Are you 18 years old and looking to buy a home? Applying for a mortgage can seem like a daunting task. Don’t worry though, I’m here to help you out. In this article, I’m going to walk you through the process of applying for a mortgage, including the paperwork you need to have ready, the different mortgage types available, and the steps to get approved. So let’s get started and make your dream of owning a home a reality!

Gather financial documents.

As an 18 year old student, the process of applying for a mortgage can be daunting. Gathering all the necessary financial documents is a critical step in the process. This includes things like bank statements, income statements, recent tax returns and any other documents that show your financial situation. It is important to ensure all documents are up to date and accurate to ensure a smooth mortgage application process.

Research lenders.

If you’re looking to apply for a mortgage, it’s important to do your research! I’d suggest looking into different lenders to see which ones offer the best rates and terms. Compare the different lenders to find the one that best fits your needs. Don’t forget to read the fine print and ask questions before signing any contracts!

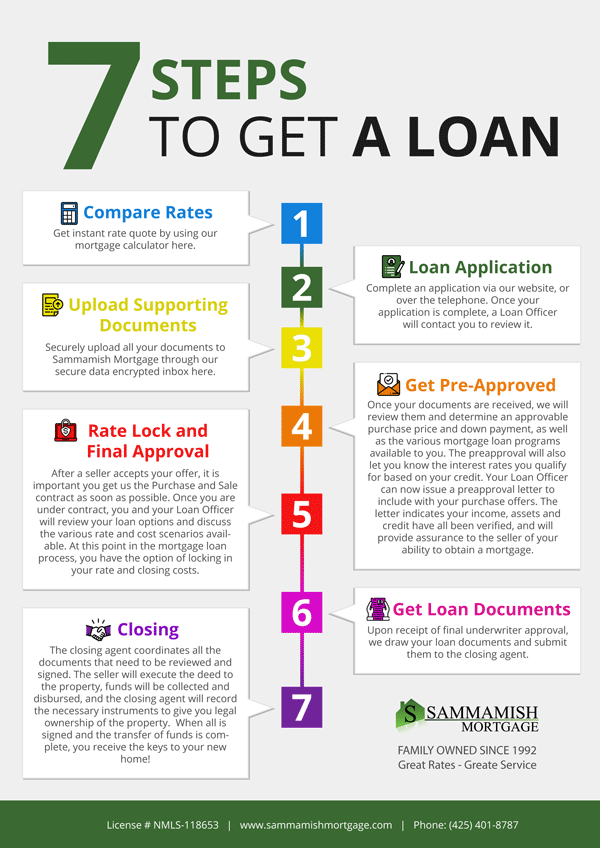

Compare rates.

If you’re looking for the best mortgage rate, you should compare different lenders to make sure you’re getting the best deal. Shop around to get the lowest rate and make sure you understand all the fees and closing costs associated with your loan. Don’t forget to factor in your credit score and income when comparing, as they can affect your rate.

Submit application.

Submitting an application for a mortgage can be a daunting and stressful process. I’m 18 and I recently applied for my first mortgage. I gathered all my financial documents and submitted them to the lender. I was nervous at first, but I quickly found out that the process was surprisingly simple and straightforward. The lender was very helpful and answered all my questions. I soon had my mortgage approved and the keys to my new home!

Negotiate terms.

Negotiating the terms of your mortgage can be daunting. It’s important to do your research and know what you’re looking for. Ask your lender plenty of questions and don’t be afraid to push back on the terms they offer you. Make sure you understand all the terms before signing the agreement; you don’t want to end up with a mortgage you can’t afford!

Finalize paperwork.

After you’ve gathered all the required paperwork, it’s time to finalize it. You’ll need to complete all the forms that your lender asks for and double-check that you’ve filled in all the details correctly. Don’t forget to sign the documents! It may seem stressful, but it’s essential to make sure you have everything done correctly before submitting your application.