Are you looking to purchase a home but are having trouble getting a traditional mortgage? A low ratio mortgage may be the right choice for you. This full guide to low ratio mortgages will provide you with an in-depth look at these types of mortgages, so you can make an informed decision about whether they are the right fit for your financial situation. We’ll discuss the advantages and disadvantages of low ratio mortgages, how to qualify, and the types of mortgages available. You’ll also learn about the potential savings a low ratio mortgage can provide. Read on to learn more about low ratio mortgages and how they can help you achieve your goals.

What Is A Low Ratio Mortgage?

Low ratio mortgages are the perfect way to get your foot in the door to homeownership. With low down payments and lower interest rates, these mortgages are an ideal option for those just starting out in their home buying journey. Low ratio mortgages require a down payment of less than 20% of the total purchase price of the home, making them much more affordable and accessible than traditional mortgages. They also come with lower interest rates, which can help keep monthly payments down. Low ratio mortgages are a great way to get into a home without breaking the bank. With more flexible eligibility requirements and lower interest rates, these mortgages are a great way to get into a home and start building equity.

Benefits of a Low Ratio Mortgage

A low ratio mortgage is a great way to get into homeownership without breaking the bank. Not only are the down payments lower, but the monthly payments can be more manageable as well. Plus, lenders are often willing to offer more flexible terms, allowing you to customize your mortgage to your financial situation. Another great benefit of a low ratio mortgage is that it can help you save money in the long run. With lower payments and interest rates, you can build equity faster and pay off your loan quicker. Plus, you may even qualify for tax benefits, depending on your specific mortgage situation. All in all, a low ratio mortgage can be a great way to get into homeownership without breaking the bank and with plenty of benefits.

How to Qualify for a Low Ratio Mortgage

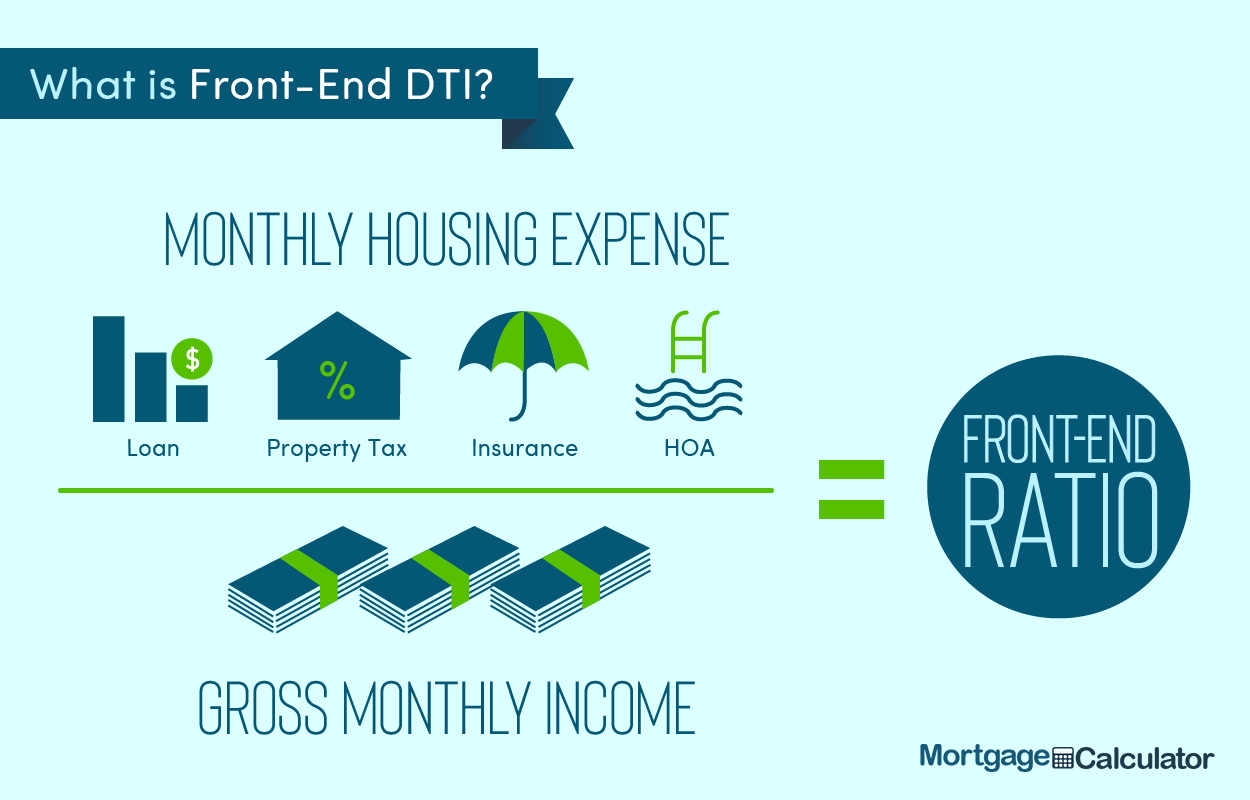

If you’re looking to get your foot in the door of the housing market, a low ratio mortgage is the perfect way to get started. To qualify for a low ratio mortgage, you need to have a steady income, good credit score, and a down payment of at least 20%. You’ll also need to provide proof of income and a list of assets. You’ll also be subject to a debt-to-income ratio, which measures your total monthly debt payments compared to your gross monthly income. If your debt-to-income ratio is too high, you may need to take steps to reduce your debt before applying. Other factors that may affect your eligibility include your employment history and the value of the home you’re looking to purchase. Knowing what you need to qualify for a low ratio mortgage can help set you up for success.

Disadvantages of a Low Ratio Mortgage

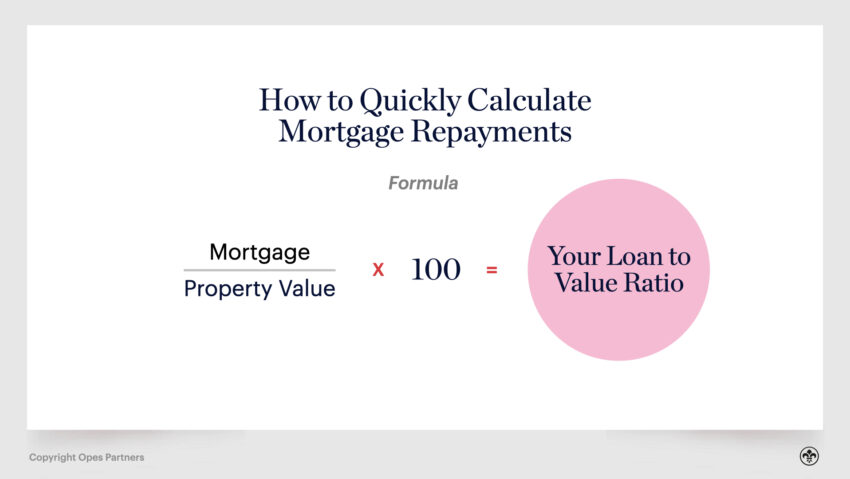

If you’re thinking about getting a low ratio mortgage, you should be aware of the potential drawbacks. One of the major drawbacks of a low ratio mortgage is that you won’t be able to borrow as much money as you would with a regular mortgage. This means you may need to come up with a larger down payment, which can be difficult for some people. Additionally, interest rates are typically higher for low ratio mortgages, so you’ll be paying more in interest over the life of the loan. Furthermore, you’ll need to meet certain criteria in order to qualify for a low ratio mortgage, and you may have to pay extra fees if your loan-to-value ratio is too low. All of these factors should be considered before you commit to a low ratio mortgage.

Tips for Avoiding Plagiarism While Writing About Low Ratio Mortgages

Writing about low ratio mortgages can be tricky. To avoid plagiarism, it’s important to focus on writing in your own words and citing any sources you draw information from. When writing, think about how you can use your own unique style to convey the same information. Additionally, make sure to give credit to those who’s work you’re referencing, including citing any quotes or other information you’ve used. Lastly, review your work to ensure that it’s original and make sure to double check any websites or sources you’ve used to ensure that the information is accurate and up-to-date. With these tips, you can be sure that your writing about low ratio mortgages is plagiarism-free and written in your own unique style.