Getting a loan for medical expenses can feel like an overwhelming task. As an 18 year old student, it can feel like a big ask to figure out the complicated process of securing a loan. But don’t worry, it doesn’t have to be so daunting! With the right information and preparation, you can get the loan you need to pay for medical expenses. This article will walk you through the steps and provide you with tips on how to get a loan for medical expenses.

Assessing Your Financial Options for Medical Expenses

If you’re looking for ways to fund your medical expenses, first assess your financial options. If you’re 18 and have a job, you may be able to take out a personal loan from a bank or credit union. You’ll need to give them proof of income and credit history to qualify, and the interest rate will vary depending on your credit score. You may also be able to apply for a loan from a government-backed program, like Medicaid, or even from a charity organization. Be sure to research the qualifications for each loan option to see if you qualify.

Understanding the Different Types of Loans Available for Medical Expenses

If you’re looking to finance your medical expenses, there are a few different loan options available. Depending on your credit score and income, you may qualify for a secured loan, unsecured loan, or a payday loan. A secured loan involves putting up collateral, such as a home or car, to secure the loan. An unsecured loan doesn’t require collateral, but you may need to have good credit and a reliable income to qualify. Payday loans are short-term and require you to pay the loan back within a certain time period. These types of loans often come with high interest rates, so it’s important to compare the terms of each loan before committing.

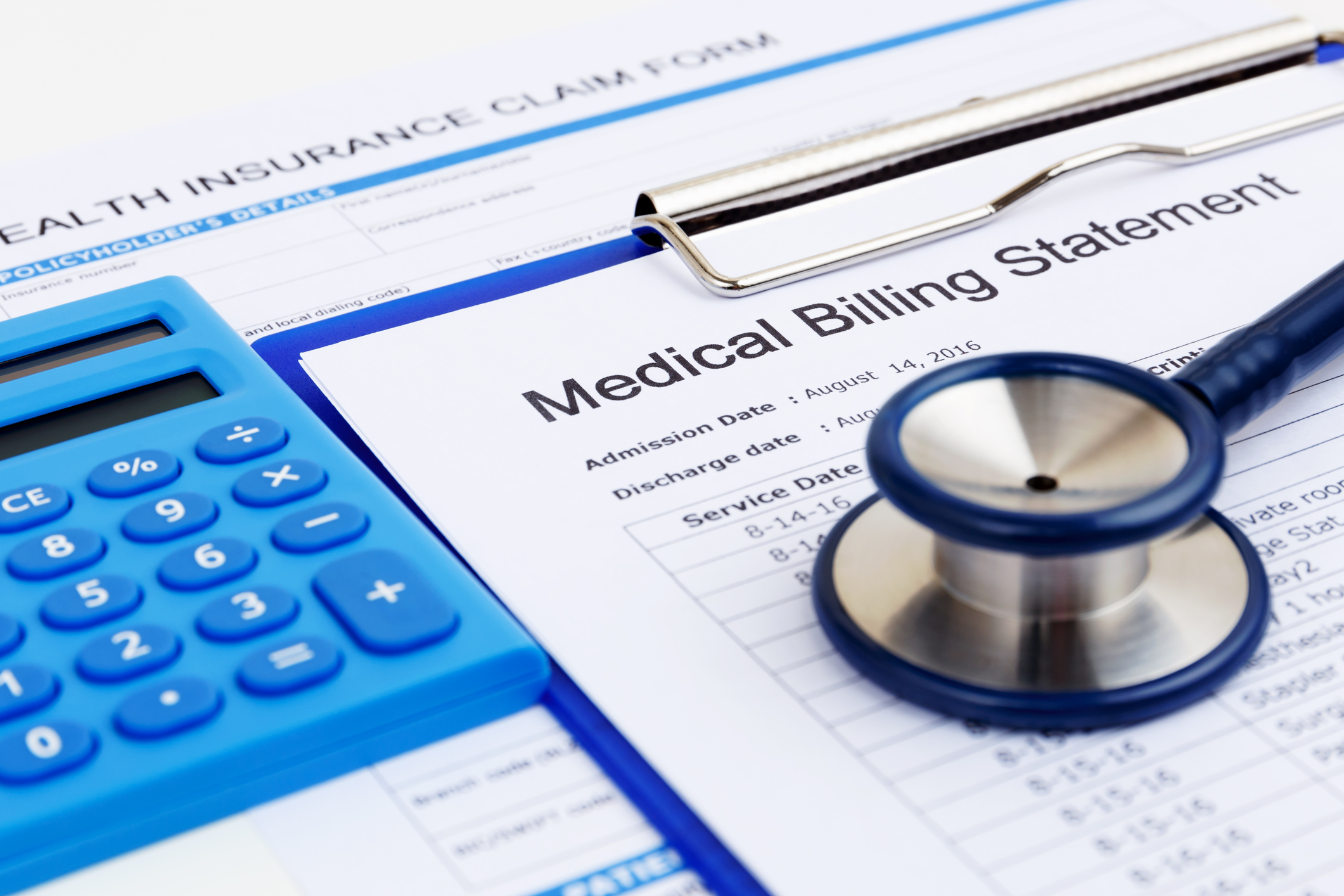

How to Choose the Right Loan for Your Specific Medical Needs

When it comes to choosing the right loan for your medical needs, it can be overwhelming. Luckily, there are a few things you can do to ensure you make the right decision. First, research different types of loans available and compare their interest rates and repayment terms. Consider any additional fees associated with the loan, such as origination or application fees. Additionally, consider if you are eligible for any government loans as they may have more favorable terms. Lastly, make sure to read the fine print to ensure you understand all the terms and conditions. This will help you make the best decision for your particular medical needs.

Tips for Avoiding Plagiarism When Applying for a Medical Loan

When applying for a medical loan, it’s important to make sure you avoid plagiarising. Plagiarism is not only unethical, it can also be illegal. To make sure this doesn’t happen, here are some tips: double-check all sources of information you use; cite any sources you use in your application; and only include information that is your own. Additionally, ensure you proofread and edit your application to make sure all the facts and ideas presented are accurate. Remember, if you don’t take the time to do this, you could face serious consequences.

What To Do If You Are Denied a Medical Loan

If you’ve been denied a medical loan, it’s important not to get discouraged. There are still plenty of options available to you. You may want to consider taking out a personal loan from a bank or credit union. Make sure to shop around for the best rate and terms. You can also look into a home equity loan, or a line of credit. Both of these options may offer lower interest rates than a personal loan. You may also want to consider a credit card with a 0% introductory rate to cover your medical expenses. With any loan, make sure you understand the terms, including the repayment schedule and fees, so that you can make the best decision for your financial situation.