Are you looking for an affordable way to purchase a home? A low ratio mortgage may be the answer! It allows you to borrow a larger amount with a smaller down payment, meaning you can take advantage of lower interest rates and more favourable repayment terms. In this article, we’ll explore what a low ratio mortgage is, how to qualify for one, and the potential benefits it could provide. Keep reading to learn how you can get a low ratio mortgage and take the first steps to owning your dream home.

Research mortgage providers

Researching mortgage providers can be a daunting task, but it’s possible to find a loan with a low ratio mortgage if you take the time to compare different providers. Shop around and don’t settle for the first offer you get, as it may not be the best deal for you.

Securing a low ratio mortgage can be daunting, but there are steps you can take to make the process go more smoothly. Start by shopping around for the best rate and researching various lenders. Talk to friends and family who have recently gone through the process and ask their advice. Lastly, make sure you have a full understanding of all the terms and conditions associated with the mortgage before signing.

Compare interest rates

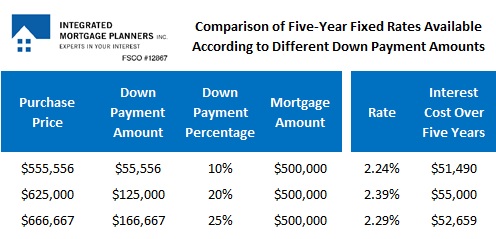

.When comparing interest rates for a low ratio mortgage, make sure to consider the long-term effects of each rate. Consider factors such as the length of the loan, the payment terms, and the penalties associated with early repayment before making a decision.

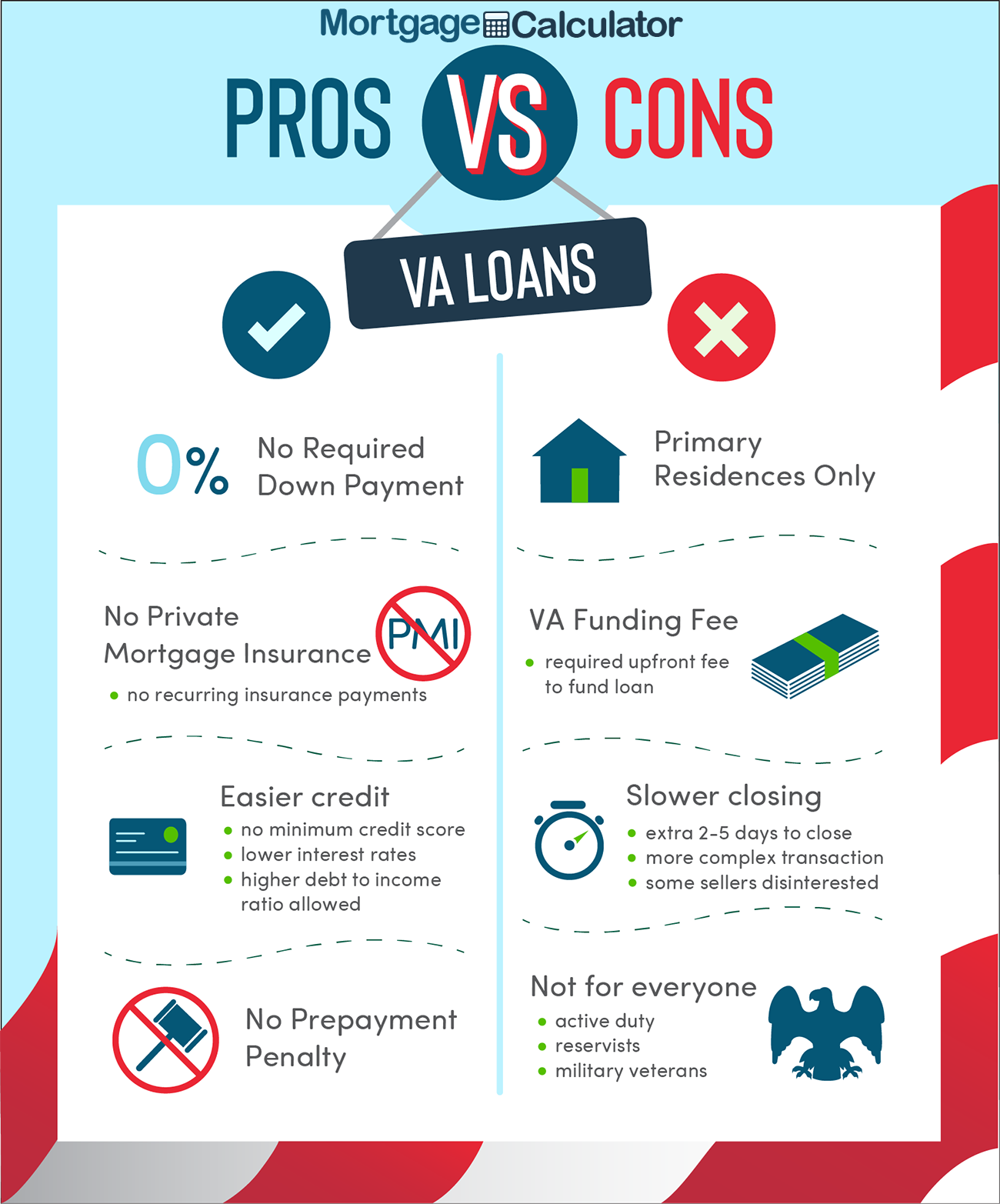

If you’re looking to get a low ratio mortgage, it’s important to understand what it is and how to qualify. A low ratio mortgage typically involves taking out a loan that is less than 80% of the value of your home. This can be beneficial as it can result in lower interest rates, lower closing costs, and a smaller down payment. Before applying for a low ratio mortgage, make sure to check your credit score and income to determine if you meet the lender’s eligibility requirements.

Calculate loan amount

Calculating the loan amount for a low ratio mortgage is an important step in the process. To calculate the loan amount, you’ll need to know the purchase price, down payment amount, and the loan-to-value ratio. Once you have all of this information, you can then determine the maximum loan amount.

One of the best ways to get a low ratio mortgage is to shop around and compare different loan products. Look for options that offer the lowest interest rate, the smallest down payment and the most favourable terms. Also, make sure to check your credit score and improve it if necessary.

Calculate income and expenses

When calculating income and expenses for a low ratio mortgage, it is important to be as accurate as possible. Make sure to include all sources of income, such as wages, investments, and rental income, as well as all expenses including mortgage payments, credit card payments, and any other loans. Being honest and transparent with income and expenses can go a long way in helping you get the best terms for your low ratio mortgage.

Getting a low ratio mortgage can be a great way to save money on your home purchase. To get the best rate, it is important to shop around and compare different lenders. You can also look into refinancing your current mortgage to get a lower rate. Additionally, make sure to have a good credit score and to provide adequate documentation for the lender.

Apply for mortgage pre-approval

Applying for a mortgage pre-approval is an important step to take when looking for a low ratio mortgage. It can help you secure a great rate and ensure that you are well-prepared when you apply for your loan. Not only does it give you an idea of what your loan can look like, it also puts you in a stronger position when applying for a mortgage.

If you’re looking for a low ratio mortgage, there are a few key tips to keep in mind. Shop around for the best rates and make sure to compare lenders to find the best deal. Review your credit score prior to applying and work on improving it if it’s not as high as you’d like. Finally, don’t be afraid to ask for assistance from a financial advisor or mortgage broker if needed.

Submit loan application.

Submitting a loan application for a low ratio mortgage can seem intimidating. However, by following the right steps and having all the necessary documents on hand, the process can be made much simpler.