If you are 18 years old and thinking of getting a government-insured mortgage, you are in the right spot! Understanding what a government-insured mortgage is, how to get one, and what it means to you as a homebuyer can be daunting – but it doesn’t have to be. In this article, I will break down everything you need to know about getting a government-insured mortgage, from what it is, to the advantages and disadvantages, to the steps you need to take to apply – everything you need to know in order to make the most informed decision for your housing needs. Let’s dive in!

Research government-insured mortgage options.

Researching government-insured mortgage options can be a daunting task for an 18-year-old. Fortunately, there are plenty of online resources that can help you get started. Websites like Fannie Mae, Freddie Mac, and the Federal Housing Authority can provide you with a wealth of information on government-insured mortgage programs. You can also use sites like Bankrate to compare rates and get an idea of what kind of mortgage you could qualify for. Take your time and do your research to ensure you get the best deal possible.

Contact banks for quotes.

If you’re looking to get a government-insured mortgage, contacting banks for quotes is a great place to start. I’m 18 and a student and I found it really helpful to get quotes from different banks so I could compare prices and see which one was best for me. This way, I could get a great deal on a government-insured mortgage without spending too much.

Compare rates/terms.

Shopping around for the best rates and terms is essential when getting a government-insured mortgage. I’ve been doing my research and comparing different lenders to see which one could give me the best deal. It’s important to look at the interest rate, points, and other fees, as well as the type of loan that best fits my financial situation. Doing my homework has paid off, and I’m confident I’ll get the best rate and terms for my mortgage.

Choose best option.

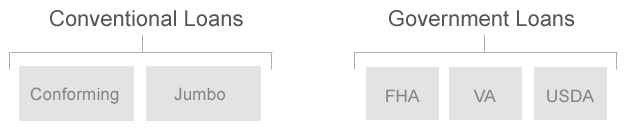

When it comes to getting a government-insured mortgage, there are many options to choose from. It’s important to research and compare the different loan types, interest rates and terms to find the best option for you. As an 18-year-old student, it’s important to look into FHA loans, VA loans, USDA loans, and other government-backed loans to determine which one is most suitable for your needs. Be sure to read the fine print and ask questions to decide which loan is right for you.

Gather paperwork.

Gathering paperwork for a government-insured mortgage can be a bit daunting. I’m an 18-year-old student who recently applied for one and let me tell you, it was no walk in the park. You’ll need to provide proof of income, credit history, bank statements and other personal documents. Make sure you have all the paperwork ready and organized before you start the application process. It’ll save you a lot of time and headache!

Apply for loan.

I’m 18 and I’m thinking about applying for a government-insured mortgage. It seems like a great way to get the financing I need to buy a house. I went online and did some research on what I need to do to apply for a loan. It looks like I’ll have to fill out an application, provide proof of income, submit documents, and have a good credit score. This process can seem daunting, but I’m determined to make it happen!