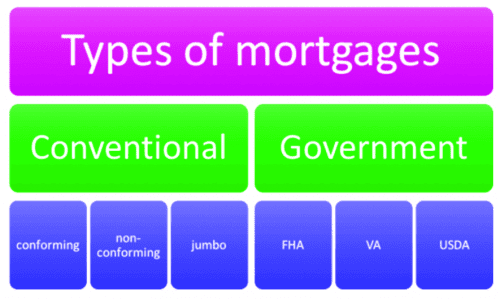

If you’re a first-time homebuyer, you may have heard the term “government-backed” or “conventional” mortgage and wondered what the difference is. Understanding the difference between these two types of mortgages can be confusing, but it’s important to know the difference so you can make the best decision when it comes to financing your first home. This article will explain the key differences between a government-backed mortgage and a conventional mortgage, so you can feel confident and informed when you apply for your mortgage loan.

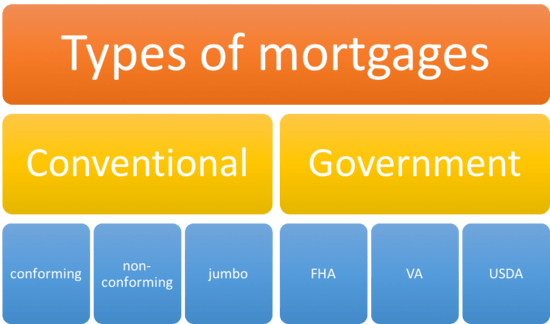

Research mortgage types.

If you’re looking to buy a house, it’s important to research the different types of mortgages available. Government-backed mortgages are backed by the federal government and typically come with lower interest rates. Conventional mortgages, on the other hand, don’t have government backing and may have higher interest rates. Knowing the difference between them can help you make the best decision for your financial future.

Compare features.

If you’re confused about the difference between a government-backed and conventional mortgage, you should know that they vary in terms of features. Government-backed loans offer lower interest rates, lower down payments, and more flexible income requirements than conventional loans. Additionally, these loans are more likely to be approved and are usually more affordable.

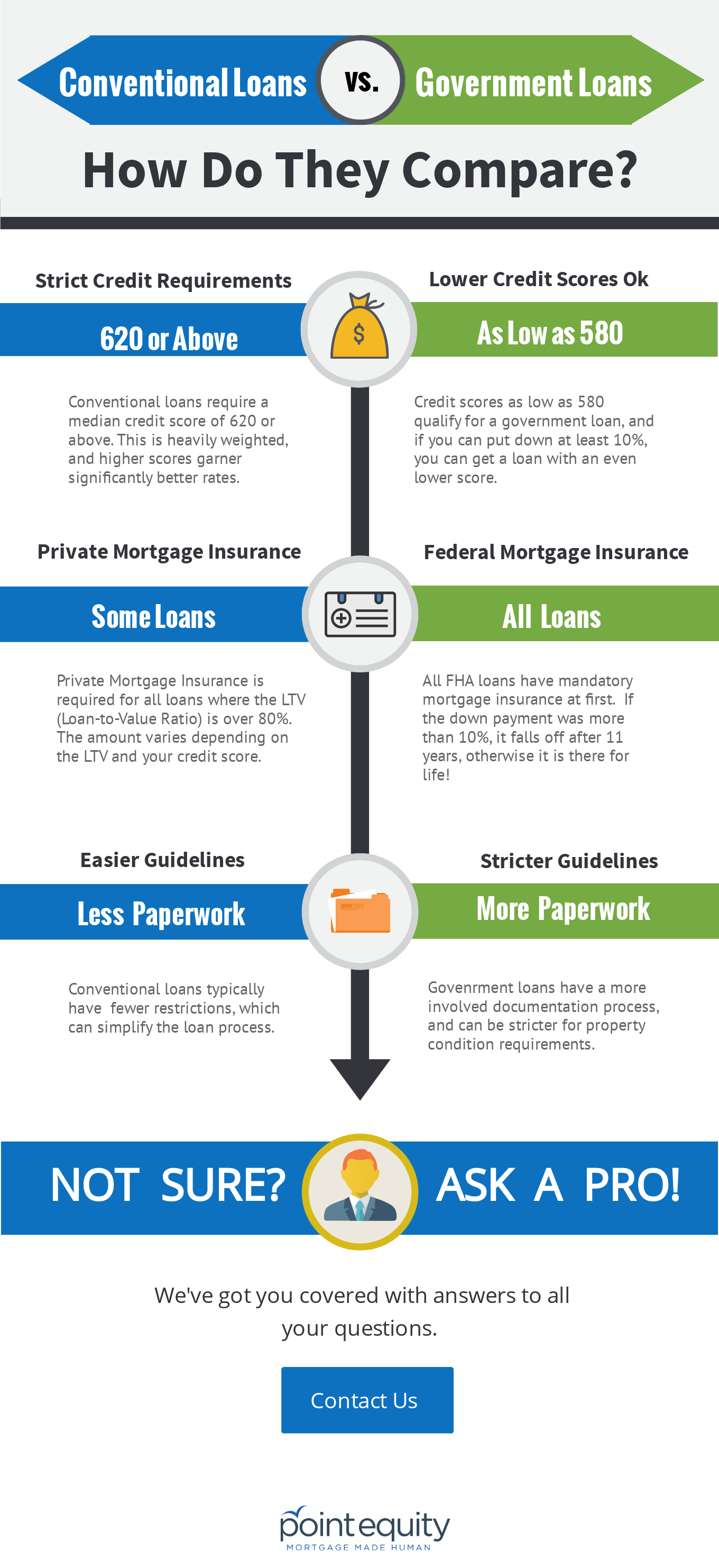

Identify differences.

It’s important for a first-time homebuyer to understand the differences between a government-backed mortgage and a conventional mortgage. Government-backed mortgages are typically easier to qualify for, and offer lower interest rates. On the other hand, conventional mortgages require higher credit scores, and offer more flexibility in terms of repayment plans. Additionally, conventional mortgages usually don’t require private mortgage insurance while government-backed mortgages usually do. Understanding these differences can help you make the best choice for your needs.

Examine advantages/disadvantages.

When comparing government-backed and conventional mortgages, it’s important to look at the advantages and disadvantages of each. Government-backed mortgages often have more flexible qualifying criteria and may offer lower interest rates, but there may be additional fees and restrictions. Conventional mortgages usually have higher interest rates and may require a larger down payment, but they often have fewer restrictions and fees. It’s important to weigh the pros and cons before making a decision.

Consult experts.

If you are confused about the difference between a government-backed and conventional mortgage, it is always best to consult experts. I have found that it is best to speak with a real estate agent or a financial planner who has experience in this area. They can help explain the various types of mortgages and provide the best advice for your individual needs.

Make informed decision.

As an 18-year-old student, I understand that making informed decisions is important. It is essential to know the difference between government-backed and conventional mortgages to make the right choice. My research has shown that government-backed mortgages have specific advantages, such as better terms and lower down payments, so it is worthwhile to get informed about them.