Are you an 18 year old student feeling overwhelmed by debt? You’re not alone; rising student loan debt, credit card debt, and other expenses can make it difficult to get back on track. But the good news is that there are debt consolidation loans available that can help you get out of debt faster! In this article, we’ll cover the top 5 debt consolidation loans to help you get out of debt quickly and easily.

What is Debt Consolidation and How Can It Help You?

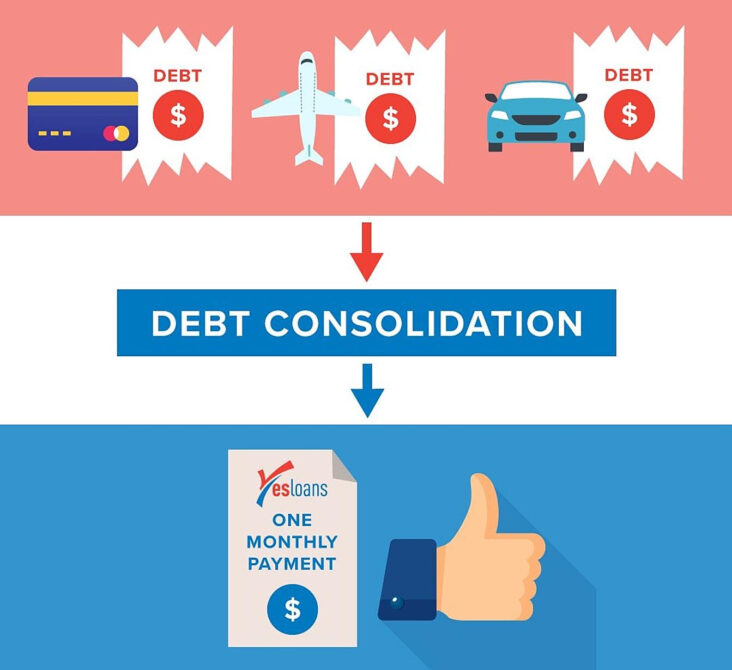

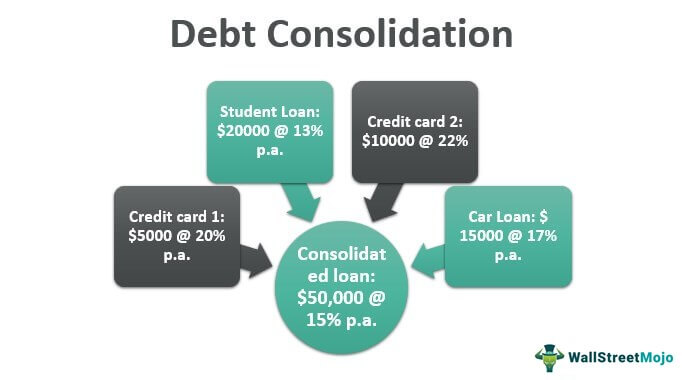

Debt consolidation can be a great way to get out of debt faster. It involves taking out one loan to pay off multiple debts, such as credit cards or student loans. This can be beneficial because it simplifies your monthly payments, and may even lower your interest rate, so you can pay off your debt faster. Additionally, it can make it easier to keep track of your payments. Debt consolidation can help you pay off your debt faster, save money on interest, and simplify your financial life.

Understanding the Different Types of Debt Consolidation Loans

When it comes to getting out of debt, debt consolidation loans are a great option. There are a few different types of debt consolidation loans, so it’s important to understand the differences between them. A secured loan requires collateral, such as a car or house, to be used as security against the loan. An unsecured loan, on the other hand, is based solely on the borrower’s creditworthiness. Personal loans and balance transfer credit cards are the two most popular types of unsecured debt consolidation loans. Finally, a home equity loan uses the equity in your home as collateral and can give you a lower interest rate than unsecured loans. All of these loan types can help you get out of debt faster, but make sure to do your research before deciding which one is right for you.

Why You Should Consider Getting a Debt Consolidation Loan

If you’re looking to get out of debt, a debt consolidation loan can be a great option. With a debt consolidation loan, you can combine multiple debts into a single loan with a lower interest rate, helping you to save money and pay off your debt faster. Not only will you save money on interest payments, but you can also simplify your monthly payments by having just one payment to make each month. Plus, you get the chance to rebuild your credit score by making timely payments on your loan. Getting a debt consolidation loan is a smart decision for anyone struggling to get out of debt.

Comparing the Top 5 Debt Consolidation Loans

Comparing the top 5 debt consolidation loans can be a daunting task. Knowing the pros and cons of each one can be the difference between getting out of debt fast and taking longer to get out of debt. Every loan will have different benefits and drawbacks, so it’s important to analyze each one before making a decision. Some of the factors to consider are the interest rate, loan term, and fees. Additionally, it’s important to look at the loan’s customer service ratings, eligibility requirements, and repayment options. Taking the time to evaluate each loan can make it easier to choose the best one for your situation.

Tips for Getting the Most Out of Your Debt Consolidation Loan

Getting the most out of your debt consolidation loan is a great way to get rid of debt quickly and efficiently. It is important to do your research and compare different lenders to make sure you get the best rate possible. Additionally, you should look into different repayment plans and make sure you understand the terms and conditions of the loan before signing up. Make sure that you can afford the monthly payments and that there are no hidden fees or surprises. Finally, make sure you look for any incentives or rewards for paying off the loan early, as that can be a great way to save money.