Are you considering purchasing a new home, and feeling overwhelmed by the mortgage process? Look no further, as we’ve got the ultimate guide to help you navigate the complex world of mortgage points. In this in-depth article, we’ll explore the ins and outs of mortgage points – what they are, how they work, and most importantly, whether they’re worth it for you. Get ready to become an expert in your home financing journey, and make an informed decision that could potentially save you thousands of dollars in the long run! So, let’s dive into the world of mortgage points and unlock the secrets to successful home financing.

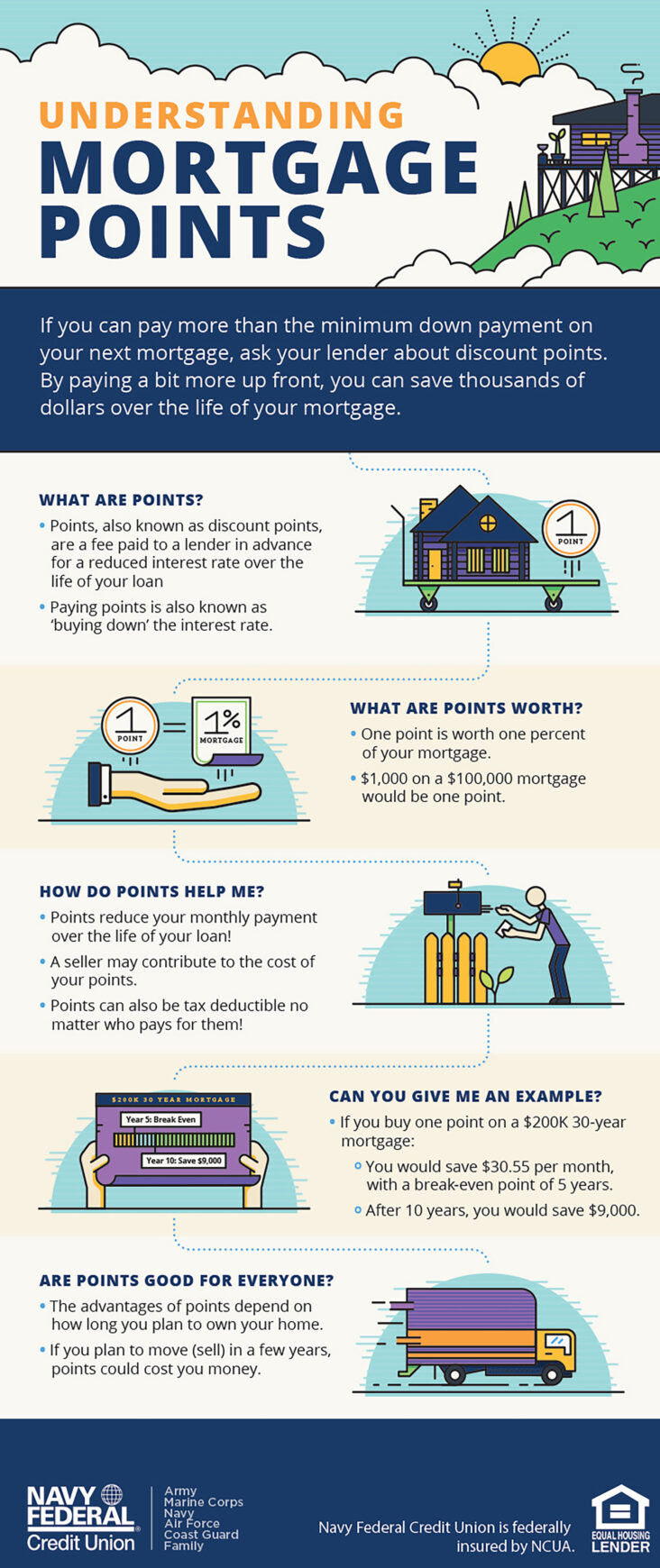

Understand mortgage points and types.

Dive into the world of mortgage points and discover the two main types: discount and origination. Learn how paying for discount points can lower your interest rate, saving you major bucks in the long run, while origination points cover lender fees. Explore if these points are worth the investment for your unique situation.

Evaluate financial situation and goals.

Before diving into mortgage points, it’s essential to evaluate your financial situation and goals. Analyze your budget, credit score, and long-term plans to determine if buying points is a smart move. Remember, mortgage points can lower monthly payments, but they also require upfront costs – so ensure it aligns with your financial goals.

Compare lenders and point offers.

In your quest to secure the best mortgage deal, it’s essential to shop around and compare lenders and point offers. Don’t just settle for the first offer you come across; explore your options and weigh the pros and cons. Remember, finding the right balance between points and interest rates can save you thousands in the long run. Happy house hunting!

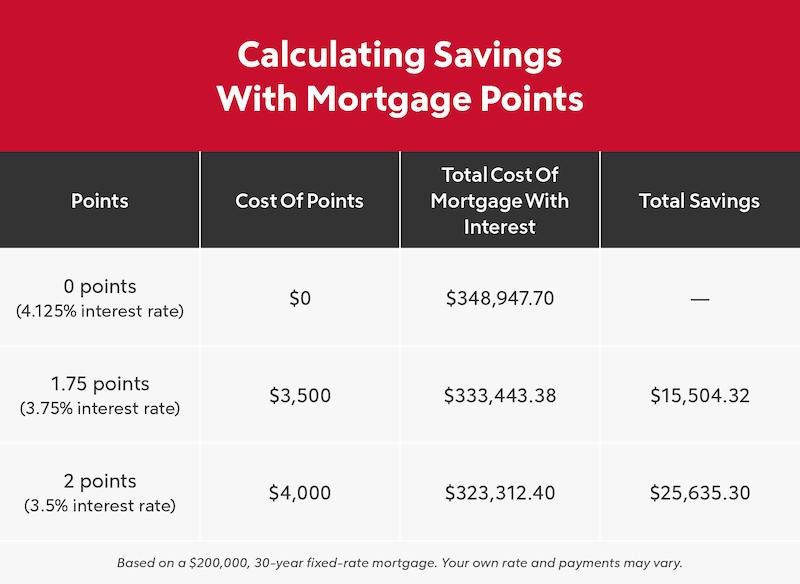

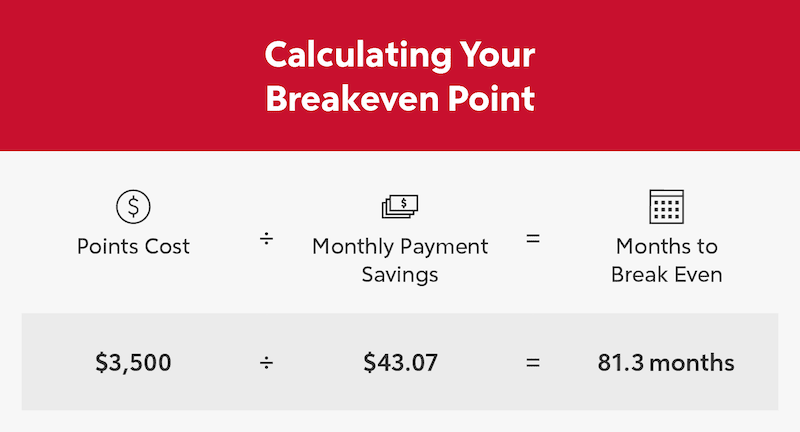

Determine break-even point for savings.

Unlock the secret to mortgage points savings by cracking the break-even point code! This magic number reveals when your upfront investment starts paying off, so you can make a smart, informed decision. Don’t let confusing jargon hold you back – dive into our easy-to-follow guide and become a mortgage points master today!

Assess tax implications for points.

When considering mortgage points, don’t forget to evaluate the tax implications. Mortgage points may be tax-deductible, potentially lowering your overall tax burden. However, these deductions vary based on your specific situation, so consult a tax professional before making any decisions to ensure you’re making a financially savvy move.

Make informed decision, consult professionals.

Making an informed decision is crucial when considering mortgage points. Don’t hesitate to consult professionals such as loan officers or financial advisors to weigh the pros and cons. With expert guidance, you’ll confidently determine if investing in mortgage points is worth it for your unique financial situation.