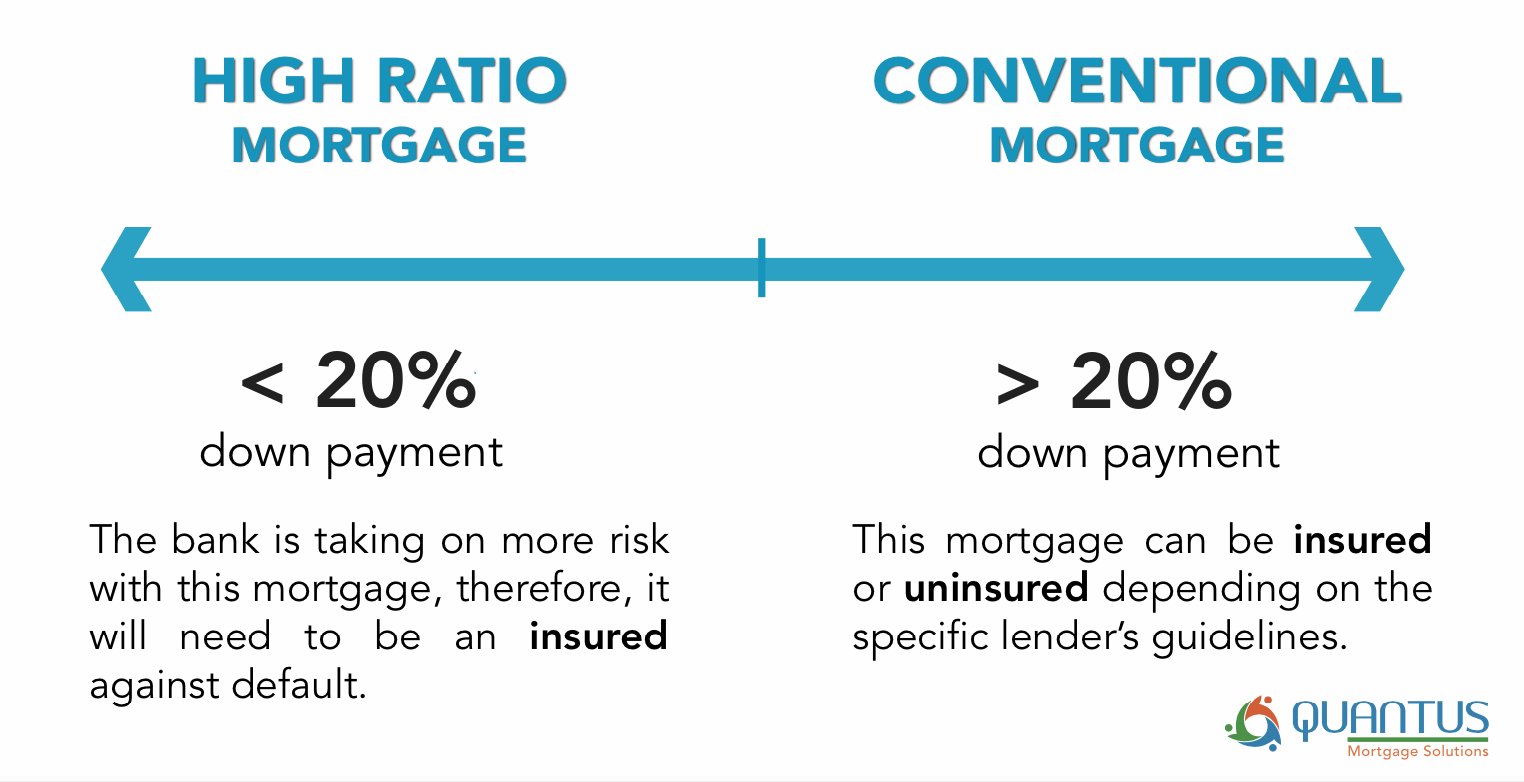

Are you looking to get a high ratio mortgage? It can be a complicated process and it’s important that you understand the basics of how to get one. With the right information, though, you can make the process of getting a high ratio mortgage smoother and easier. In this article, we’ll provide you with all the information you need to know about how to get a high ratio mortgage, including what it is, the benefits of it, and how to qualify for one. You’ll also get answers to some of the most common questions about high ratio mortgages and find out some of the best places to start looking for one. So if you’re looking to make your dreams of homeownership a reality, this article is for you!

Research lenders & rates.

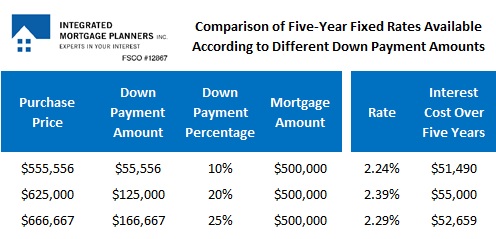

When researching lenders and rates, it is important to compare different rates and lenders to find the best deal for your needs. Make sure to shop around and read the fine print to ensure you get the best deal possible.

Compare mortgage terms.

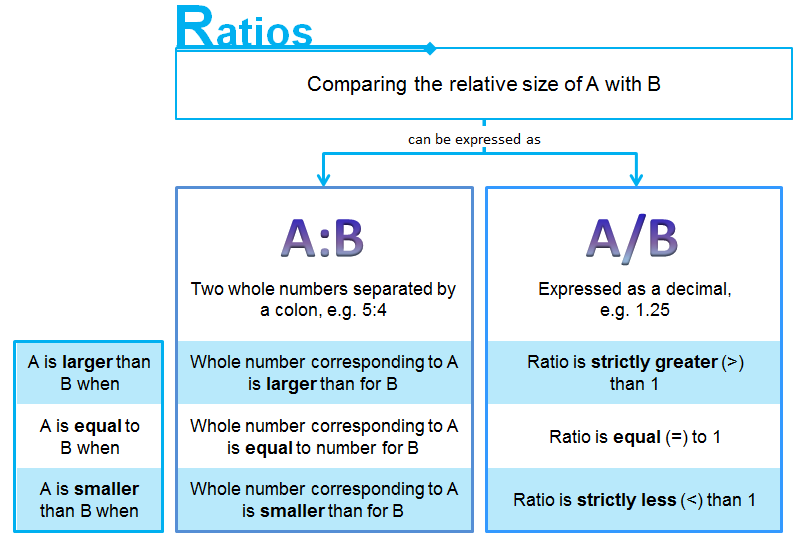

When comparing mortgage terms, it is important to consider the costs associated with the loan as well as the interest rates and terms. Look for mortgages that offer a high loan-to-value ratio, which will allow you to borrow more against the value of your home.

Check credit score.

It is important to check your credit score if you want to get a high ratio mortgage. Knowing your credit score can help you understand how lenders may view you and if you are eligible for a loan. Make sure to check your credit score before applying for a mortgage.

Document income & assets.

When applying for a high ratio mortgage, it is important to provide accurate and up-to-date documentation of your income and assets to ensure that you qualify. Make sure you have all the necessary records and documents ready to submit.

Secure pre-approval.

Securing pre-approval is an important step when looking to secure a high ratio mortgage. Pre-approval will give you an understanding of how much you can borrow and what your budget should be. It is recommended you get pre-approved before you start shopping for a home.

Apply for mortgage.

When applying for a high ratio mortgage, it’s important to do your research and compare rates to find the best mortgage for you. Make sure to check your credit score and gather all the necessary documents for your application.