Are you looking to finance a major purchase, consolidate debt, or do home improvements? Home equity line of credit (HELOC) might be the perfect solution for you. A HELOC is a type of loan that allows you to borrow against the equity in your home. In this article, you’ll learn the basics of how to get a HELOC, the advantages and disadvantages of this type of loan, and how to compare different loans to find the best one for your needs. Read on to get the information you need to make the right decision for your financial situation.

Research HELOC lenders

Researching HELOC lenders can be made easier by looking into online reviews, asking family and friends for recommendations, and comparing interest rates and terms. Take the time to find the best lender for your needs and you’ll be on your way to getting the best HELOC.

A HELOC is a great way to access the equity in your home and use it for home improvements, debt consolidation, or other expenses. It’s important to weigh the benefits and risks before taking out a HELOC to make sure it’s the best option for you.

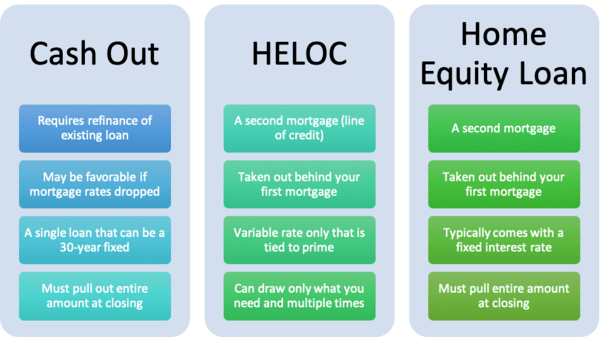

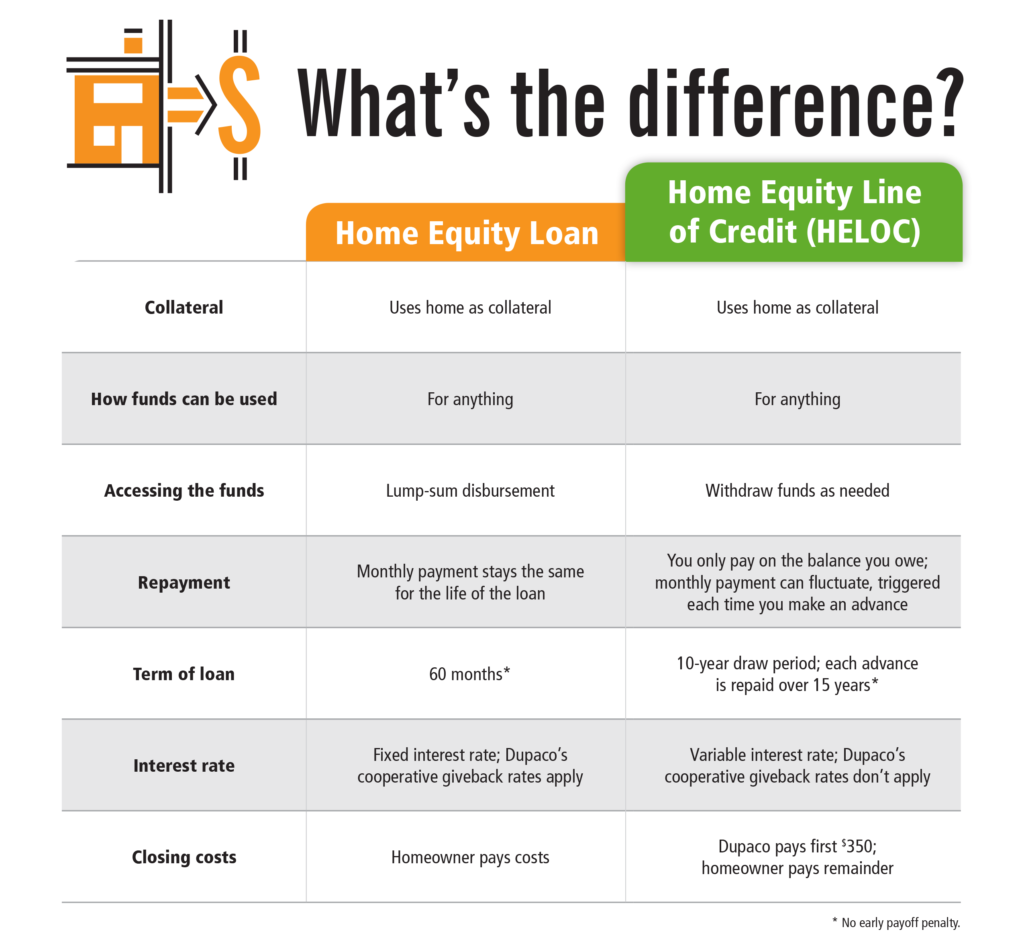

Compare loan options

When shopping for a HELOC, it’s important to compare loan options to find the best fit for your individual needs. Consider factors such as interest rates, repayment terms, and any additional fees or charges before making a decision.

When getting a HELOC, it’s important to shop around and compare offers from multiple lenders in order to find the best deal that meets your needs. Do your research, review the terms and conditions, and make sure you understand all the costs and fees associated with the loan.

Apply for HELOC

Applying for a HELOC is a relatively simple process. Start by gathering all of your financial documents, such as pay stubs and income statements, and contact a lender to discuss your needs and eligibility.

sentenceA HELOC is a great way to access the equity you have built in your home and use it for projects, investments, and more. With a HELOC, you can get approved quickly and get the funds you need right away.

Submit income verification

Submitting income verification is a necessary step in getting a HELOC. You’ll need to provide proof of income to the lender to get approved, such as bank statements, pay stubs, or tax returns. It’s important to make sure all the documents are accurate and up to date, as the lender will need to verify your financial information.

A Home Equity Line of Credit (HELOC) is a great way to get access to the equity in your home. It can provide you with a line of credit that you can use for a variety of purposes, such as funding home improvement projects, paying off debt, or even financing a car. With a HELOC, you can access the funds you need while still keeping your home as collateral.

Wait for lender decision

Once you have submitted your application, the lender will review all the information and make a decision. It is important to be patient during this process and to keep an eye out for communication from the lender.

When considering a HELOC, a key step is to determine how much you can borrow. Knowing the amount you can borrow, as well as the terms of the loan, will help you make the best decision for your financial situation.

Receive funds.

Once you receive the funds from your HELOC, it’s important to use them wisely. Make sure to review your budget and create a repayment plan to make sure you can pay off your loan on time.