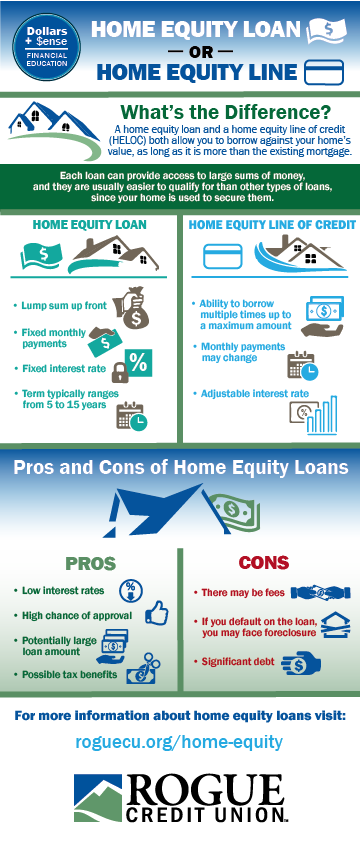

Are you looking for a way to finance your next home improvement project or cover unexpected costs? Home equity loans can be an affordable and reliable source of funding. With a home equity loan, you can use the equity in your home as collateral to secure a loan amount. This article will explain how to get a home equity loan, including the necessary steps to take and the pros and cons of taking out such a loan. Keep reading to learn more about this valuable financial tool and how it can help you achieve your financial goals.

Check eligibility requirements

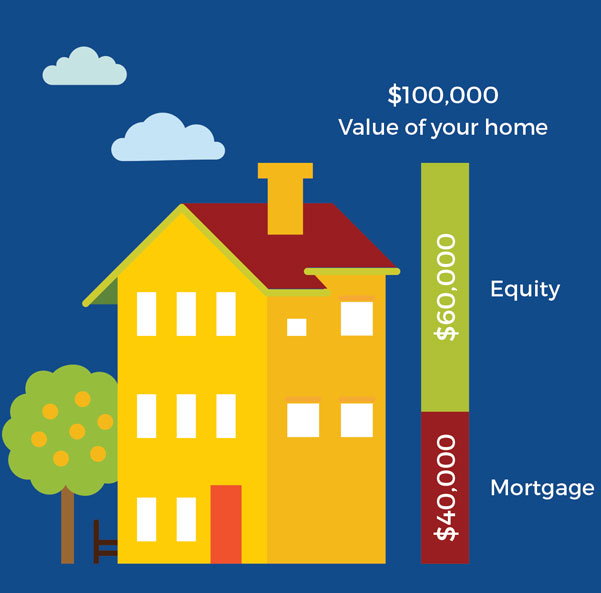

Before you can get a home equity loan, you must first check to see if you are eligible. Eligibility requirements usually include having sufficient equity in your home, a good credit score, and a regular income. Make sure you have all the necessary documents to apply for the loan.

Compare lenders and rates

Comparing lenders and rates for a home equity loan can be a tedious process, but it is worth the effort to ensure you get the best deal possible. Researching different lenders and the rates they offer will help you make the most informed decision for your home equity loan.

Gather necessary documents

Gathering necessary documents for a home equity loan can be a daunting and time consuming task. Be sure to have your financial statements, credit reports, tax returns, and other documents in order to make the process as smooth as possible.

Complete application form

Once you have decided to obtain a home equity loan, the next step is to fill out the application form. This is a simple process that can be completed online or in person. Be sure to provide accurate information and any necessary documents to ensure the process goes as smoothly as possible. It’s important to remember that the lender will need to assess your creditworthiness, so be sure to provide all necessary information to expedite the process.

Submit application & docs

Once you have decided to apply for a home equity loan, it is important to gather all of the necessary documents and submit a completed application with them. This can help to ensure that the process runs smoothly and that you get the best rate possible.

Wait for decision/approval

Once you have submitted all of your documentation, you will need to wait for the lender to make a decision on your home equity loan application. This decision is usually made within a few days, so be sure to stay patient during this time.