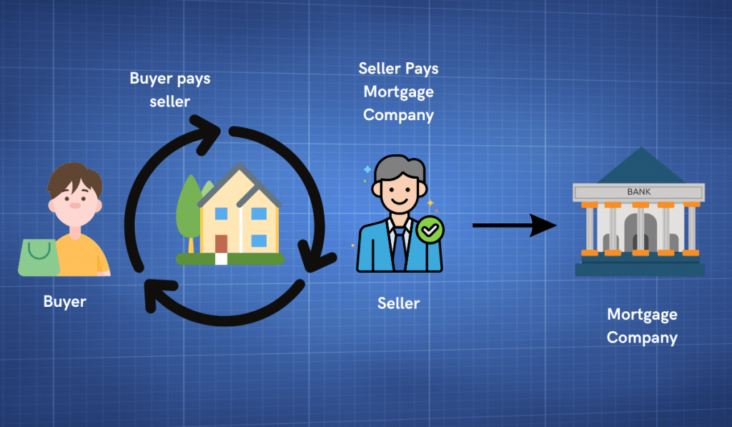

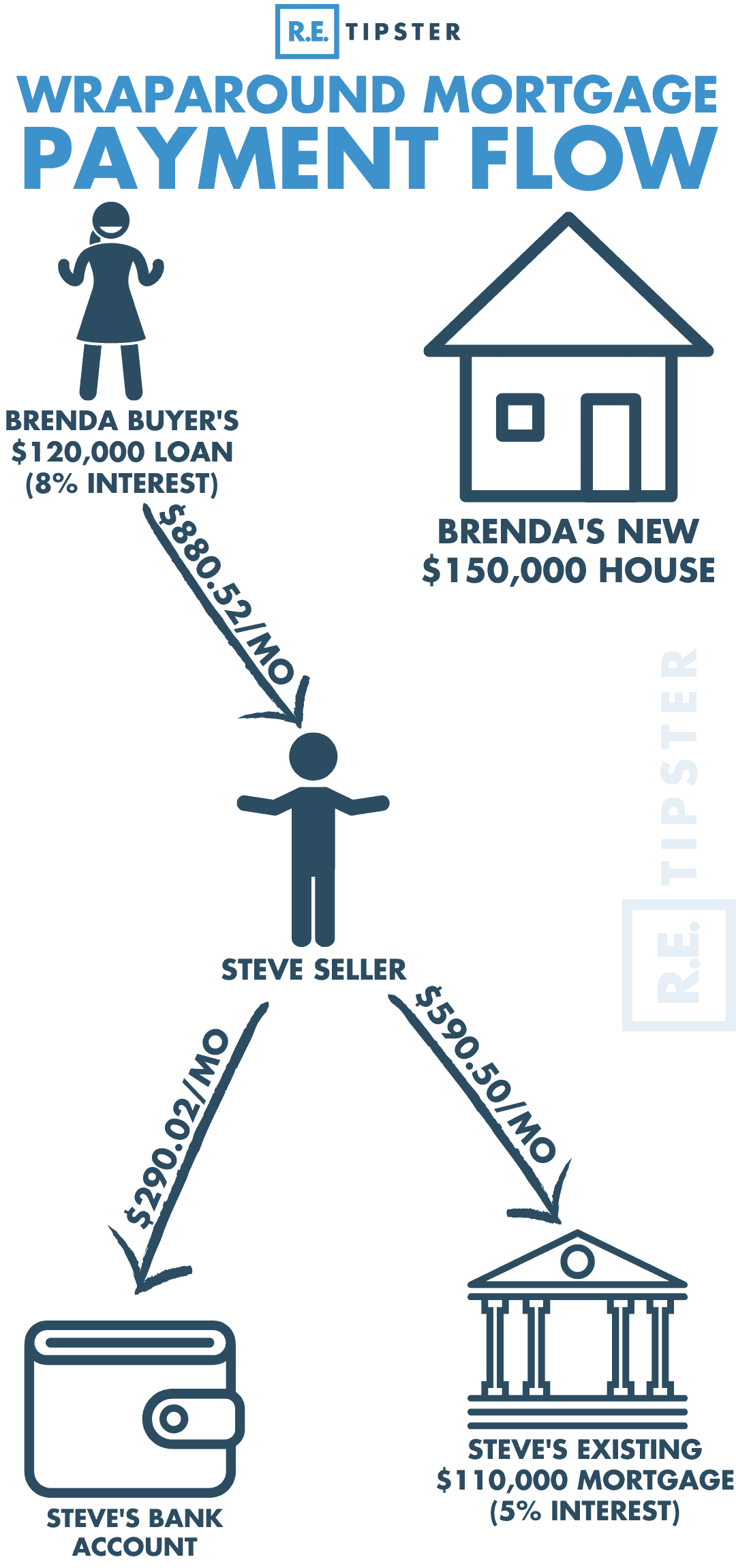

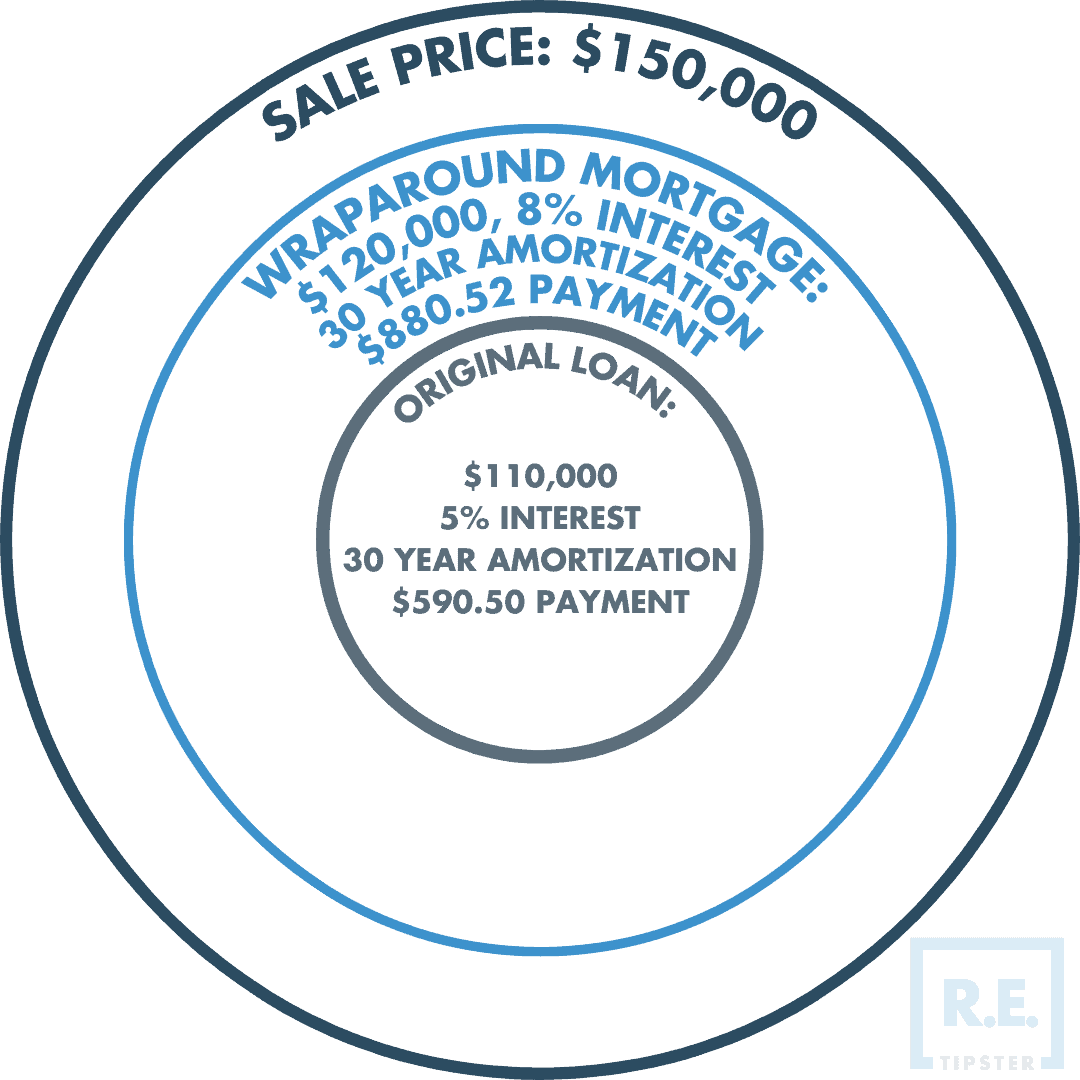

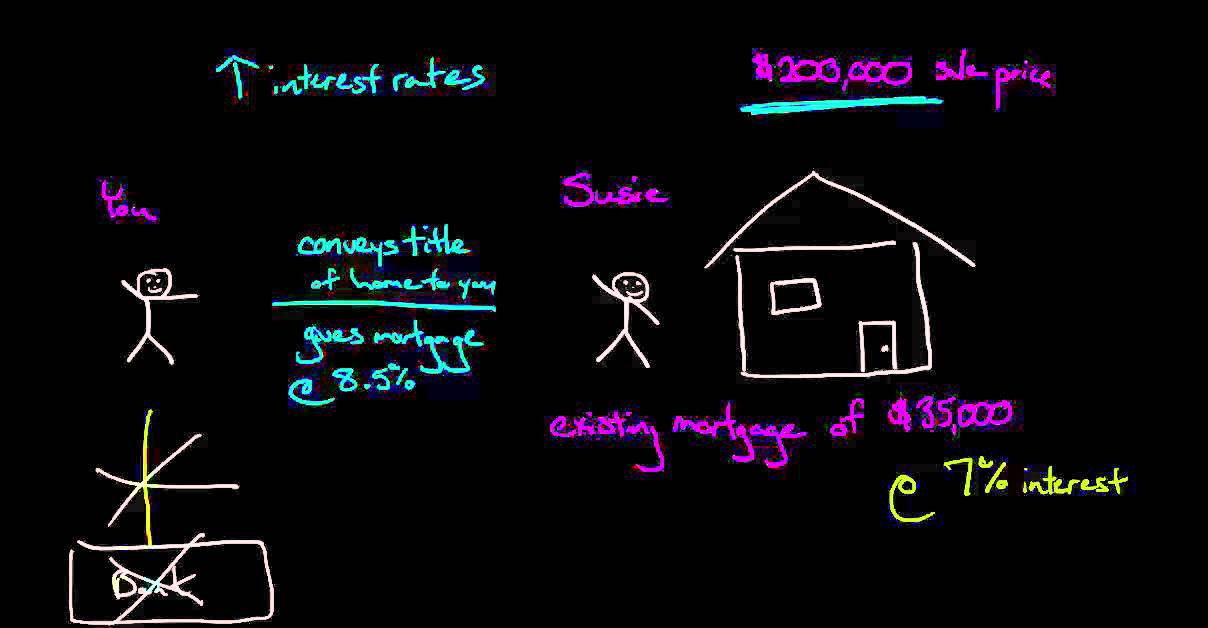

Are you dreaming of owning your own home, but don’t have enough cash to pay for it in full? A wraparound mortgage could be the answer. This type of loan allows you to purchase a property by taking out a loan that wraps around the existing mortgage. With a wraparound mortgage, you can enjoy the benefits of owning your own home without having to come up with a large down payment or put yourself in serious debt. In this article, we’ll explain how to get a wraparound mortgage and the advantages and disadvantages to consider before you take the plunge.

Research available options.

Researching available options for a wraparound mortgage can be daunting. The best way to get started is to compare lenders and their available products to find one that best suits your needs.

Compare rates and fees.

Comparing the rates and fees for wraparound mortgages is essential to ensure you get a good deal. Shop around for different lenders and read reviews to find the best option for you.

Contact lenders.

When looking for a wraparound mortgage, it’s important to contact the right lender for your needs. Do your research and compare lenders to find the best rates and terms for your situation.

Submit application.

Submitting an application for a wraparound mortgage is the first step in the process. It is important to make sure you have all the information necessary to complete the application accurately. Your lender will need to know your financial history and current credit score to determine your eligibility. Additionally, you should make sure to provide all the necessary documentation to support your application.

Review documents.

When reviewing documents for a wraparound mortgage, it is important to ensure that all the paperwork is in order and that all the information is accurate. This is critical in order to guarantee that the loan will be approved and that you will receive the best terms.

Sign agreement.

Once you have talked with your lender and discussed the terms of the loan and agreed to them, it is time to sign the agreement. Make sure there are no surprises and that you understand the terms before signing. Once the agreement is signed, you will be on your way to getting a wraparound mortgage.