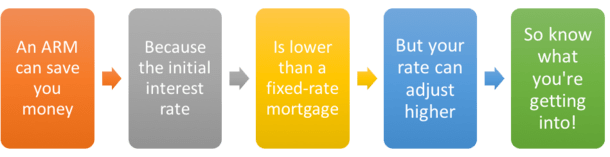

Are you considering purchasing a home, but don’t know whether to go for a fixed-rate mortgage or an adjustable-rate mortgage (ARM)? If so, you’ve come to the right place! In this article, we will be discussing the advantages and disadvantages of ARMs so that you can decide if this is the right mortgage option for you. We will explore the different types of ARMs, the factors that influence the interest rate, and the best strategies for getting the most out of your ARM. So, read on to get the full scoop on adjustable-rate mortgages!

Research ARM lenders.

Do your research on ARM lenders to ensure you get the best deal on your adjustable-rate mortgage. Compare rates, terms, and fees to make sure you get the most competitive deal.

Compare rates/terms.

Comparing rates and terms of adjustable-rate mortgages can be a daunting task, so it’s important to make sure you’re getting the best deal for your situation. Shop around for the best rates and make sure to read the fine print before committing to a loan.

Gather financial documents.

Gathering your financial documents is an important step in applying for an adjustable-rate mortgage (ARM). You’ll need to provide evidence of your income, assets, debts and credit score. Make sure you have these documents handy before beginning the application process.

Submit loan application.

When applying for an ARM, be sure to submit your loan application as soon as possible. Completing the application correctly is key to getting the best rate and terms on your mortgage.

Wait for approval.

Once you’ve submitted an application for an adjustable-rate mortgage and all the necessary documents, the lender will review them and decide whether or not to approve your loan request.

Sign loan documents.

Once you have found a lender and have agreed on the loan terms, the next step is to sign loan documents. Take the time to review the documents carefully, and make sure you understand what your responsibilities are before signing.