Are you looking for an innovative way to finance your home purchase? A Shared Appreciation Mortgage (SAM) may be the perfect solution for you! SAMs are a relatively new form of home financing that give you the ability to buy a home while minimizing the amount of money you need to pay upfront. This unique financing option offers you a mix of traditional mortgage financing plus a portion of the appreciation in the value of the home when it is sold. Read on to learn all about SAMs and how you can use them to get into your dream home.

Research lenders and terms.

Researching lenders and terms for a Shared Appreciation Mortgage can be a daunting task, but taking the time to compare different lenders and their terms can save you money and frustration in the long run.

Contact lender/broker.

When looking for a Shared Appreciation Mortgage (SAM), it is important to contact an experienced lender or broker. They can help you understand the various options available to you and guide you through the process.

Complete application

Once you have decided to apply for a Shared Appreciation Mortgage (SAM), you must complete an application. This application will require you to provide detailed personal and financial information, including your income, debts, assets, and credit history. Be sure to fill out the application accurately and completely to ensure your application is processed quickly and efficiently.

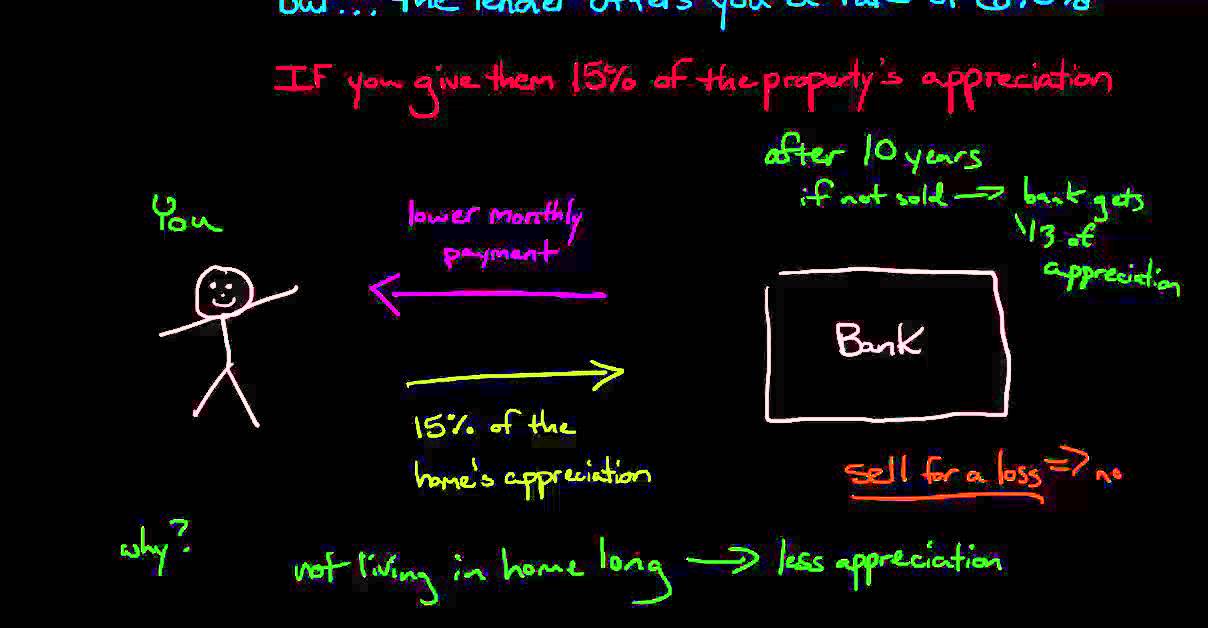

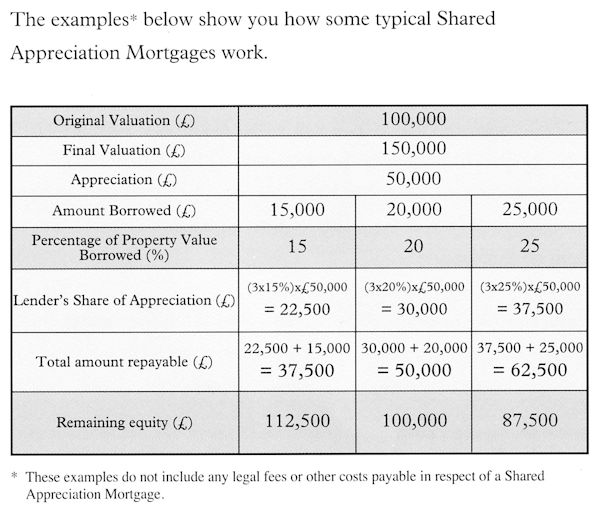

Shared appreciation mortgages (SAMs) can be a great way to access cash from the equity in your home. These mortgages are designed to provide you with a lump sum of money in exchange for a portion of the appreciation of your home in the future. SAMs can provide a great way to access funds without having to take out a loan or refinance your home.

Provide proof of income.

When applying for a shared appreciation mortgage, it is important to provide proof of income to demonstrate your ability to pay back the loan. This could include documents such as tax returns, pay stubs, and bank statements. Providing this information will help lenders to determine if you are a suitable candidate for a Shared Appreciation Mortgage.

Submit closing paperwork.

Once the closing paperwork is completed, it is time to submit it to your lender. Make sure to double-check all forms and documents to ensure there are no mistakes before submitting.

Receive loan funds.

Once you have been approved for a shared appreciation mortgage, the loan funds will be transferred to your bank account. This is an easy and convenient way to receive the money you need to purchase your dream home.