If you’re 18 years old and looking to buy a new home, you know the importance of comparing different types of mortgages to find the one that’s right for you. Comparing the different types of mortgages can seem overwhelming, but it doesn’t have to be! In this article, I’ll provide some tips and tricks to make comparing mortgages easy and enjoyable. You’ll learn how to compare different types of mortgages, weigh the pros and cons, and make the right decision for your needs. With the right information, you’ll be able to confidently choose the mortgage that works best for you!

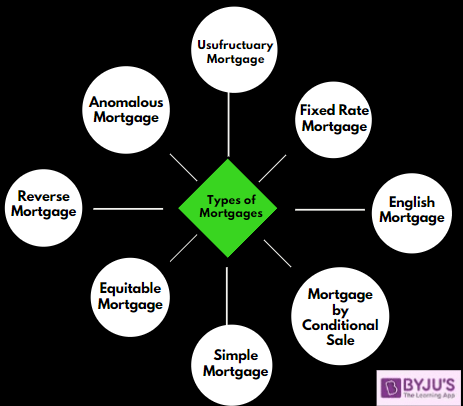

Research mortgage types.

Researching different types of mortgages can be overwhelming, but it’s important to make sure you’re getting the best deal. Start by looking into fixed-rate and adjustable-rate mortgages, and compare rates, fees, and other features to decide which one fits your needs. Make sure to also research lenders to get the best deal. Comparing mortgages doesn’t have to be hard, just take your time and do your research.

Calculate interest rates.

Calculating interest rates on mortgages can be tricky and it’s important to compare different types of mortgages before making a decision. Different lenders offer different types of mortgages, so it’s important to compare the interest rates and other factors such as repayment terms and fees before making a choice. Make sure to shop around and compare different lenders to get the best deal.

Assess loan terms.

I’m an 18-year-old student, and when comparing different types of mortgages, it’s important to assess the loan terms. Look at the length of the loan, the interest rate, and any fees associated with the loan. Compare these factors to find the best mortgage for your needs. Make sure you understand the terms before signing on the dotted line.

Evaluate fees/costs.

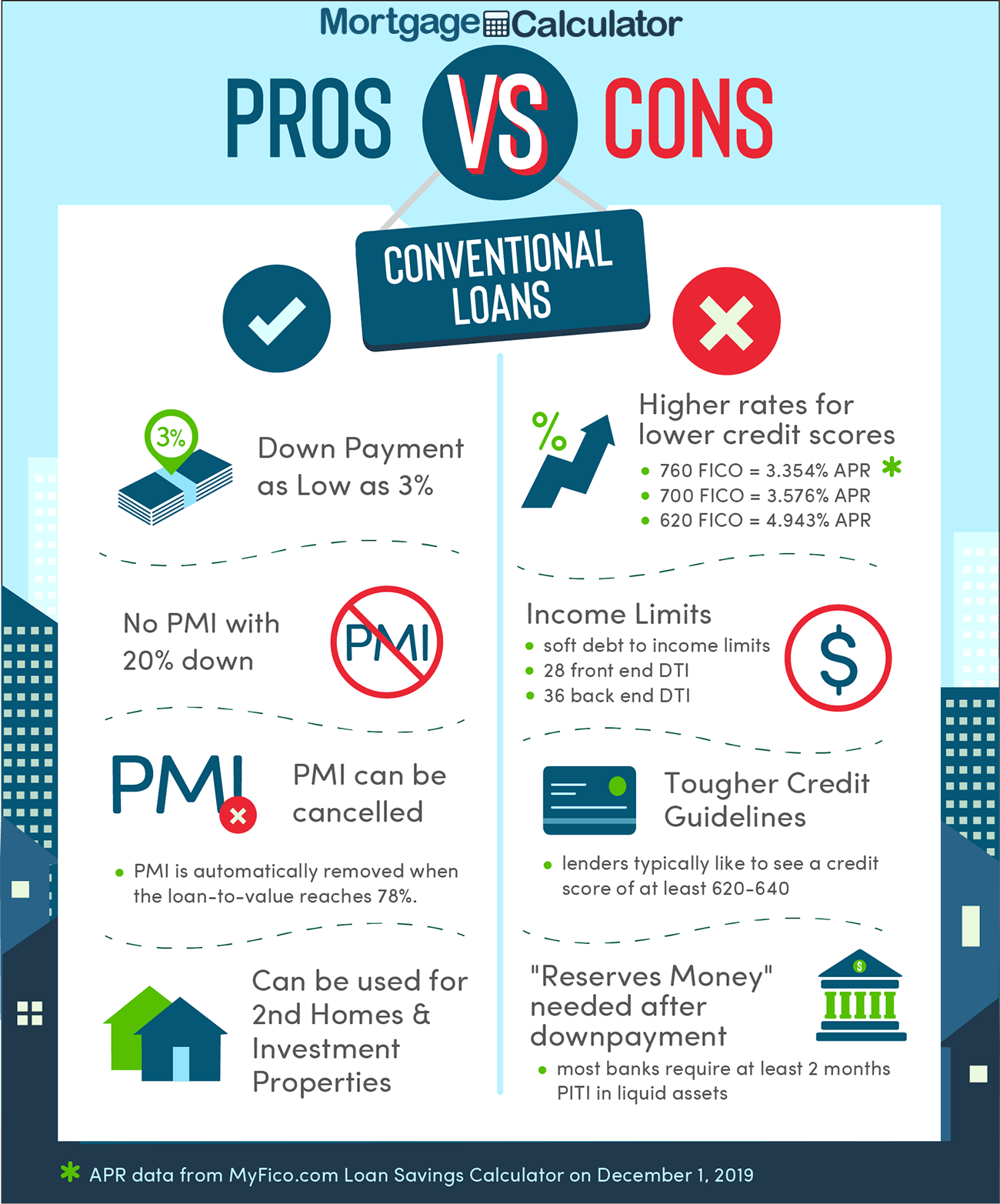

When evaluating different mortgages, it’s important to look into the fees and costs associated with each. Make sure to compare the total cost of the loan over the lifetime of the mortgage, including fees such as closing costs, origination fees, and points. Also, consider the interest rate you’re being offered and whether it’s fixed or adjustable. Comparing mortgages can be a daunting task, but it’s worth taking the time to make sure you’re getting the best deal for your financial goals.

Compare lenders’ offers.

Comparing lenders’ offers can be daunting. However, it’s important to make sure you find the best rate. Ask your friends and family for referrals, read reviews online, and don’t forget to factor in fees and other important details. Take your time to compare different lenders and make sure to get the best deal. It may take a bit of effort, but in the end it’ll be worth it.

Select best mortgage.

When it comes to selecting the best mortgage, it can be a daunting task. With so many different types of mortgages available, it can be hard to compare them and determine which one is right for you. To make the process easier, consider researching different types of mortgages, such as fixed-rate, adjustable-rate, and FHA mortgages. Compare the interest rates, fees, and terms to determine which mortgage is the best fit for your financial situation.