If you’re an 18 year old looking to purchase your first home, then you may have heard about conventional mortgages as an option. Conventional mortgage loans are a great way to start building equity in your own home, but they can be tricky to navigate. In this article, I’m going to break down the basics of how to get a conventional mortgage and provide some helpful tips to help you make the most of your loan.

Gather financial documents

Gathering financial documents is an important step when trying to get a conventional mortgage. Make sure you have your most recent tax returns, bank statements, pay stubs and any other necessary documents. If you’re a student, you may need to provide a proof of enrollment and proof of income to qualify. Additionally, you may need to document any assets you have such as cars, stocks, and bonds. Take your time to make sure you have all the documents you need before you apply.

Compare lenders/rates

It’s super important to shop around and compare rates when looking into getting a conventional mortgage. With so many lenders out there, it can be hard to know where to start. Do your research, read reviews and see what other borrowers have to say. Look at the loan terms and interest rates each lender offers to find the best fit for your budget and lifestyle.

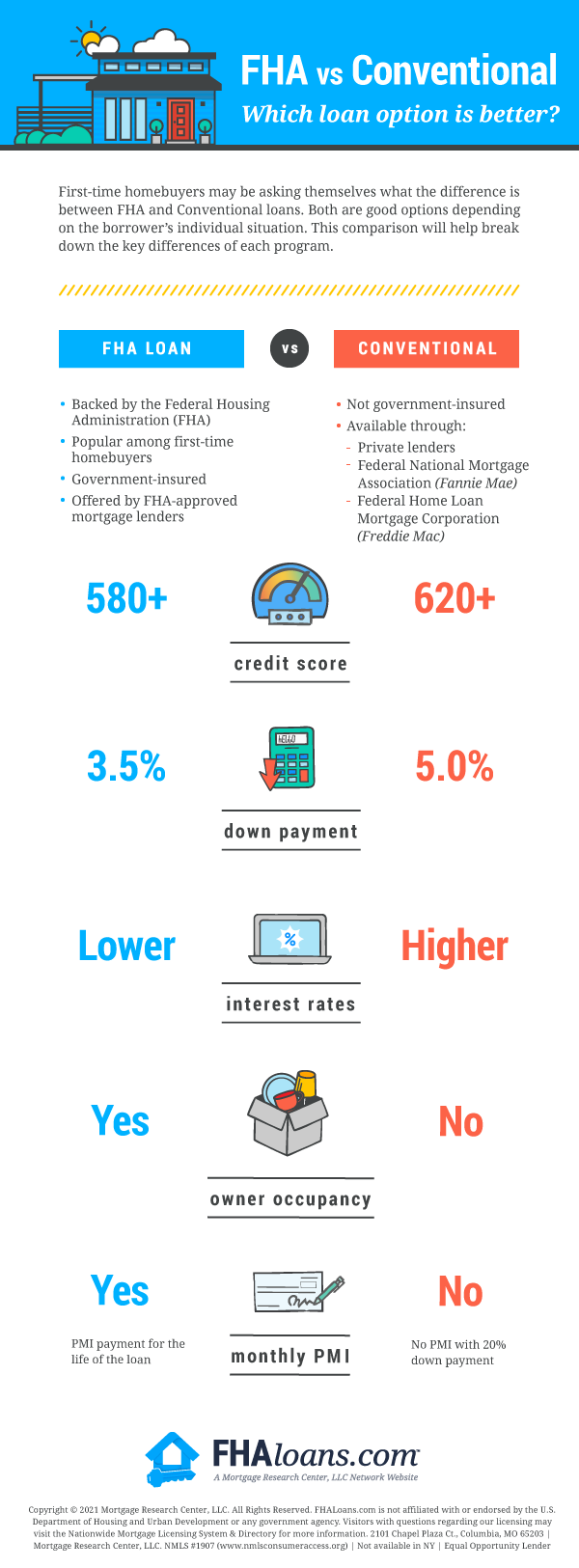

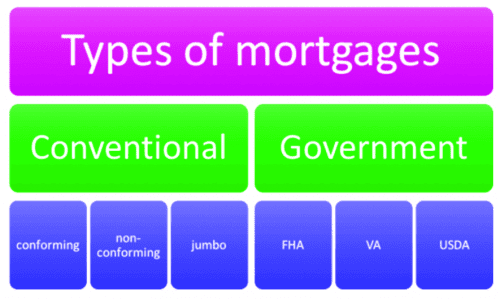

Choose mortgage type

Choosing the right type of mortgage for your needs is essential. A conventional mortgage is a great option for those looking for a fixed-rate mortgage with low down payment requirements and more flexibility in credit score qualifications. It’s important to research lenders and compare rates to find the best deal for your situation. With the right loan, you can make your dream of homeownership a reality.

Apply for loan

Applying for a conventional mortgage loan can be intimidating, but it doesn’t have to be. I’m an 18-year-old and I recently applied for a loan and it was a breeze. You just need to fill out the application and submit it to the lender. They’ll review your credit score and financials to determine if you qualify for the loan. With a conventional mortgage loan, you can get a lower interest rate and more flexibility. Don’t be scared! Applying for a loan isn’t as hard as you think.

Submit documents

Submitting documents for a conventional mortgage is not as hard as it may seem. I recently got one and all I did was collect my documents such as tax returns, bank statements, pay stubs, and other documents and submit them to my lender. It was easy and straightforward and I got my loan in no time.

Close loan

Getting a conventional mortgage can be a complicated process, but it doesn’t have to be! Closing your loan is the final step in the process and can be a smooth and stress-free experience if you have the right team on your side. With an experienced loan officer and a strong support system, you can make sure that your loan is closed on time and as expected.