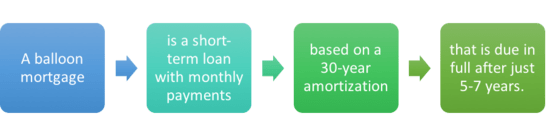

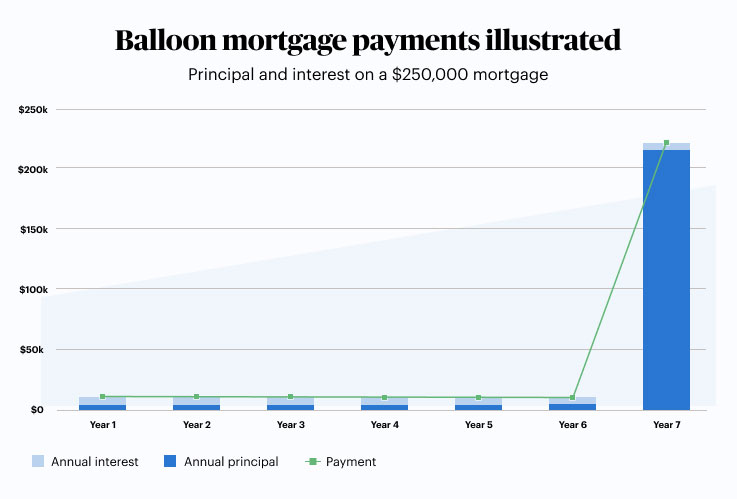

Are you looking for a way to get into your dream home without breaking the bank? A balloon mortgage might be the best solution for you! A balloon mortgage offers a lower interest rate than a traditional mortgage, allowing you to pay significantly less in monthly payments. This type of mortgage can be a great option for those who want to purchase a home but don’t want to be stuck in a long-term mortgage. In this article, we’ll discuss how to get a balloon mortgage and the benefits you can enjoy from it.

Research balloon mortgages.

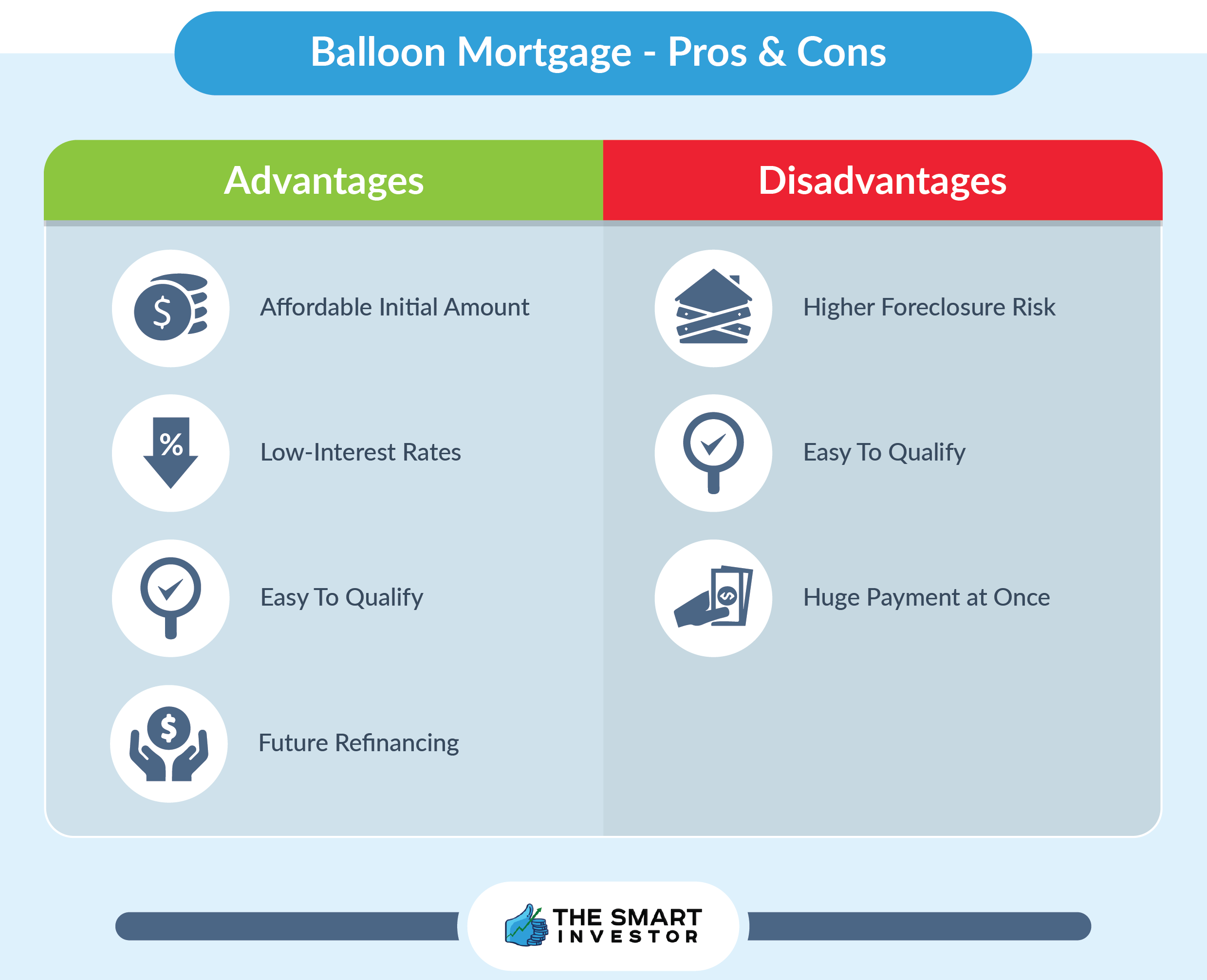

Researching balloon mortgages can be a great way to get a lower interest rate and a lower monthly payment. However, it is important to understand the risk involved with this type of loan before making a decision.

Find lender/broker.

When looking for a lender or broker for a balloon mortgage, it’s important to do your research and look for reputable lenders and brokers with competitive interest rates.

Compare rates/terms.

When shopping for a balloon mortgage, it’s important to compare rates and terms from different lenders. Make sure to take the time to find the best deal for you, and ensure that you understand the terms of the loan before signing.

Apply for loan.

When applying for a balloon mortgage loan, ensure that you have a clear understanding of the terms of the loan and the amount of money you will be required to pay at the end of the loan period.

Meet conditions/requirements.

In order to qualify for a balloon mortgage, you must meet certain conditions and requirements. These could include a good credit score, a steady source of income and a down payment of at least 20%. Additionally, lenders may require additional documentation such as proof of employment and bank statements.

Sign contract/agreement.

It is important to read through the contract/agreement carefully and understand all of the details before signing. Make sure to ask questions to your lender if there is anything that you do not understand, as balloon mortgages are long-term commitments.