If you’re a student looking for ways to finance your future home, you may want to consider an adjustable-rate mortgage (ARM). An ARM can be a great option for young people looking to purchase a home, as it typically offers lower interest rates than a traditional fixed-rate loan. In this article, we’ll explain what an ARM is, how it works, and the advantages and disadvantages of getting one. We’ll also provide some tips on how to get the most out of your ARM. So, if you’re ready to learn more about this mortgage option, let’s get started!

Research mortgage lenders

Researching mortgage lenders is important when considering an ARM. You should compare lenders and their loan terms, fees, and interest rates. Look for reviews of the lenders you are considering, and only go with the ones that have the best reviews. Make sure to ask questions and get all the details before signing on the dotted line.

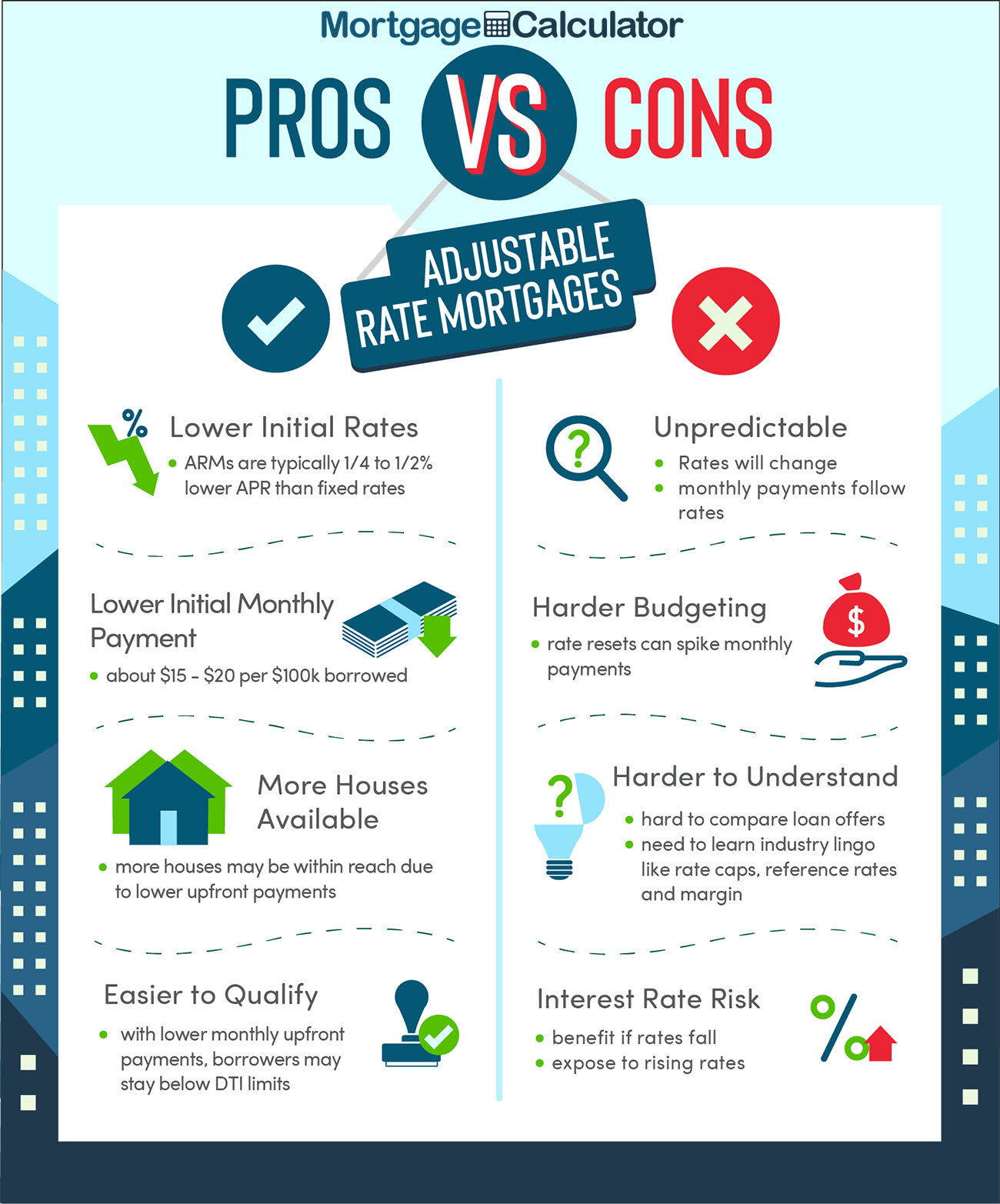

Compare loan options

If you’re looking to get an Adjustable-rate Mortgage, it’s important to compare your loan options. Consider talking to your bank or a mortgage broker to get an idea of what you qualify for, and make sure you’re aware of the pros and cons of an ARM. Researching different loan providers and their rates will help you make the best decision for your financial situation.

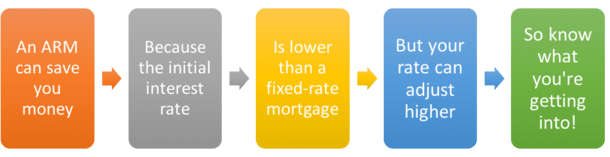

Understand ARM terms

When getting an adjustable-rate mortgage (ARM), it’s important to understand the terms. An ARM typically has a lower initial interest rate than a fixed-rate mortgage, but after the initial period, the interest rate may go up or down. It’s important to know the length of the initial period, the index used to determine the rate, the margin, and the caps on the rate. Knowing these terms can help ensure you make the best decision when it comes to your mortgage.

Check credit score

Before getting an Adjustable-rate mortgage (ARM), it’s important to check your credit score. Depending on your score, you may be able to qualify for a lower interest rate. Checking your credit score is easy, and you can do it online for free. It’s best to check your score at least twice a year to make sure nothing has changed and you’re still in good standing.

Apply for loan

Applying for an adjustable-rate mortgage (ARM) loan can be a daunting process for a young adult. Fortunately, there are several simple steps to follow. First, check your credit score and make sure it is in good shape. Next, research different loan products to find the best option for you. Lastly, contact a loan officer to discuss the details and apply for the loan. Following these steps should help you get the ARM loan you need.

Finalize paperwork.

Once you have found the ARM mortgage that fits your budget and needs, you need to finalize the paperwork. This includes signing the loan documents, providing proof of income and employment, and any other documentation required by your lender. It’s important to read through all the paperwork carefully before signing, to make sure that you understand the terms and conditions of the loan.