Are you considering tapping into the hidden potential of your home’s equity to fund a major expense or consolidate debt? If so, a home equity loan may be the financial solution you’re seeking. But before diving headfirst into this popular lending option, it’s crucial to weigh the pros and cons of a home equity loan. In this comprehensive guide, we’ll explore the ins and outs of home equity loans, their advantages and drawbacks, and help you make an informed decision that aligns with your financial goals. Don’t miss out on unlocking the true value of your home – read on to discover if a home equity loan is the right fit for your unique financial situation.

Lower interest rates: Home equity loans typically have lower interest rates compared to other types of loans, such as personal loans and credit cards

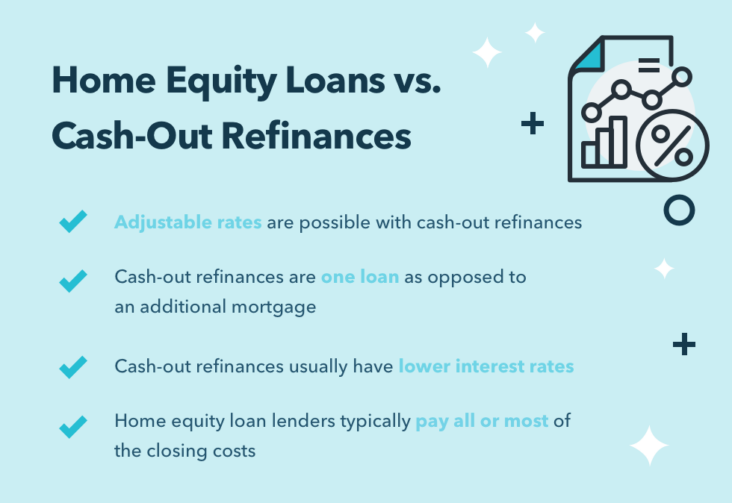

One significant advantage of home equity loans is their lower interest rates, which can save borrowers a substantial amount of money in the long run. Since these loans are secured by your home’s equity, lenders perceive them as less risky and are therefore more inclined to offer competitive rates. As a result, homeowners can benefit from reduced borrowing costs, making home equity loans a more affordable option when compared to high-interest alternatives like personal loans or credit cards. By opting for a home equity loan, you can leverage your property’s value to secure a cost-effective solution for financing major expenses or consolidating debt, while also potentially improving your credit score.

This can help you save money on interest payments over the life of the loan.

One of the primary benefits of a home equity loan is the potential to save a significant amount on interest payments over the life of the loan. By leveraging the equity in your home, you can typically secure a lower interest rate compared to other forms of credit, such as personal loans or credit cards. This lower rate translates to reduced monthly payments and less interest paid over time, which can greatly impact your overall financial stability. Furthermore, with a fixed-rate home equity loan, you can enjoy predictable payments and avoid the volatile fluctuations that come with variable-rate loans. In short, opting for a home equity loan can be a financially savvy decision that ultimately saves you money in the long run.

Tax-deductible interest: The interest paid on a home equity loan may be tax-deductible, depending on how the funds are used

One significant advantage of a home equity loan is the potential for tax-deductible interest. The interest paid on such loans may be eligible for tax deductions, particularly if the funds are utilized for home improvements, debt consolidation, or other qualifying expenses. This financial benefit can help borrowers reduce their taxable income, potentially leading to substantial savings during tax season. However, it’s essential to consult with a tax professional to understand the specific tax implications and eligibility criteria for your individual situation. Overall, the tax-deductible nature of home equity loan interest can be an impactful factor in your decision-making process.

If the loan is used for home improvements or other qualifying expenses, the interest can be deducted from your taxable income, potentially reducing your tax liability.

Home equity loans can be advantageous when utilized for home improvements or other qualifying expenses, as the interest paid on these loans may be tax-deductible. This tax benefit can potentially lower your overall tax liability, providing significant savings during tax season. By investing in your property through renovations and upgrades, you can also increase its value, thereby enhancing your financial status. However, it’s essential to consult with a tax professional to ensure your planned expenses qualify for the tax deduction. Leveraging a home equity loan for eligible purposes can be a strategic move to optimize your financial portfolio and maximize the benefits of home ownership.

Large loan amounts: Since the loan is secured by your home’s equity, you can typically borrow a significant amount of money

One significant advantage of a home equity loan is the ability to access large loan amounts, which can be extremely beneficial for homeowners in need of substantial funds. This is possible because the loan is secured by your home’s equity, allowing you to borrow against the value of your property. As a result, home equity loans often provide a more cost-effective solution for major expenses, such as home renovations, debt consolidation, or college tuition. By leveraging the value of your property, you can obtain the necessary funds while potentially benefiting from lower interest rates and favorable repayment terms compared to unsecured loans.

This can be useful for funding large expenses, such as

A home equity loan can be an advantageous financial tool when it comes to funding significant expenses, such as home renovations, college tuition, or debt consolidation. By tapping into the equity in your home, you gain access to a large lump sum at a lower interest rate compared to credit cards or personal loans. This cost-effective method enables homeowners to borrow funds while preserving their savings and investments. However, it’s essential to consider the potential risks and carefully assess your financial situation before opting for a home equity loan, as it could impact your long-term financial stability and home ownership.