Are you 18 years old and trying to get a loan, but worried that your low credit score might be a problem? Don’t worry – it is possible to get a loan with a low credit score! In this article, I’ll cover everything you need to know about how to get a loan with a low credit score, from understanding your credit score to finding a lender that will work with you. Read on to find out how to get the loan you need, even with a low credit score!

Understand What Credit Score Lenders Look For

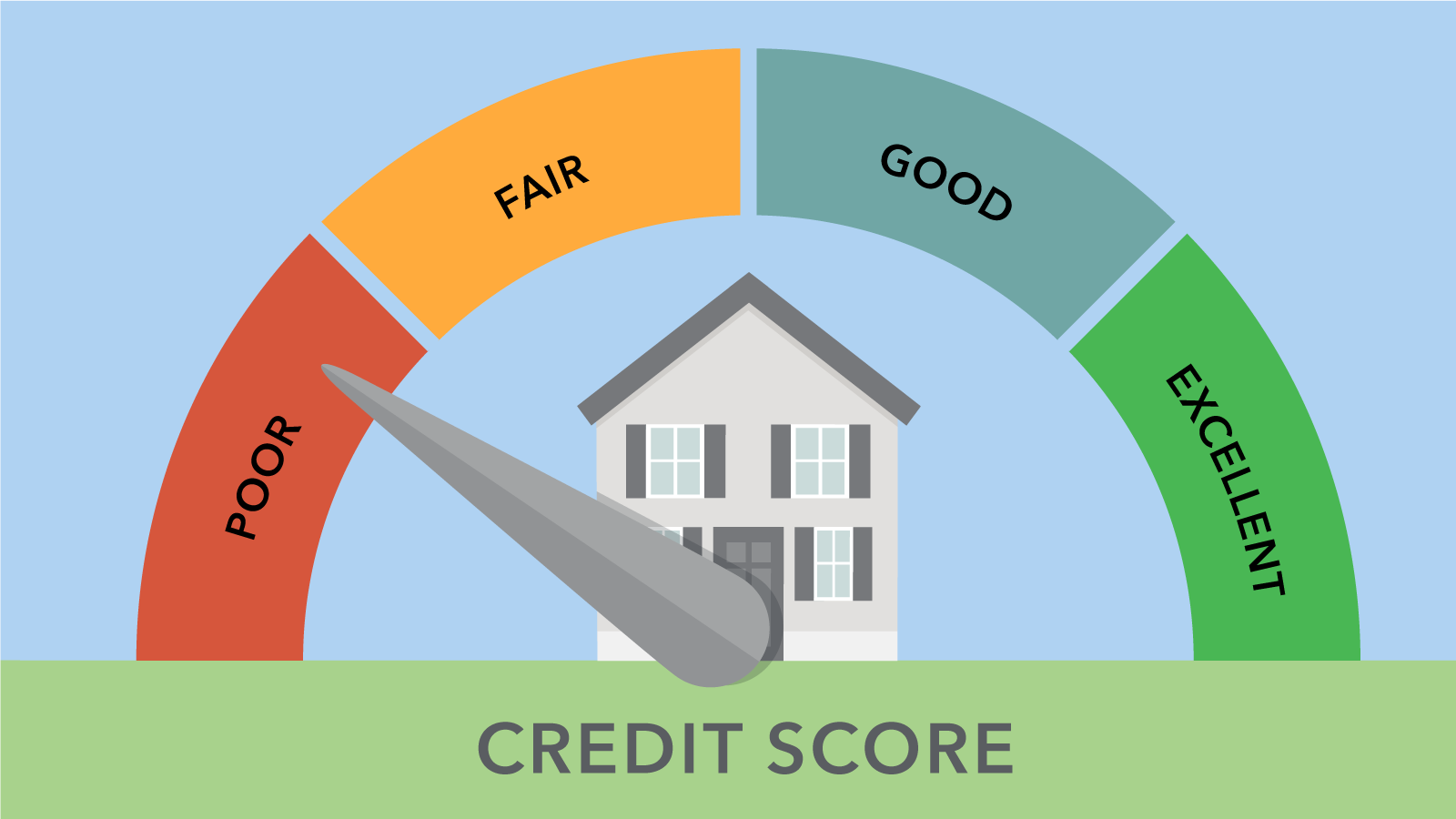

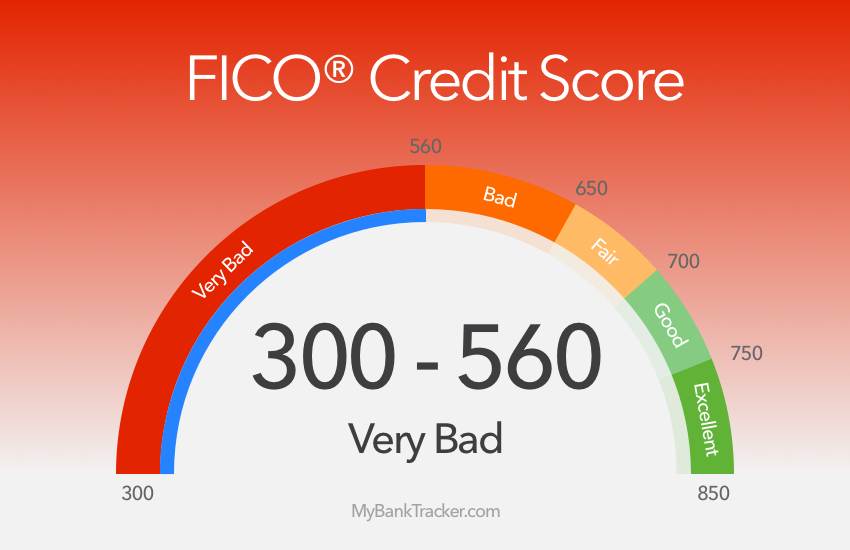

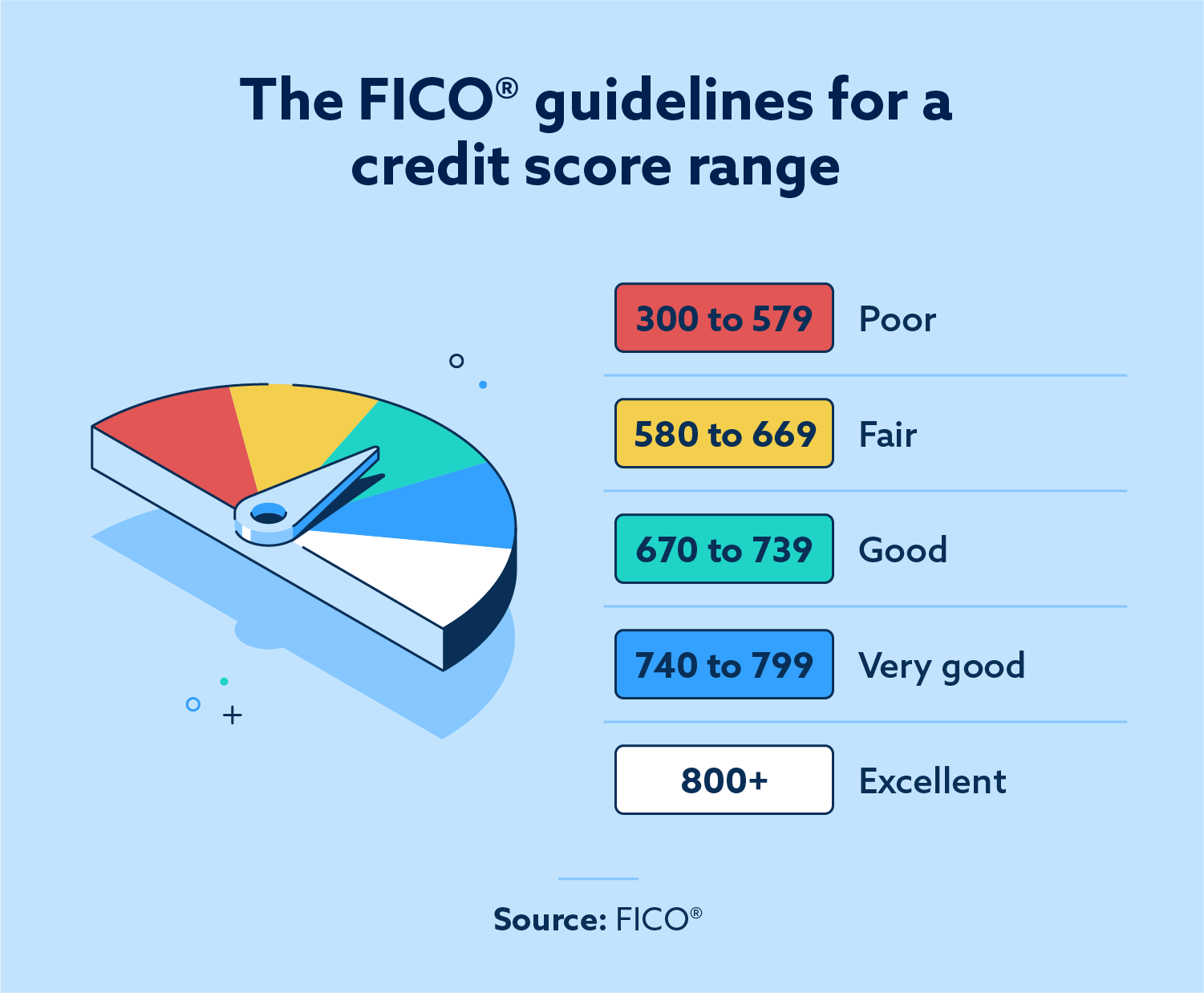

As a 21 year old, I understand that having a low credit score can make it difficult to get approved for a loan. It’s important to understand what lenders look for when evaluating a borrower’s credit score. While there is no one-size-fits-all approach, lenders generally look at a borrower’s payment history, credit utilization ratio, length of credit history, and types of credit in use. Paying bills on time, keeping credit card balances low, and diversifying credit accounts can all help to improve a credit score. Understanding these factors can help you get a loan even with a low credit score.

Gather Documents to Show Financial Responsibility

If you’re an 18 year old student hoping to get a loan with a low credit score, you’ll need to gather documents to show financial responsibility. Start by getting copies of your recent tax returns and bank statements. You’ll also need to provide proof of employment, such as pay stubs or a letter from your employer. Finally, you should have proof of any other assets you may have, such as investments or savings accounts. Gathering these documents will take time and effort, but they’re essential if you want to get the loan you need.

Research Different Types of Loans

Researching different types of loans is a great way to get a loan with a low credit score. It can be tricky to find the best loan if you have a bad credit score, but don’t get discouraged! There are a few options to consider, such as an unsecured loan, a secured loan, or even a loan from a credit union. Each of these loan types have their own benefits and drawbacks, so it’s important to make sure you research the different types to find the one that’s right for you. Don’t forget to use online resources to compare rates, so you can find the best loan for your financial situation.

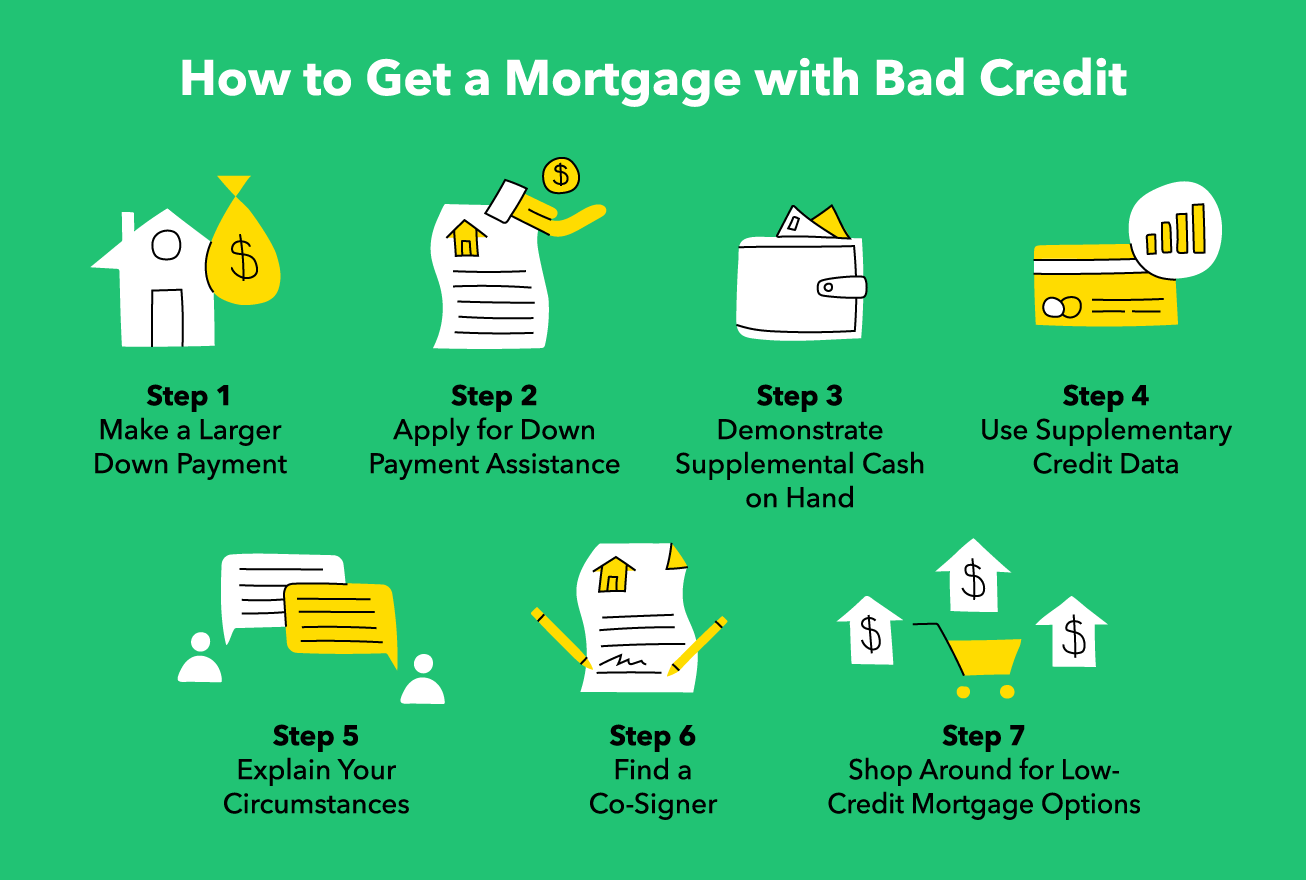

Consider Alternative Options to Secure a Loan

If you have a low credit score and are looking to secure a loan, it may be worth considering alternative options. One such option is peer-to-peer lending, whereby you can borrow money directly from a lender online. You may be able to get a loan even if your credit score is low, as lenders take other factors into account such as your income, job stability and existing debt. Another option could be to borrow from friends or family members. Although it can be difficult to ask for help, it can be beneficial for both parties – you get the loan you need, and they get to help you out. Additionally, you may even be able to get a loan from your employer, depending on the company you work for. Ultimately, there are plenty of options available to those with a low credit score, so don’t give up hope.

Use a Cosigner to Improve Your Chances of Approval

If you have a low credit score, getting a loan can be difficult. But having a cosigner can improve your chances of getting approved. A cosigner is someone who agrees to be legally responsible for the loan if you default on it. My parents have cosigned for me in the past and it has been a great help. I highly recommend finding a cosigner if your credit score is low – it can make a huge difference. Make sure you choose someone who has a good credit score and is willing to take on the risk of being a cosigner. This can give you access to lower interest rates and better loan terms.