Are you trying to figure out whether a VA or conventional mortgage is the best option for you? If you’re 18 and just starting out, understanding the difference between the two can be confusing. Don’t worry! This article will help you to understand the difference between a VA and conventional mortgage so you can make an informed decision about what’s best for you.

Research VA vs

Doing research on VA vs conventional mortgages can be overwhelming. I’ve spent a lot of time comparing the two to figure out which one is best for me. I used online resources to understand the differences between the two, such as the fees, interest rates, and other requirements. With the help of these resources, I was finally able to understand the difference and make an informed decision.

Conventional

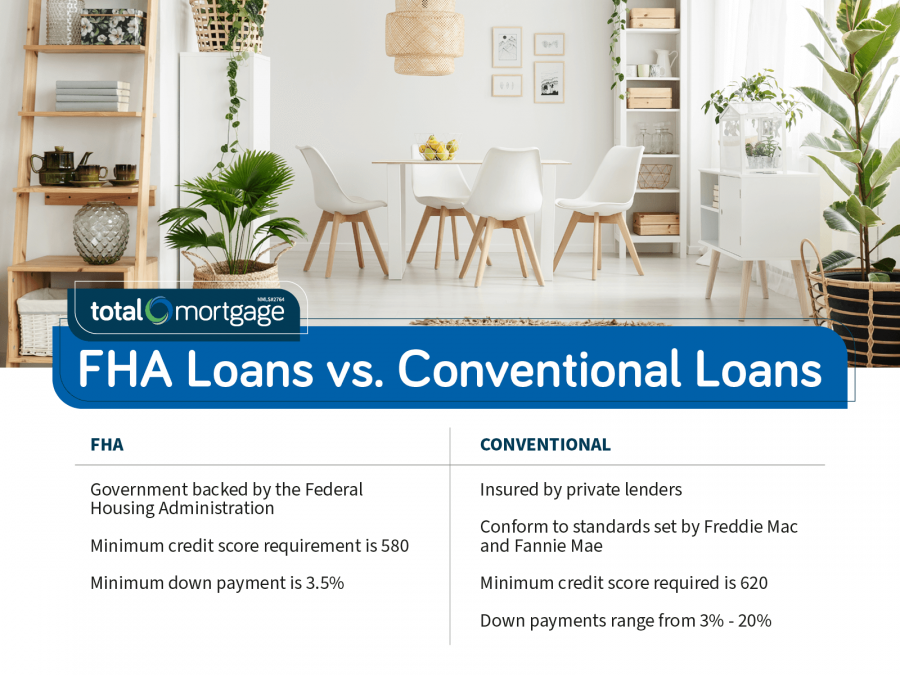

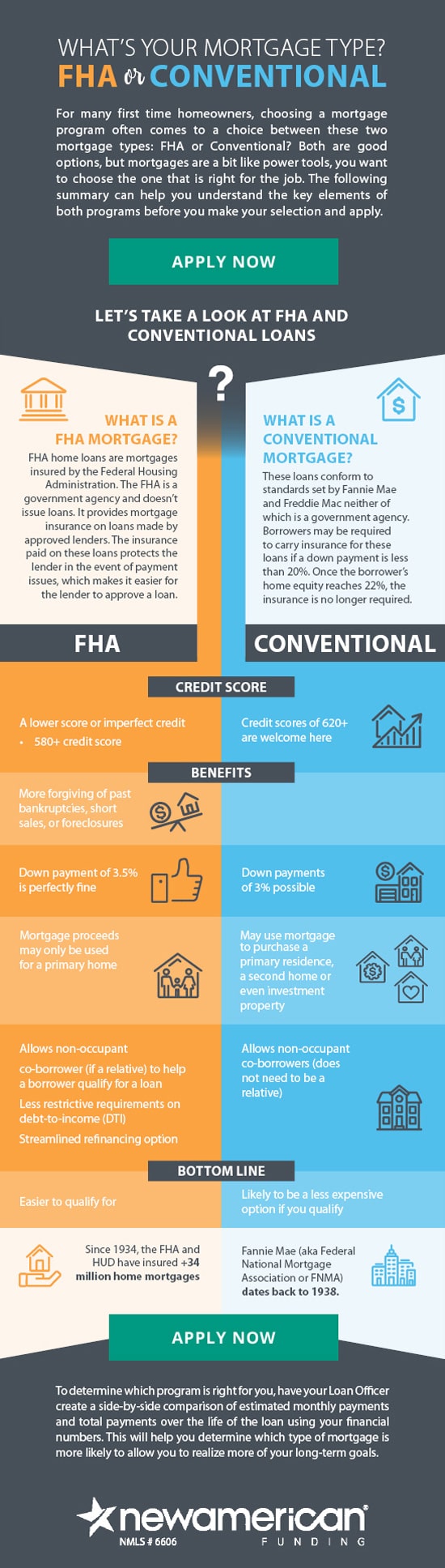

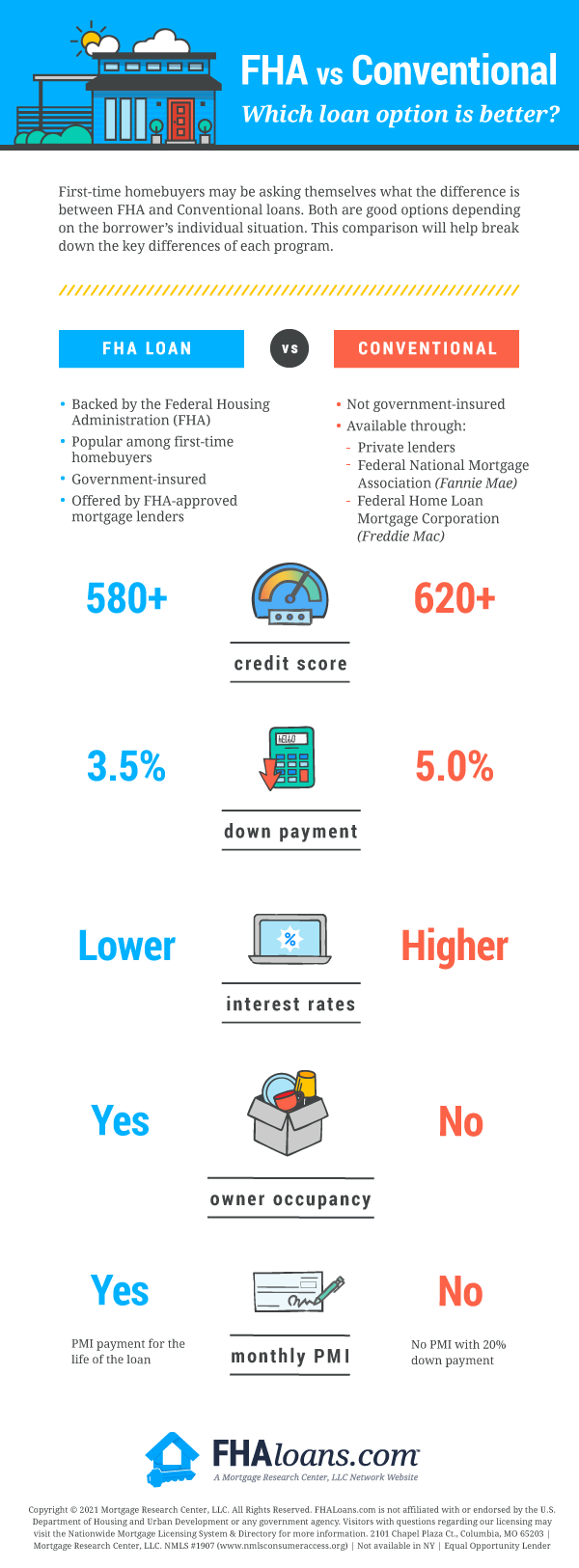

Conventional mortgages are traditional home loan options that are not backed by the government. They typically have fixed-rate terms, require a higher down payment, and have stricter qualifications. They also involve more paperwork and involve more fees, such as closing costs. They are a great option for those who can afford it and don’t need the government’s help in obtaining a loan.

Compare mortgage criteria

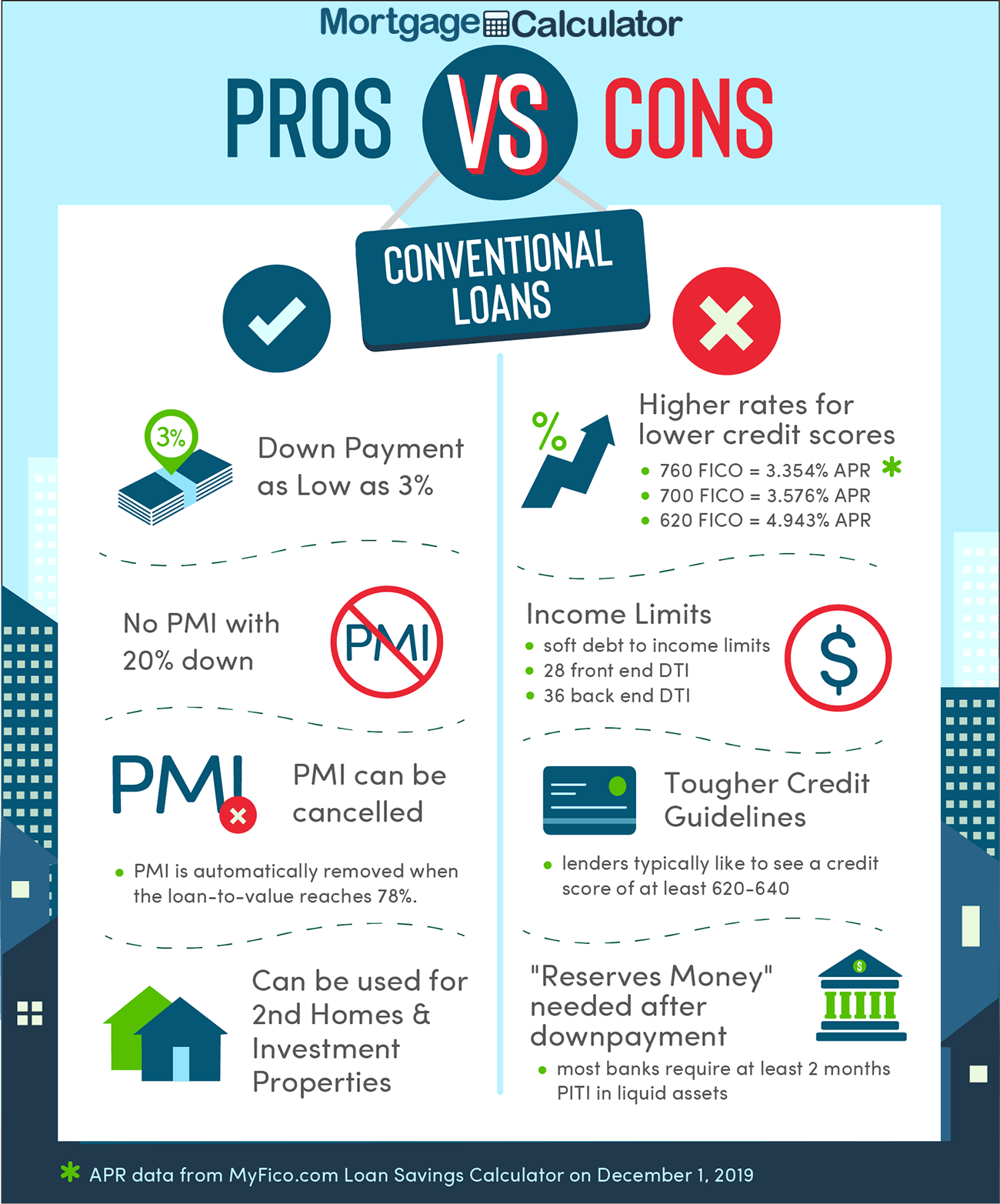

Comparing VA and conventional mortgages can be confusing, but there are some key differences to consider. VA mortgages provide veterans with a lower interest rate, no down payment, and no mortgage insurance. On the other hand, conventional mortgages require a higher down payment and usually require mortgage insurance. Additionally, VA loans often offer better interest rates and more flexible repayment options than conventional loans. It’s important to weigh these factors when deciding which type of mortgage is right for you.

Understand VA benefits

Being a veteran has its perks! One of the biggest benefits is access to a VA mortgage, which can be a great option for those who qualify. VA mortgages offer lower interest rates, no down payment, and no private mortgage insurance compared to conventional mortgages. With these benefits, veterans can save a lot of money on their home loan.

Evaluate loan types

It can be tough to understand the difference between a VA and conventional mortgage. To evaluate which loan type is right for you, consider the cost of each loan type, the credit requirements, and the monthly payments. VA loans may have lower credit scores and lower down payments, but they often have higher closing costs compared to conventional loans. Evaluate all of these factors to make sure you’re getting the best mortgage product for your situation.

Identify payment differences

When it comes to mortgages, the main difference between a VA and conventional loan is in the payment. VA loans often offer lower monthly payments since they don’t require a down payment, whereas conventional loans typically require a 20% down payment. Additionally, VA loans don’t require mortgage insurance, whereas conventional loans often do. So if you’re looking for a lower payment, a VA loan is probably the way to go.

Compare interest rates

Comparing interest rates between VA and conventional mortgages is essential to make sure you’re getting the best deal. VA mortgages often have lower rates than conventional loans since they require no down payment and the lender doesn’t need to pay for mortgage insurance. It’s important to shop around and compare different lenders to find the best rate for your specific situation.