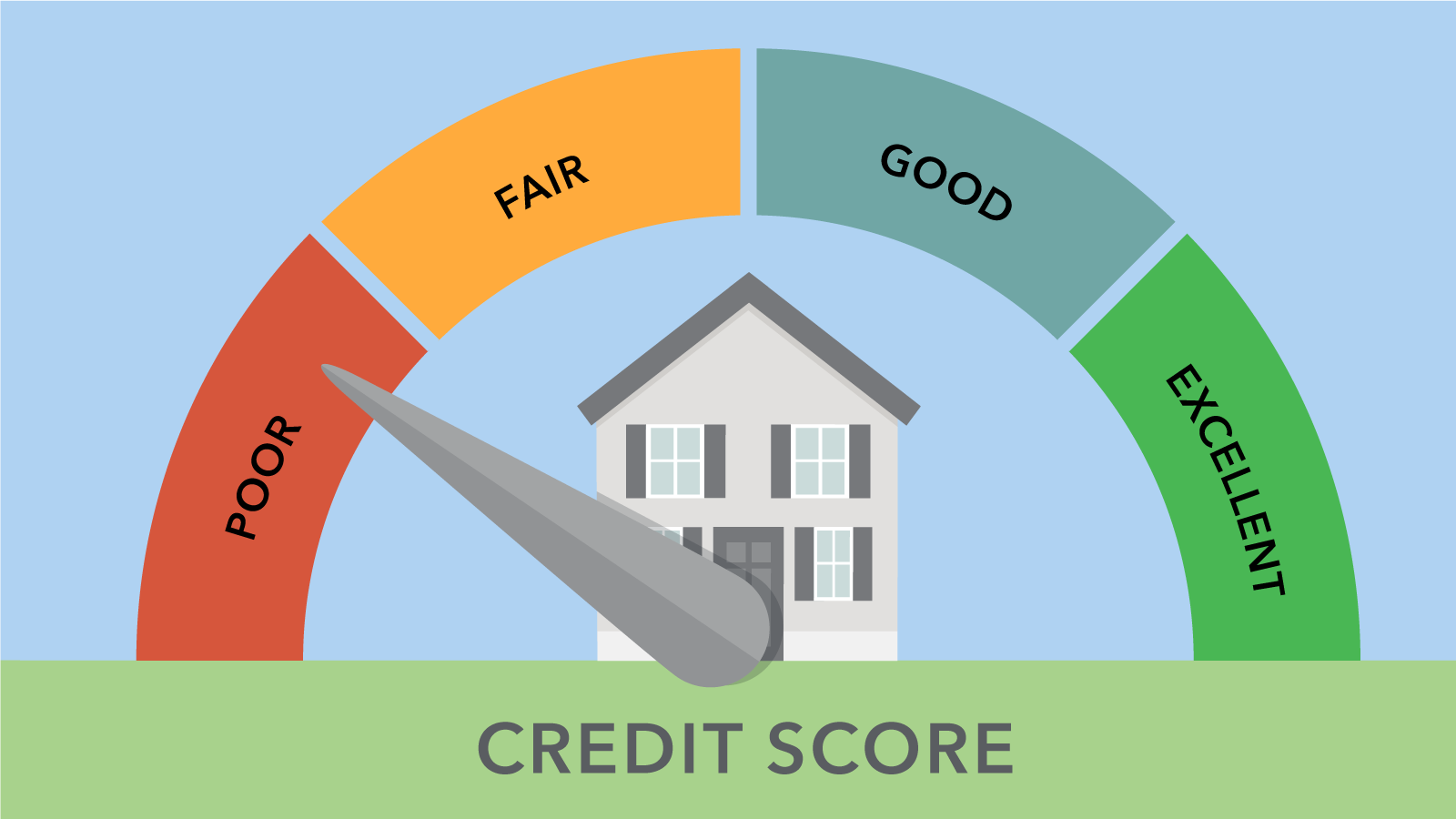

If you’ve got a low credit score and you’re looking to get a mortgage, don’t worry – there are still options available to you! As an 18 year old student, I know how difficult it can be to secure a mortgage with a low credit score. Luckily, with the right strategies and resources, it is still possible to get a mortgage with a low credit score. In this article, I’ll be sharing my tips and tricks on how to get the mortgage you need, even with a low credit score. Let’s get started!

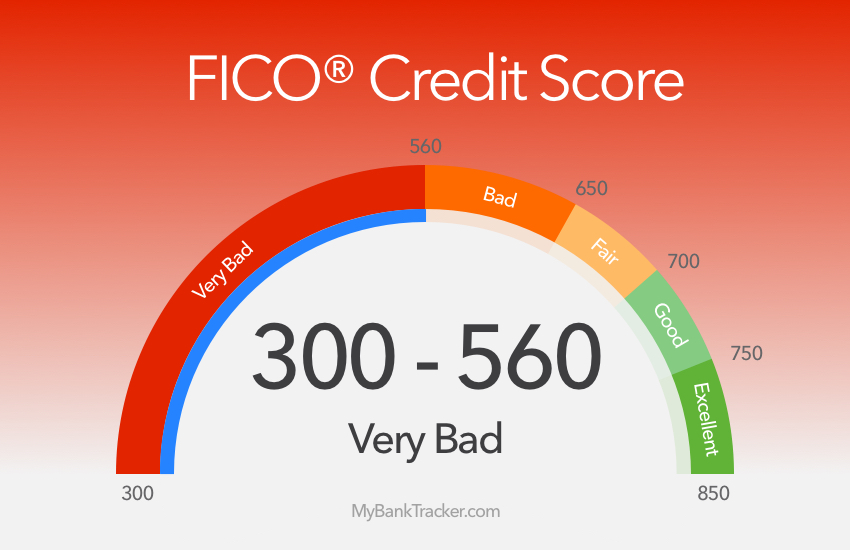

Check credit score

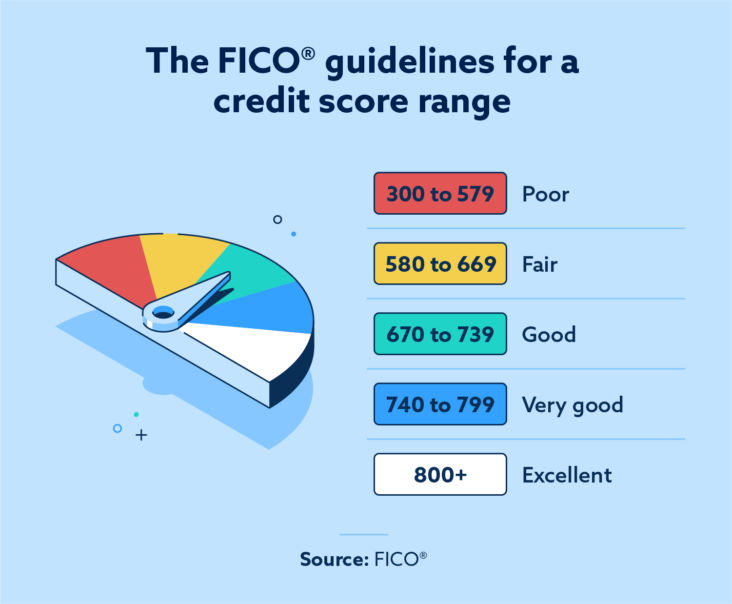

As a young adult with a low credit score, checking my credit score is the first step I need to do in order to get a mortgage. I use websites like Credit Karma or Credit Sesame to keep an eye on my credit score and credit report, so I can understand why I have a lower score and how to fix it. It’s important to check my credit score regularly, so I can make sure I’m on the right track.

Improve score/history

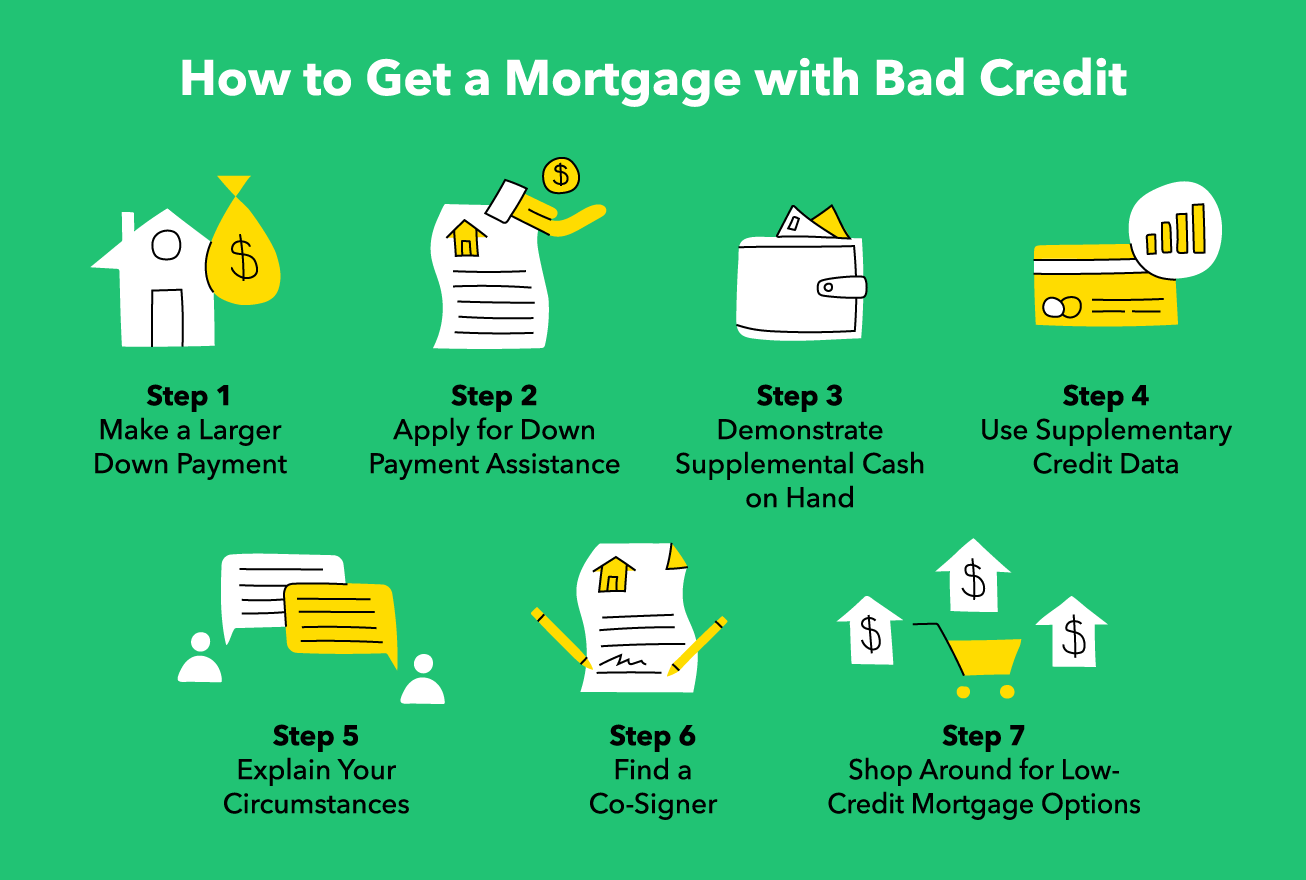

As a college student I know it can be hard to get a mortgage with a low credit score. To improve my score and history, I started by becoming more aware of my spending and making sure to pay all my bills on time. I also checked my credit report for any errors that could be dragging down my credit score and disputed any incorrect items. Lastly, I opened a new low-interest credit card and made sure to pay it off in full every month to build my credit.

Compare interest rates

Comparing interest rates is an important part of getting a mortgage with a low credit score. I’m 18 and researching this process, so I know how important it is to be diligent when comparing different lenders’ interest rates. Some lenders may offer lower rates, but make sure to read the fine print and understand the terms of the loan. Shopping around is key to finding the best deal for you!

Find low-down payment option

If you have a low credit score, it’s not impossible to get a mortgage. There are several low-down payment options out there that can help you get into homeownership. For example, FHA loans can offer a down payment of as low as 3.5% and VA loans can offer no down payment at all. You may also qualify for state and local programs that offer discounts on mortgage rates. Do your research to find the best option for your situation.

Get pre-approved

If you have a low credit score, getting pre-approved for a mortgage can be a great way to boost your chances of getting the loan you need. It’s important to understand the process and speak with a knowledgeable mortgage broker to get the best deal. Working with a reputable lender who can help you understand your credit score and how it impacts your loan application is essential. With the right guidance, you can secure the mortgage you need and start building financial stability.

Submit mortgage application

I’m 18 and I’m looking to get a mortgage, but my credit score is really low. I know it’s hard but I’m determined to make this work. I’ve been gathering all the documents and information I need to submit my mortgage application. I’m going to make sure I have everything ready and in order so that I can go through this process with as little stress as possible.