Are you looking to purchase a home but don’t understand how to get a fixed-rate mortgage? Don’t worry, you’re not alone! With today’s fluctuating market and rates, it can be difficult to know where to start. Fortunately, understanding how to get a fixed-rate mortgage is simpler than you think. In this article, we’ll explain the basics of getting a fixed-rate mortgage, how to compare quotes, and how to get the best rate. Whether you’re a first-time homebuyer or an experienced homeowner, we’ve got you covered with our comprehensive guide to getting the best fixed-rate mortgage for your needs.

Research fixed-rate mortgages.

When researching fixed-rate mortgages, it’s important to compare different lenders and understand the long-term implications of the rate you choose.

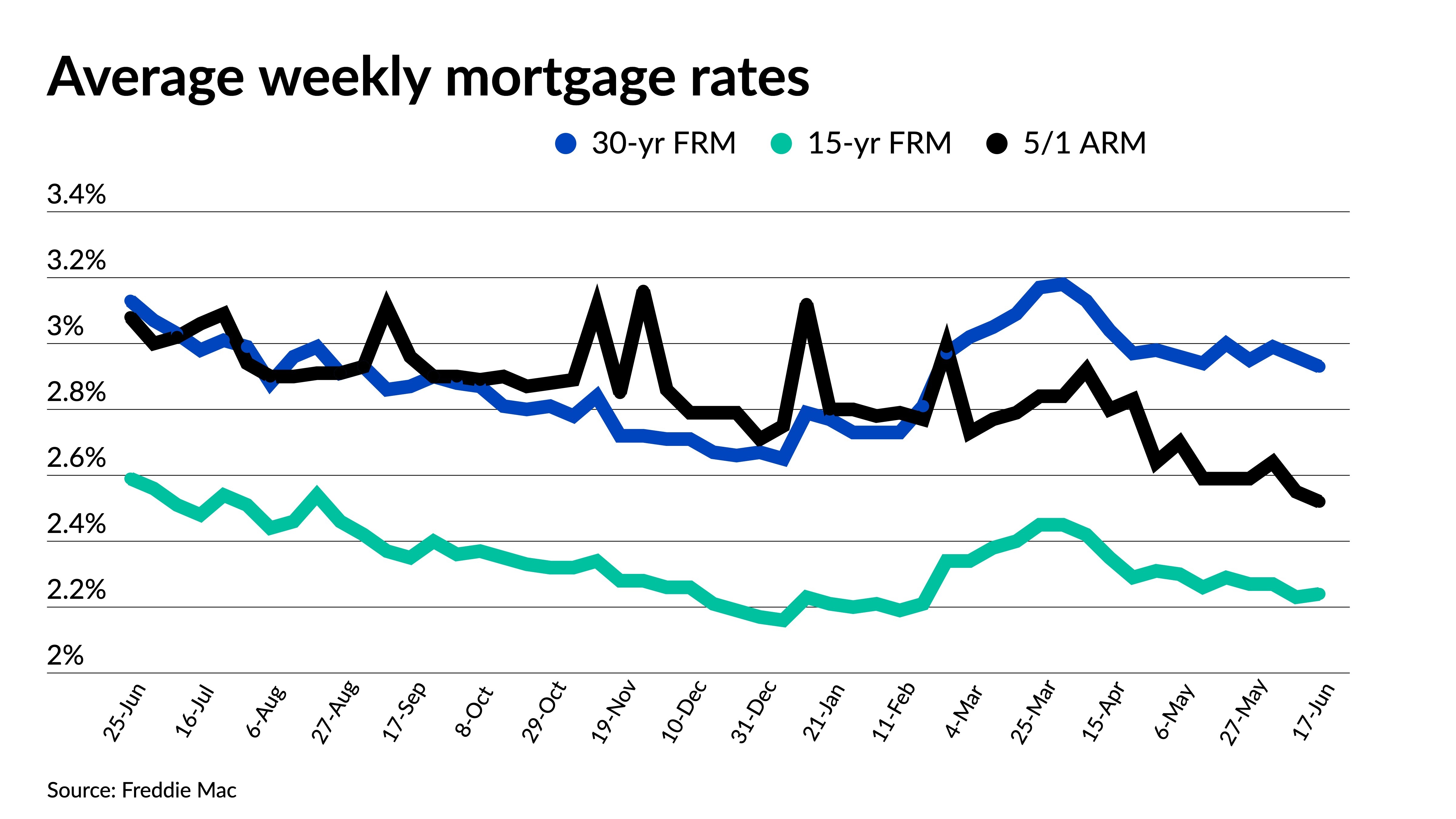

Compare interest rates.

When comparing interest rates, it’s important to research different lenders and compare the rates they offer for fixed-rate mortgages. Make sure to check all the fine print and evaluate the terms and conditions of each loan.

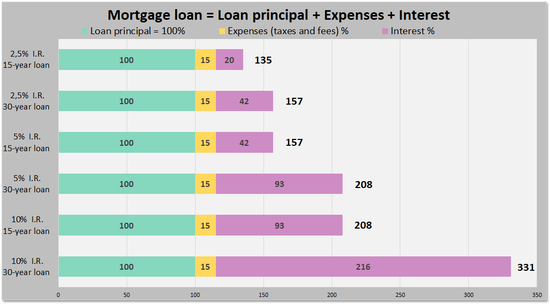

Calculate total costs.

When looking for a fixed-rate mortgage, it is important to calculate the total costs, including interest, fees, and taxes. Doing so will help you determine which loan option best fits your budget and financial goals.

Choose mortgage lender.

When looking for a mortgage lender, be sure to compare different lenders to ensure you’re getting the best rate and terms for your new mortgage.

Submit loan application.

Once you have decided to get a fixed-rate mortgage, the next step is to submit a loan application. Be sure to provide accurate and up-to-date financial information in order for the lender to evaluate your eligibility for a loan.

Receive mortgage approval.

Once you have received pre-approval from a lender, you can start shopping for your ideal fixed-rate mortgage. Make sure to compare rates from different lenders to find the best deal.