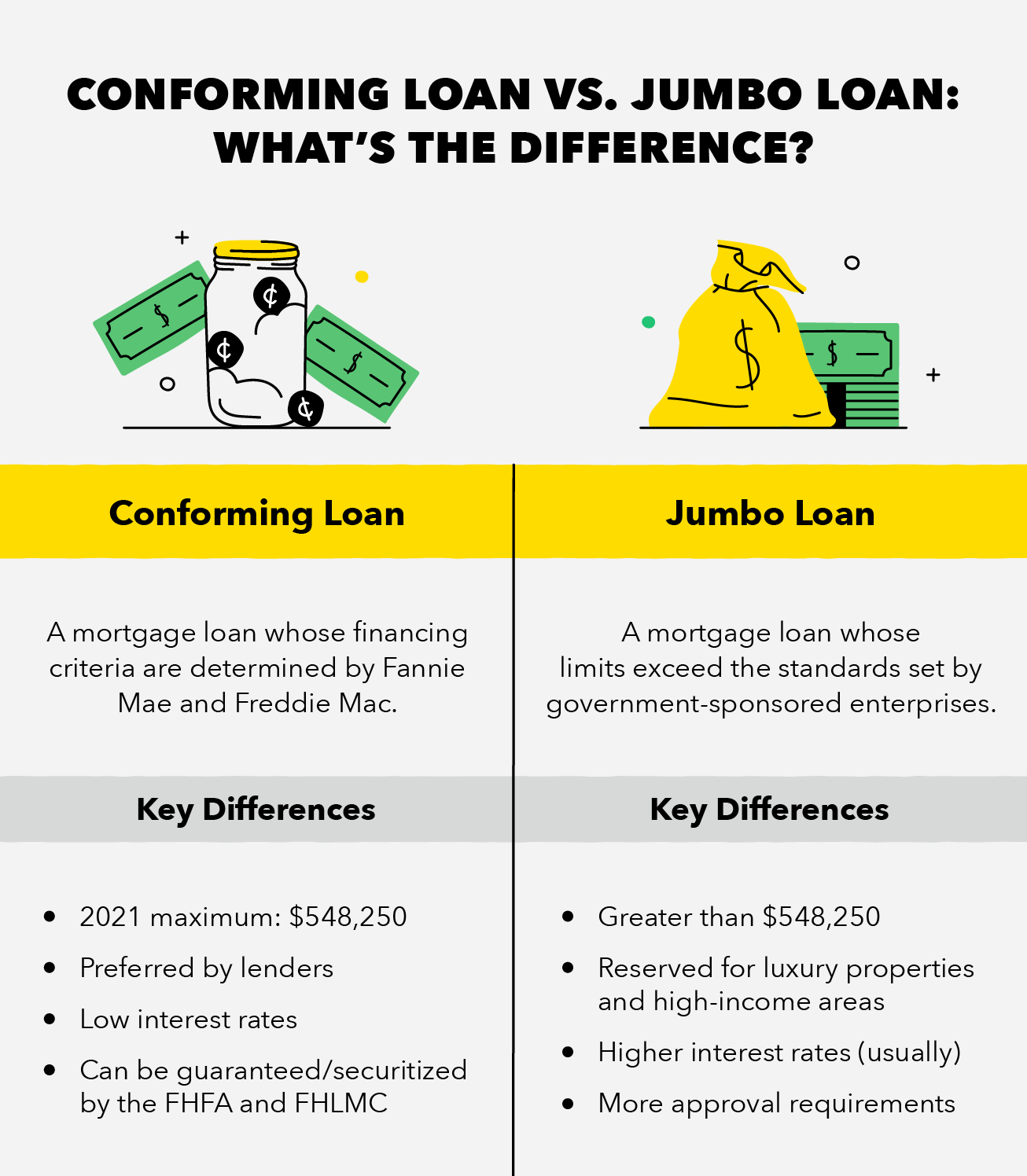

Are you looking to buy a home, but don’t have enough cash to cover the full purchase price? A jumbo mortgage may be your solution. Jumbo mortgages are loans that exceed the maximum loan limits set by federal regulations and are available to buyers in need of more financing. With a jumbo mortgage, you can purchase a home that exceeds the conforming loan limit set by Fannie Mae and Freddie Mac. In this article, we’ll explore how to get a jumbo mortgage, the benefits and drawbacks of this option, and some tips for qualifying for a jumbo loan. Read on to learn more about jumbo mortgages and how you can use them to purchase the home of your dreams.

Research lenders & rates.

Researching lenders and rates is an important step in getting a jumbo mortgage. Make sure to compare different providers to get the best rate and terms for your situation.

Check credit score.

It is important to check your credit score before applying for a jumbo mortgage. This will help you determine if you are eligible for the loan and if you can get the best rate. Monitoring your credit score is also beneficial for future financial planning.

Gather financial documents.

When applying for a jumbo mortgage, it is important to be prepared with financial documents such as recent pay stubs, tax returns, bank statements, and investments. Having these documents readily available will make the process much smoother.

Calculate affordability.

When calculating affordability for a jumbo mortgage, it is important to consider the total cost of borrowing, including the loan amount, interest rate, loan terms, and closing costs. It is important to carefully explore all options to ensure that you are comfortable with the loan you choose.

Apply for loan.

When applying for a jumbo loan, it is important to be prepared and organized. Have all necessary documents ready and make sure to shop around for the best interest rate.

Finalize paperwork.

Once you have identified the lender and the loan program that best meets your needs, it is important to make sure that you complete all necessary paperwork accurately and completely. This is the only way to ensure that your jumbo mortgage application is properly processed.