Are you a student looking for an easy way to buy a house? Fixed-rate mortgages are a great option for people in your situation. They offer a low, fixed interest rate for the life of the loan, which makes it easier to budget. With a fixed-rate mortgage, you don’t have to worry about your payments increasing over time. In this article, I’ll explain how to get a fixed-rate mortgage and the advantages it offers.

Research lenders/rates

When considering a fixed-rate mortgage, research is key! Check out online reviews and compare lenders to find the best rates. Ask around to see what others have experienced with different lenders. You can also use online mortgage calculators to determine the best rate for your situation. Don’t forget to factor in the costs of fees, closing costs, and other expenses associated with the loan.

Calculate budget/debt

When calculating your budget and debt, you should take into account all of your expenses, such as rent, bills, credit cards payments, student loans, and any other debts. You should also include your income and savings, so you can get a better idea of your financial situation. Having a good understanding of your finances is key to getting a fixed-rate mortgage and staying on top of your payments.

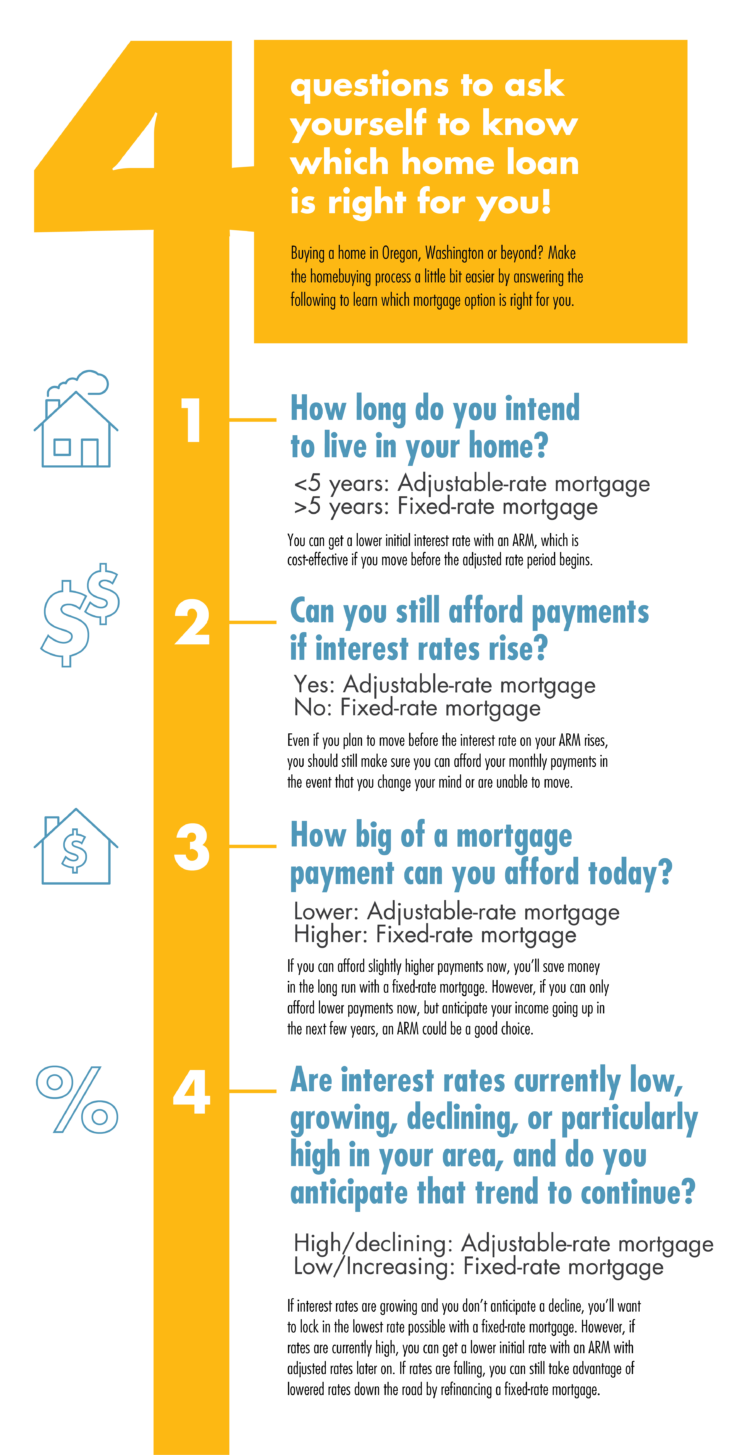

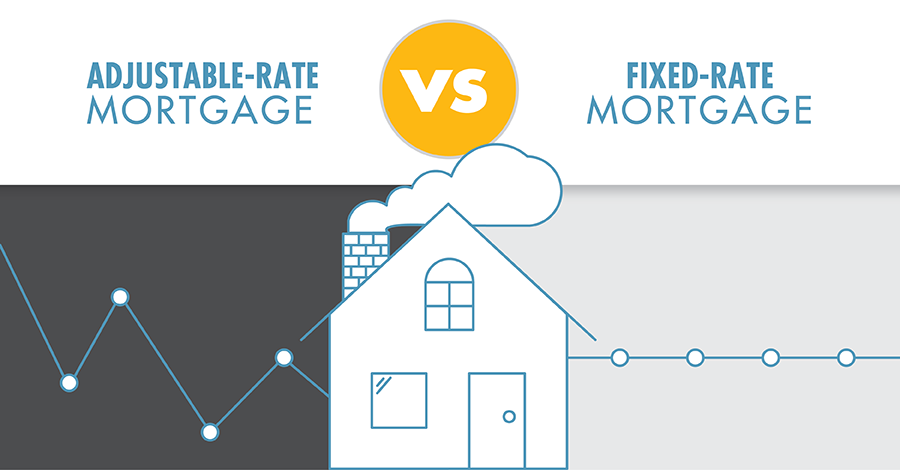

Compare mortgage options

One of the best ways to compare mortgage options is to look at the different types of fixed-rate mortgages available. From 15-year to 30-year, there are several options that could fit your budget and lifestyle. Check out different lenders to find the best rates and terms for your mortgage. Don’t forget to consider any prepayment penalties or other fees that may apply.

Apply for pre-approval

If you’re an 18-year-old looking to get a fixed-rate mortgage, one of the first steps you should take is to apply for pre-approval. Pre-approval will give you an idea of how much you can borrow, and what your monthly payments will look like. This can be a great way to know how much you can afford, and plan your budget appropriately. Plus, it’s a great way to give yourself a head start when you start shopping for your mortgage.

Document income/assets

When applying for a fixed-rate mortgage, you’ll be asked to provide documents that can prove your income and assets. This can include pay stubs, bank statements, tax returns, and proof of investments. As an 18-year-old, it’s important to understand the power of a good credit score, and that this can help you get the best rate. Be sure to ask questions and get clarification on any documents you may need to provide.

Finalize mortgage details

Once you’ve decided to get a fixed-rate mortgage, the last step is to finalize the mortgage details. The process may seem intimidating, but it’s actually quite straightforward. Your lender will provide you with all the necessary paperwork and discuss the different options available. Make sure to ask questions and read through the documents carefully so that you understand all the terms and conditions. It’s important to have all your questions answered before signing any paperwork.