and save, and also looking into ways to get a better loan deal with my bank. I know that having a good credit score is important, and I’m working hard to improve my score. I’m also researching the different types of loans available and understanding the terms and conditions of the loan to ensure I’m getting the best deal possible. By understanding my financial situation and creating a plan, I’m better prepared to negotiate a better loan deal with my bank.

Know Your Rights as a Borrower

As a borrower, it’s important to know your rights. Banks are required by law to provide you with all the details of your loan agreement, including the interest rate, fees, and repayment terms. Knowing this information will help you negotiate a better loan deal with your bank. It’s also important to understand the various consumer protections available to you. For example, the Truth in Lending Act requires banks to disclose all the costs associated with the loan and to provide the borrower with the right to cancel the loan within three days of signing. Make sure to read all the fine print carefully and ask questions before signing any agreement.

Research Other Banks to Compare Loans

As a student, I know it’s important to research to get the best deal. When it comes to loan deals, it’s extremely important to research other banks and compare different loans. This way, you’ll know which banks are offering the lowest interest rates and can negotiate a better deal with your bank. You can check the interest rate, fees, and other terms and conditions of the loans offered by other banks and then compare them with the terms of your bank. This will help you get the best deal and could potentially save you money.

Use Your Negotiation Skills to Reach a Better Loan Deal

As a young adult who is just starting out in life, it’s important to remember that negotiation skills can come in handy when it comes to securing a better loan deal with your bank. I recently found out that by using my negotiation skills, I was able to get a lower interest rate on my loan and also a longer period of repayment. I did this by doing my research beforehand, being confident, and presenting a strong case to my bank. I also made sure to be patient and not to be intimidated by the bank’s representatives. With a bit of negotiation and hard work, I was able to get a loan deal that was more suitable for my financial situation.

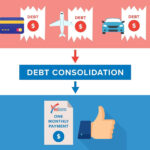

Consider Other Forms of Financing to Avoid Bank Negotiations

If you’re not comfortable negotiating a better loan deal with your bank, don’t worry. There are other options when it comes to financing! Consider using private lenders, credit unions, or even crowdfunding. These options can provide a lower interest rate and more flexible repayment terms. You could even choose to invest your money in the stock market, or get a loan from family and friends. Whatever you choose, make sure you do your research and know the risks involved before committing.