Are you looking to buy a home but concerned about the large down payment that comes with a jumbo mortgage? Don’t worry – you’re not alone! With the right information and a few simple tips, you can learn how to get a jumbo mortgage and make the process much easier. In this article, I’ll share my experiences as an 18-year-old student on how to get a jumbo mortgage, from understanding the basics to finding the best deal. With this guide, you can rest assured that you’ll be able to get the best mortgage for your needs.

Establish Good Credit Score

When it comes to obtaining a jumbo mortgage, having a good credit score is key. To establish a good credit score, I have to make sure I pay off my credit cards and other bills on time, and keep my credit utilization low. I also have to actively check my credit and dispute any errors or inaccuracies I may find. With these steps, I can build a solid credit score that will help me qualify for a jumbo mortgage.

Save For Large Down Payment

If you’re 18 and looking to get a jumbo mortgage, it’s important to start saving now. Start by setting a budget, tracking your expenses and cutting back wherever you can. Put aside as much money as you can each month into a savings account specifically for your down payment. Aim to save as much as you can each month so you can reach your goal faster.

Find Experienced Mortgage Lender

If you’re looking for an experienced mortgage lender to help you get the best jumbo mortgage rate, it’s important to do your research. Ask your friends and family if they can recommend a lender they’ve used in the past, or look for reviews online. Make sure you understand their fees and interest rates, and that they’re experienced in jumbo mortgages. Doing your research will help you find the best lender for your needs.

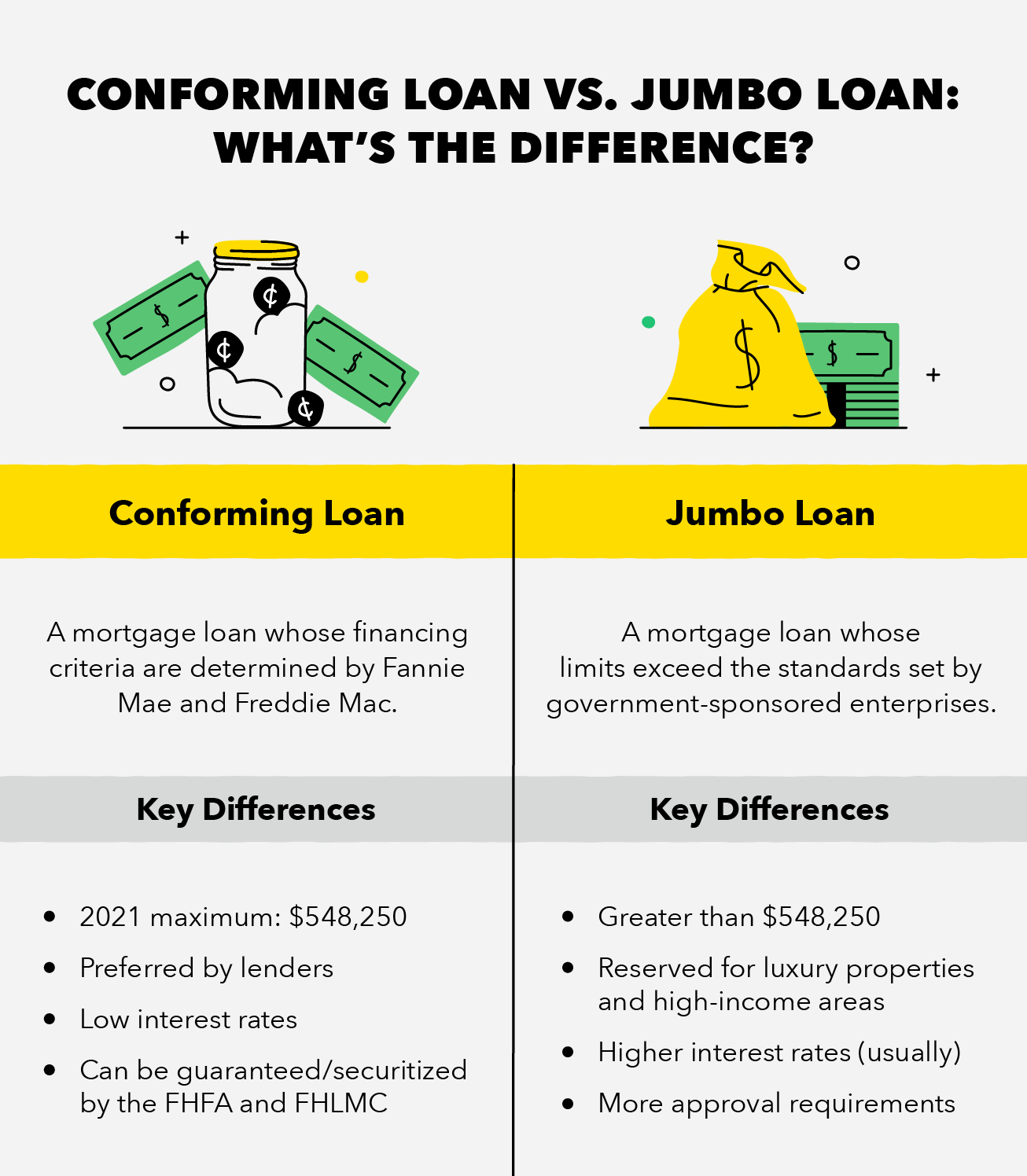

Research Interest Rates

When it comes to getting a jumbo mortgage, it’s important to research interest rates to make sure you get the best deal. I’m 18 years old and have been researching different lenders to compare their interest rates. I’ve been looking online and reading reviews to make sure I’m getting the best deal possible. I’m also asking around to get advice from friends and family who have already been through the process.

Submit Financial Documents

Submitting financial documents is key to getting a jumbo mortgage. Make sure to have all of your tax returns, pay stubs, bank statements and other documents ready for review. Having all your documents in order will make the process of getting a jumbo mortgage go much smoother. Get your paperwork organized ahead of time to make the process easier and faster.

Negotiate Terms & Rates

Negotiating the terms and rates for a jumbo mortgage can be intimidating, but with the right guidance, it doesn’t have to be. Start by researching current mortgage rates and terms, then talk to a professional mortgage broker about what’s available. Don’t be afraid to ask for a better rate or terms, and remember to be patient – it might take some time, but it’ll be worth it!