Are you looking for a way to get a closed mortgage? Closed mortgages are a great way to protect yourself from interest rate hikes, and provide you with the security of knowing exactly what your payments will be for the duration of the loan. In this article, we’ll share some helpful tips to help you get the most out of your closed mortgage. From understanding the different types of closed mortgages to exploring the different options available, we’ll help you find the best solution for your needs.

Research lenders/rates

Researching lenders and rates for a closed mortgage can be a complicated process. To make the process easier, start by comparing the rates and terms of different lenders and brokers to find the one that best fits your needs.

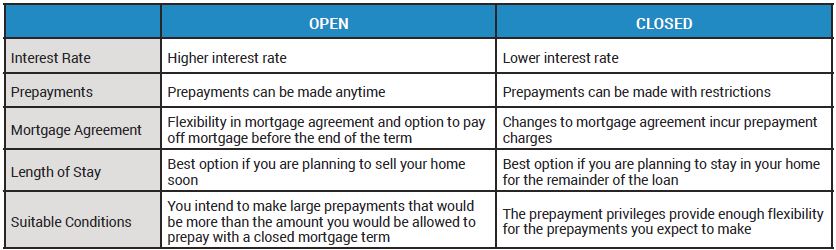

Compare mortgage types

Closed mortgages are great for those looking for stability in their payments. They are generally a fixed rate mortgage and have a predetermined set of payments over a certain term. Closed mortgages offer the security of a predictable payment and interest rate that stays the same until the mortgage is paid off. However, it is important to compare mortgage types to determine the best fit for your financial goals.

Calculate affordability

When calculating affordability for a closed mortgage, it’s important to consider your current financial situation and long-term goals. Research mortgage rates and calculate how much you can afford monthly and in total. Make sure to consider any other fees, such as closing costs or prepayment penalties.

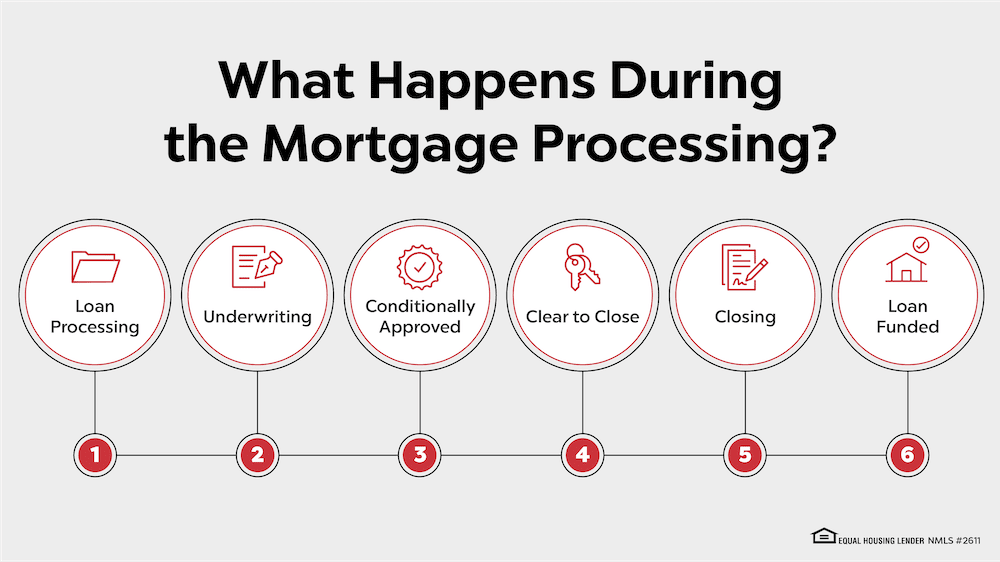

Submit documents/info

When applying for a closed mortgage, it is important to submit all necessary documents and information to the lender. This includes information such as your income, liabilities, and credit score. It is important to ensure that all the documents you provide are accurate, up to date and complete, as this will help ensure that your loan is approved. Furthermore, you should make sure to read the terms and conditions of the loan before signing to make sure that it is the right option for you.

Receive pre-approval

sentenceReceiving pre-approval for a closed mortgage is an important step in the home buying process. It allows you to understand how much you can afford and gives you the confidence to make an offer when you find the right house.

Finalize paperwork/payment

Once you have found the type of mortgage that suits your needs and your budget, the last step is to finalize the paperwork and make the payment. This can be a daunting process, so it is important to take your time and double-check all the details. Make sure to ask questions if there is something you don’t understand.