Getting an FHA mortgage can be a great way for an 18 year old student to get into the housing market. FHA mortgages are backed by the Federal Housing Administration and are available to people with lower credit scores and smaller down payments. With the right knowledge and preparation, anyone can get an FHA mortgage and become an owner of their own home. In this article, I will provide the necessary steps and tips to help you get your FHA mortgage.

Check FHA eligibility.

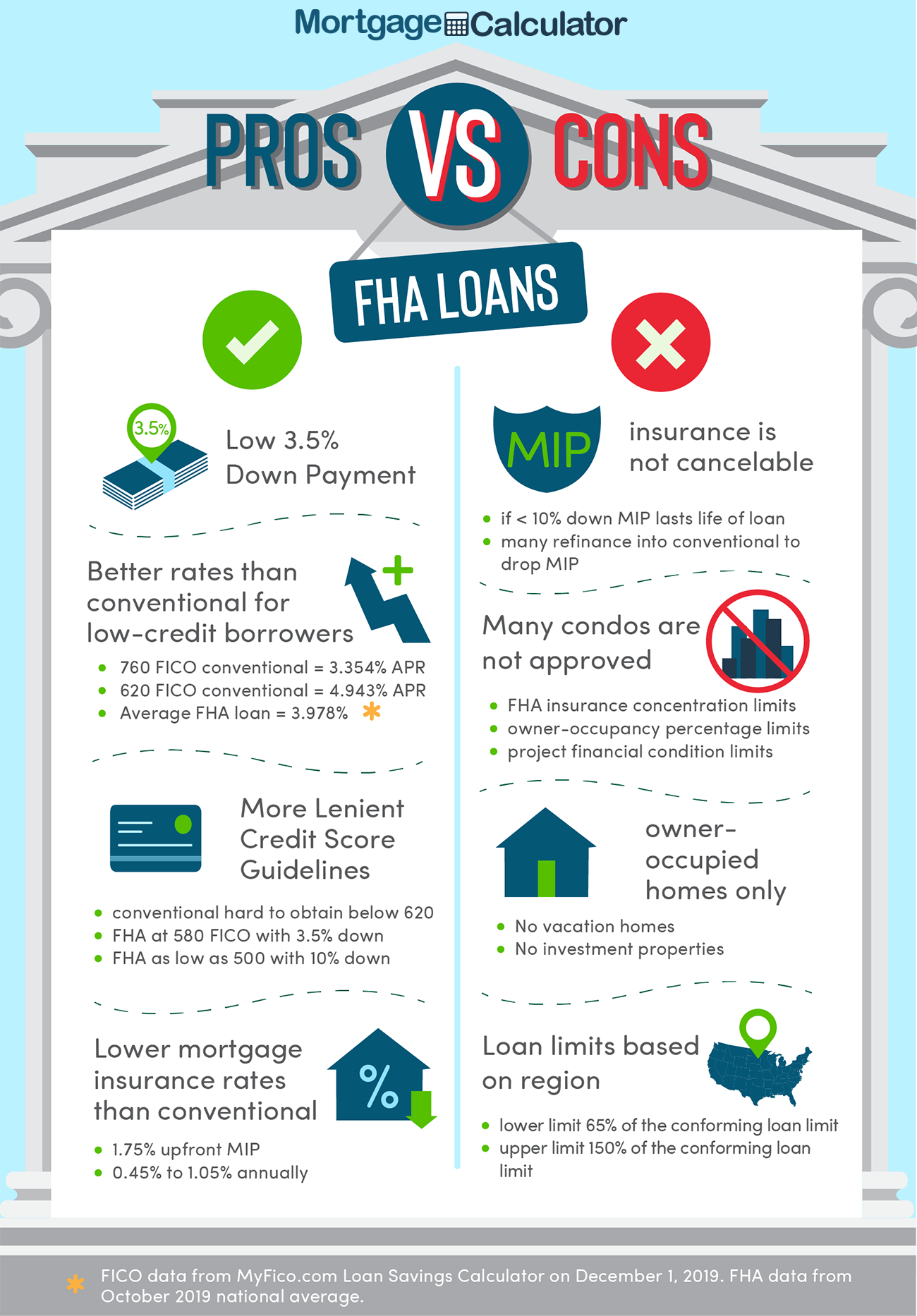

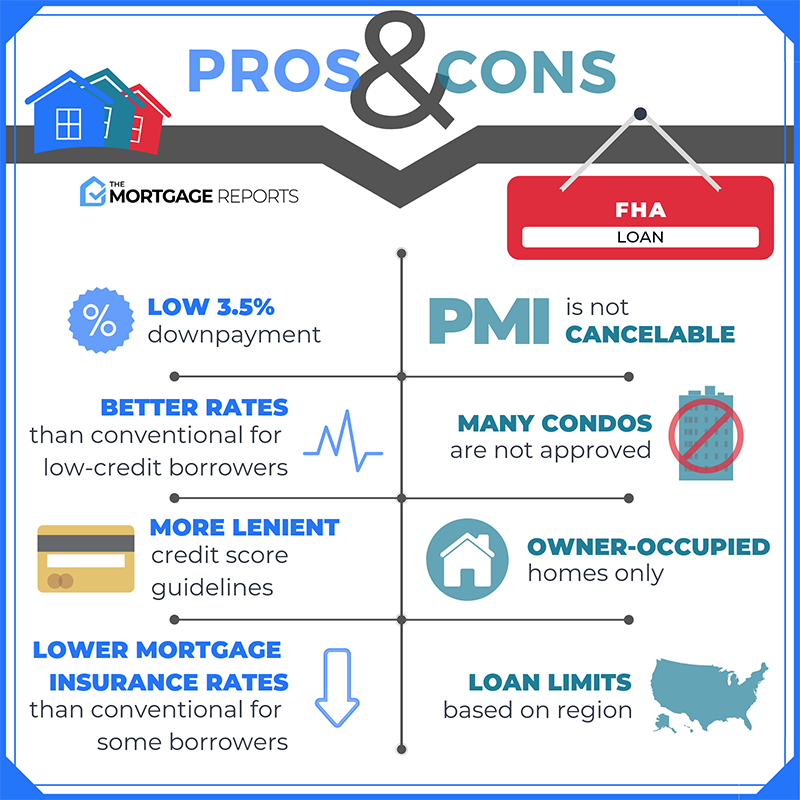

If you’re considering an FHA loan, it’s important to make sure you’re eligible. First, check to see if you meet the criteria for an FHA loan, such as having a credit score of 580 or higher, a steady income and debt-to-income ratio of less than 43%. Additionally, you’ll need to provide proof of employment, income and assets. Lastly, you’ll need to be a US citizen or have a valid work visa to be eligible for an FHA mortgage.

Gather financials.

Gathering financials to get an FHA mortgage can seem really intimidating, but it doesn’t have to be! All you need to do is make sure you have your income information, like pay stubs and tax returns, as well as your bank statements. That way, you’ll be able to provide the lender with everything they need to get you approved for your FHA mortgage.

Find mortgage lender.

Finding a mortgage lender for an FHA mortgage can be an intimidating process. Luckily, there are resources available to help you find the right lender. Start by doing an online search to find a local lender with experience in FHA mortgages. Research their customer reviews and ask friends and family for referrals. It’s also a good idea to get pre-approved for the loan before you start the process. That way, you’ll be able to quickly and confidently make an offer if you find the perfect home.

Submit loan application.

Submitting a loan application for an FHA mortgage can seem daunting, but it doesn’t have to be. As a 18-year-old student just starting out, I can tell you that the process is actually pretty simple. All you have to do is gather the necessary documents, fill out the application, and submit it to the lender. It’s important to make sure you have all the required documents in order to get approved quickly. With the right preparation and research, you can get your FHA mortgage in no time!

Complete home appraisal.

Getting an FHA mortgage means you have to go through a home appraisal process. This can be daunting, as the appraiser looks at many aspects of the home, like its condition, features, and location. But, with the right preparation, you can make the process smoother, and get the loan you need. Make sure you understand what the appraiser is looking for, and make sure your home is in the best condition it can be. Don’t forget to check for any repairs that are needed!

Receive FHA mortgage.

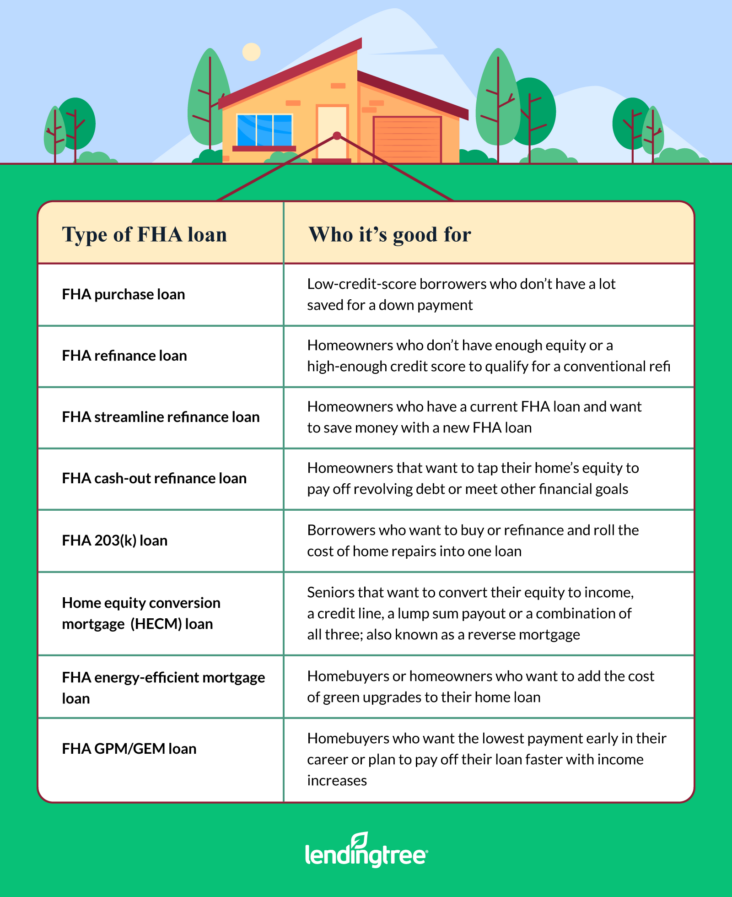

Getting an FHA mortgage is a great option for young people who are looking to buy their first home. The process is straightforward and it’s easy to qualify for a loan, even for those who don’t have perfect credit. Plus, FHA mortgages have a lower down payment and more forgiving credit requirements, making them much more accessible than traditional loans. With a little research and planning, I’m confident that I can receive an FHA mortgage and become a homeowner.