Are you a first-time homebuyer unsure of which type of mortgage to choose? Fixed-rate or adjustable-rate mortgages can both offer advantages, but which one is right for you? As an 18-year-old student, you want to make sure you make the right financial decision. This article will provide a comprehensive guide to help you compare and contrast the two types of mortgages so you can make the best choice for your future.

Research mortgage types.

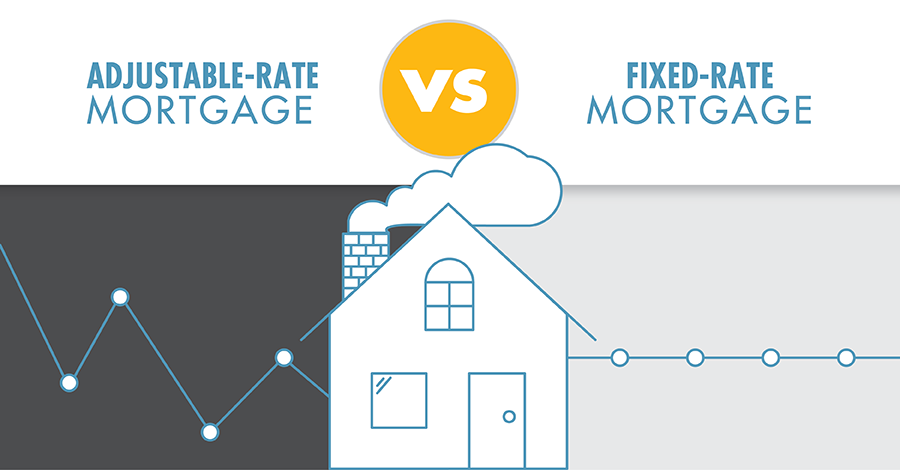

Researching mortgage types can be intimidating, but it’s important to understand the differences between a fixed-rate and adjustable-rate mortgage. Fixed-rate mortgages provide the security of predictable monthly payments, while adjustable-rate mortgages offer lower initial payments but variable interest rates over time. It’s essential to consider all the factors before making a decision.

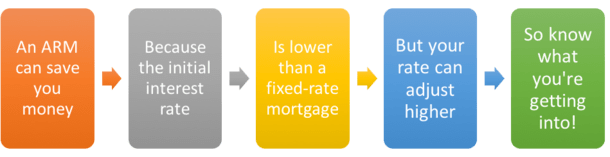

Compare interest rates.

When comparing interest rates, it’s important to think about your long-term plan. A fixed-rate mortgage has a set interest rate that won’t change, while adjustable-rate mortgages can offer lower rates initially, but the rate can change over time. It’s important to understand the pros and cons of each option to make the best decision for your financial future.

Assess needs/goals.

When choosing between a fixed-rate or adjustable-rate mortgage, it’s important to assess your needs and goals. As a young adult, I’d recommend considering how long you plan to stay in your home and how your income may change over time. A fixed-rate mortgage means the rate is fixed for the life of the loan, so if you plan to stay in your home for the long-term, this might be a good option. If your income may change, an adjustable-rate mortgage could be better.

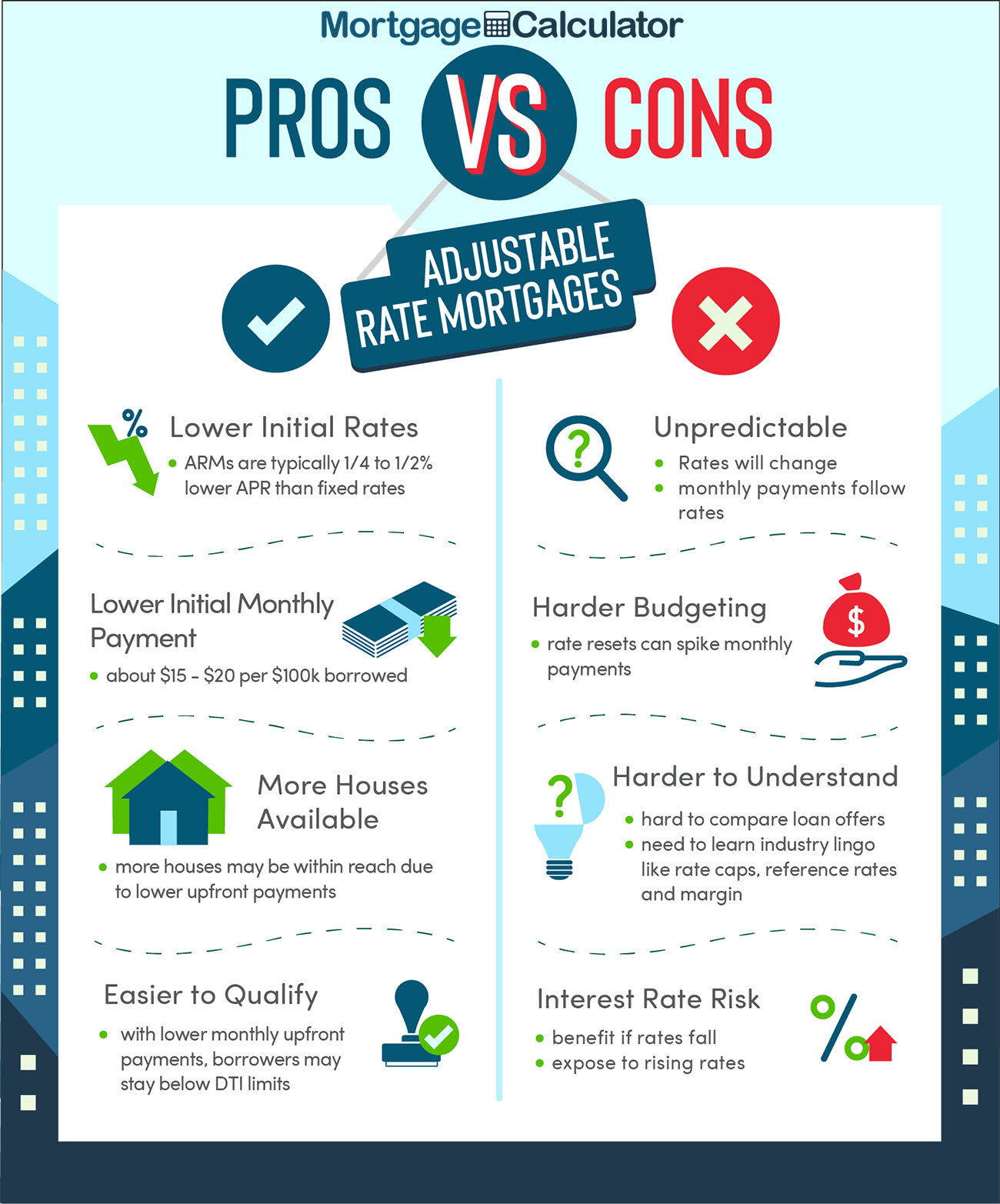

Review payment options.

When it comes to mortgages, deciding between fixed-rate and adjustable-rate options can be tricky. To make the best decision for you, it’s important to review the payment options for both and consider the pros and cons. A fixed-rate mortgage locks in a set interest rate for the life of the loan, whereas an adjustable-rate mortgage can fluctuate depending on market conditions. It’s important to weigh the risks and rewards of each to make the most informed decision.

Consider future changes.

When considering future changes, it’s important to look at what the future may hold. Whether you’re a recent graduate, getting ready to start a family or planning ahead for retirement, your financial situation could change drastically in the coming years. A fixed-rate mortgage may be a good option if you’re looking for stability, whereas an adjustable-rate mortgage could help you take advantage of a potential decrease in interest rates.

Choose best option.

When it comes to choosing the best mortgage option for you, it’s important to consider the fixed-rate vs adjustable-rate mortgage. Fixed-rate mortgages offer a fixed interest rate for the life of the loan, while adjustable-rate mortgages start with a lower rate, then change over time. Before you decide, make sure to consider the pros and cons of each option, as well as how long you plan on staying in your home.