Are you ready to embark on the exciting journey of homeownership but unsure of how much house you can truly afford? Look no further! Our comprehensive guide on how to use a mortgage affordability calculator will help you accurately determine your budget, ensuring you find the perfect home without breaking the bank. With valuable tips and insights, you’ll be able to confidently navigate the real estate market, armed with the knowledge of your financial capabilities. So, say goodbye to guesswork and hello to homeownership with this essential tool for every aspiring homebuyer.

Gather financial information and documents.

Kickstart your mortgage affordability journey by rounding up all your financial deets. You’ll need documents like pay stubs, tax returns, bank statements, and a list of your debts (think student loans, credit card balances). The more accurate your info, the better the calculator can help you find your dream home budget!

Locate a mortgage affordability calculator.

Kickstart your home-buying journey by locating a user-friendly mortgage affordability calculator online. Simply search “mortgage affordability calculator” on your preferred search engine, and you’ll find a plethora of options. These handy tools can help you estimate your ideal budget, ensuring you can comfortably afford your dream home while balancing other financial priorities.

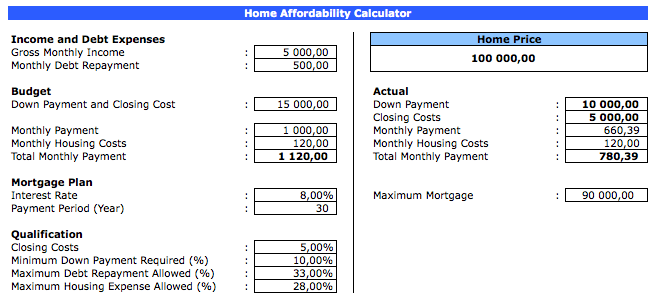

Input income, expenses, and debts.

In this crucial step, you’ll input your income, expenses, and debts into the mortgage affordability calculator. This info helps paint a clear picture of your financial situation, ensuring you find a home that doesn’t break the bank. Properly assessing your budget is the key to a stress-free home-buying journey!

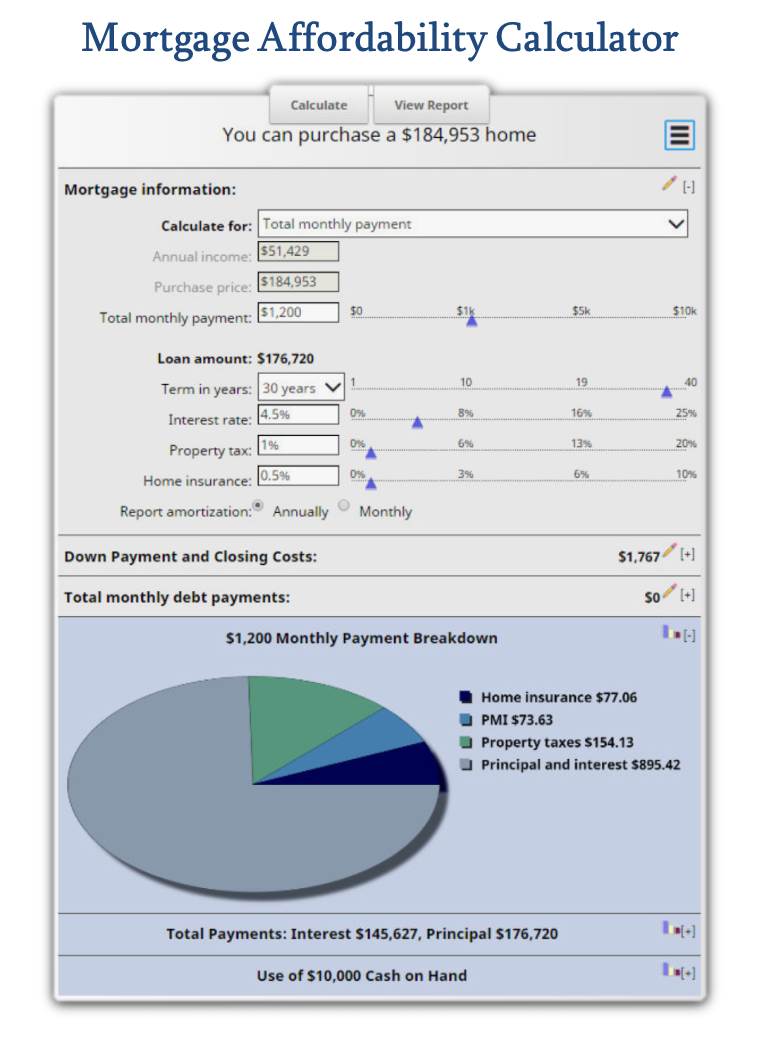

Adjust loan term and interest rate.

Discover the magic of tweaking your loan term and interest rate with a mortgage affordability calculator! Play around with different combinations to find the perfect balance for your budget. Remember, a lower interest rate or a longer loan term can make a huge difference in your monthly payments. Unlock the best options for your dream home today!

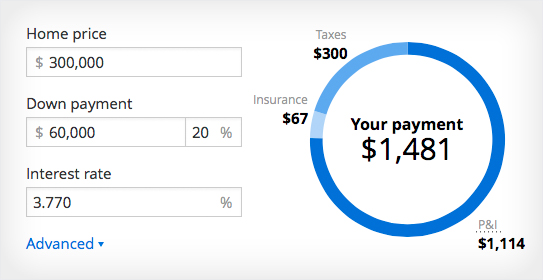

Evaluate the estimated monthly payment.

Dive into the homebuying process confidently by evaluating your estimated monthly mortgage payment with a mortgage affordability calculator. Easily determine your budget by considering factors like loan amount, interest rate, and loan term. Stay in control of your finances and secure your dream home without breaking the bank!

Adjust and reassess until satisfied.

Discover your perfect budget by tweaking the variables in a Mortgage Affordability Calculator. Experiment with loan terms, interest rates, and down payment amounts until you’re satisfied with the results. Keep refining your options to ensure you’re making a smart financial decision for your dream home. Stay on top of the game with this powerful tool.