Are you feeling overwhelmed by your hefty student loan debt? Fear not, because Income-Driven Repayment (IDR) plans might just be the key to unlocking the door to student loan forgiveness! This comprehensive guide will walk you through the essentials of IDR plans, which can significantly reduce your monthly payments and even lead to complete loan forgiveness after a certain period. Say goodbye to sleepless nights and hello to financial freedom, as we dive into the world of Income-Driven Repayment plans and explore how they can transform your student loan journey for the better.

Exploring the Basics of Income-Driven Repayment Plans: How They Can Ease Your Student Loan Burden

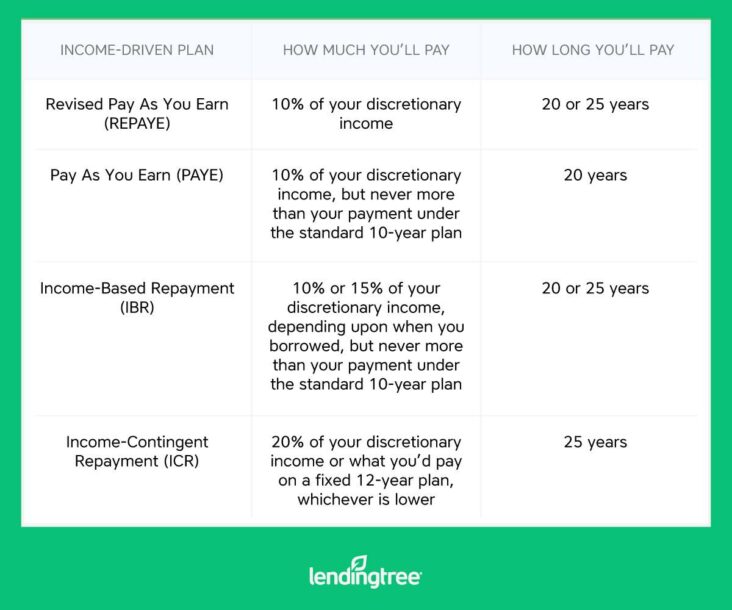

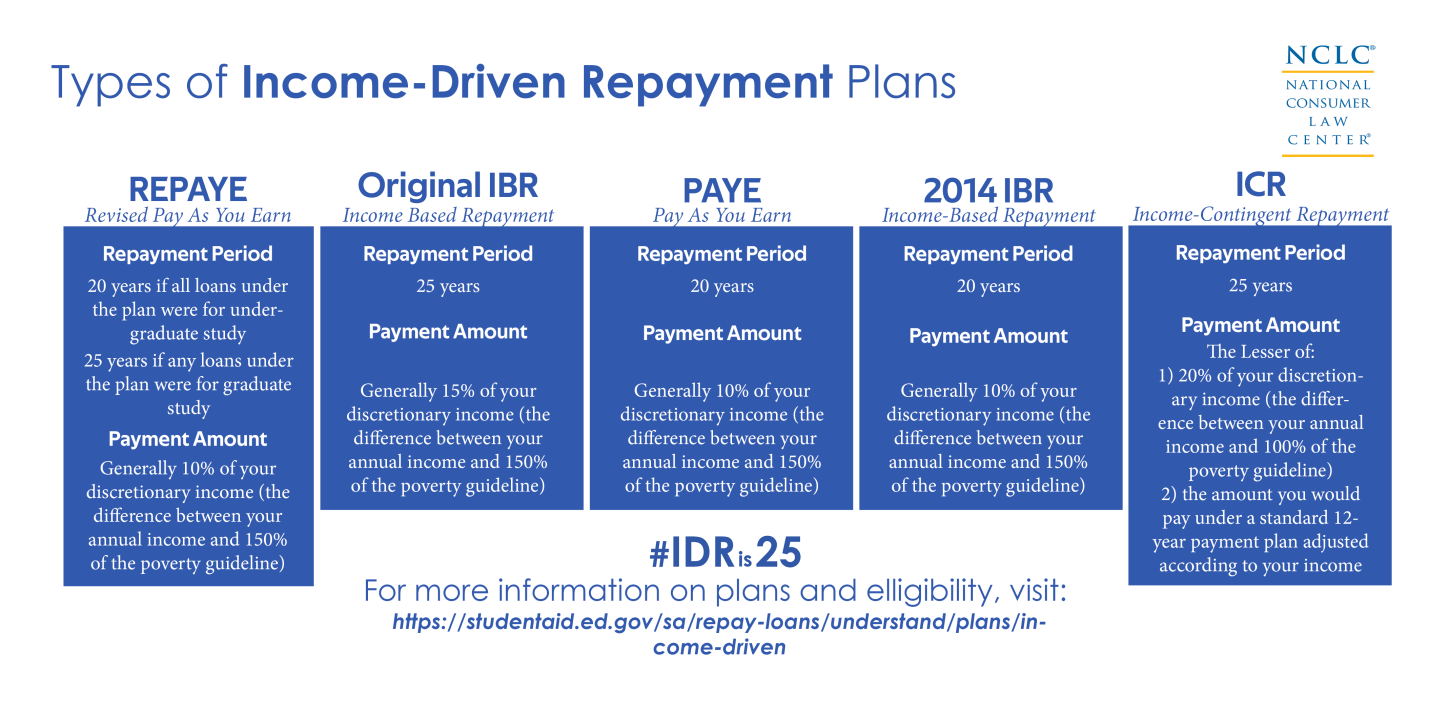

Income-Driven Repayment Plans (IDR) offer a practical solution to managing your student loan debt, providing financial relief through customizable monthly payments based on your income and family size. These plans can significantly ease your student loan burden by potentially reducing your monthly payments and offering loan forgiveness after a specific term. With various IDR options available, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), you have the opportunity to select the plan that best suits your financial situation. Ultimately, IDR plans contribute towards a sustainable repayment strategy, enabling you to focus on your future without being overwhelmed by student loan debt.

Top Income-Driven Repayment Plans to Consider: A Comprehensive Comparison for Student Loan Forgiveness Seekers

Discover the top Income-Driven Repayment Plans that can lead you to Student Loan Forgiveness with our comprehensive comparison guide. We’ll help you navigate through various options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Understand the eligibility criteria, payment caps, and forgiveness timelines for each plan to make an informed decision. Our expert analysis will empower you to choose the best repayment strategy, reduce your financial burden, and ultimately achieve student loan forgiveness. Don’t let student debt hold you back; explore our guide and take control of your financial future today.

The Eligibility Criteria for Income-Driven Repayment Plans: Ensuring You Qualify for Student Loan Forgiveness

To ensure you qualify for student loan forgiveness through Income-Driven Repayment (IDR) plans, familiarize yourself with the eligibility criteria. First, you must have federal student loans, specifically Direct Loans or Federal Family Education Loan (FFEL) Program loans. Private loans are not eligible. Next, consider your income level, as these plans are designed for borrowers with low income relative to their debt. Submitting your annual income information is mandatory, as it helps determine your monthly payment. Moreover, each IDR plan has its own specific requirements, so carefully review your options, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Navigating the Application Process for Income-Driven Repayment Plans: A Step-by-Step Guide to Achieving Student Loan Forgiveness

Navigating the application process for Income-Driven Repayment (IDR) plans can be a daunting task, but our step-by-step guide will simplify the journey towards student loan forgiveness. Begin by assessing your eligibility for IDR plans and selecting the most suitable option for your financial circumstances. Next, gather documentation of your income, family size, and federal student loans. Remember to submit the necessary forms, including the Income-Driven Repayment Plan Request, through the Federal Student Aid website or your loan servicer. Finally, be diligent in recertifying your income and family size annually to remain on track for student loan forgiveness, and watch your debt gradually decrease as you progress.

Income-Driven Repayment Plan Success Stories: Real-Life Examples of Achieving Student Loan Forgiveness and Financial Freedom

Discover inspiring success stories of real-life individuals who have achieved student loan forgiveness and financial freedom through Income-Driven Repayment (IDR) plans. These empowering examples showcase the transformative impact of IDR plans on borrowers’ lives, enabling them to overcome the burden of student loan debt and pursue their dreams. By exploring various strategies and navigating the complexities of IDR plans, these determined individuals have unlocked the path to a debt-free future. Embark on this enlightening journey and learn how you too can benefit from Income-Driven Repayment plans, attain student loan forgiveness, and achieve financial independence.