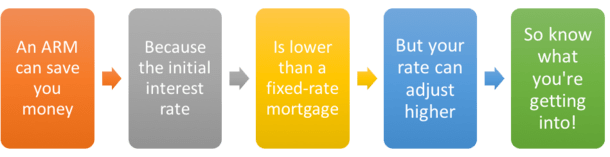

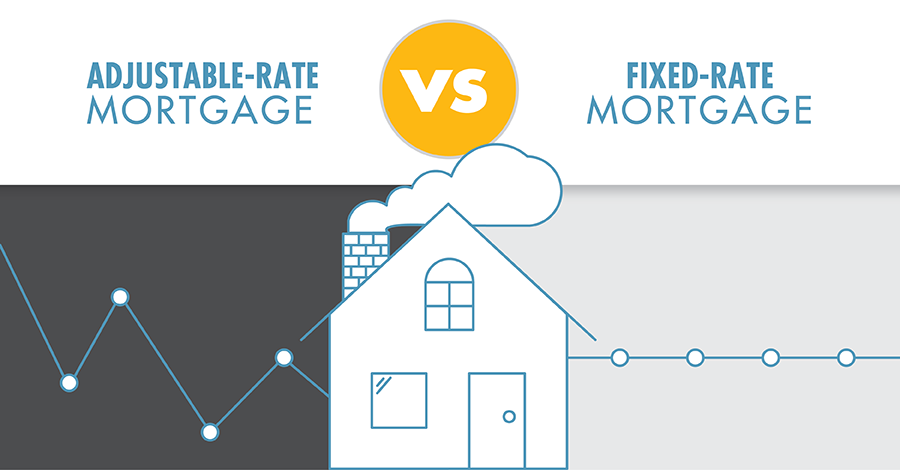

Are you looking to get an adjustable rate mortgage but want to secure a fixed period? Adjustable rate mortgages (ARMs) have become a popular option among homeowners and buyers due to their lower interest rates, but their fluctuating rates can be a major disadvantage. Luckily, it is possible to get an adjustable rate mortgage with a fixed period, allowing you to benefit from the lower rates without worrying about rate changes in the future. In this article, we’ll explain the basics of adjustable rate mortgages and how to get one with a fixed period.

Research mortgage lenders.

When researching mortgage lenders, compare rates, fees, and customer reviews to find the best one for you. Don’t forget to ask about their adjustable-rate mortgage options with fixed periods.

Compare options.

When comparing adjustable rate mortgage options, be sure to look at the fixed period length and consider whether it’s a good fit for your financial situation.

Choose fixed period.

It is important to choose a fixed period for your adjustable rate mortgage if you want to be sure of what your monthly payments will be for the duration of the loan.

Calculate affordability.

When calculating your affordability for an adjustable rate mortgage with a fixed period, it is important to consider all of your current expenses, such as student loans, car payments, and other debt. Additionally, you should also factor in potential increases in interest rates over the life of the mortgage.

Submit application.

When applying for an adjustable rate mortgage with a fixed period, it’s important to make sure all of your documentation is up-to-date and accurate. Make sure to provide all of the necessary paperwork to ensure that your application is considered.

Negotiate terms.

When negotiating the terms of an adjustable rate mortgage with a fixed period, it’s important to be clear about what you’re asking for and to always be prepared to walk away if the terms aren’t suitable for you.