If you’re 18 and looking to buy a house, one of the most important steps is to make sure your credit score is in tip-top shape. Having a good credit score can make the homebuying process much smoother, so it’s important to take the time to understand how you can improve your credit score. In this article, we’ll cover the basics of credit scores and how to improve yours before you apply for a mortgage. Whether you’re new to credit or looking for ways to give your credit score a boost, this article will help you get on the road to great credit.

Monitor credit report regularly.

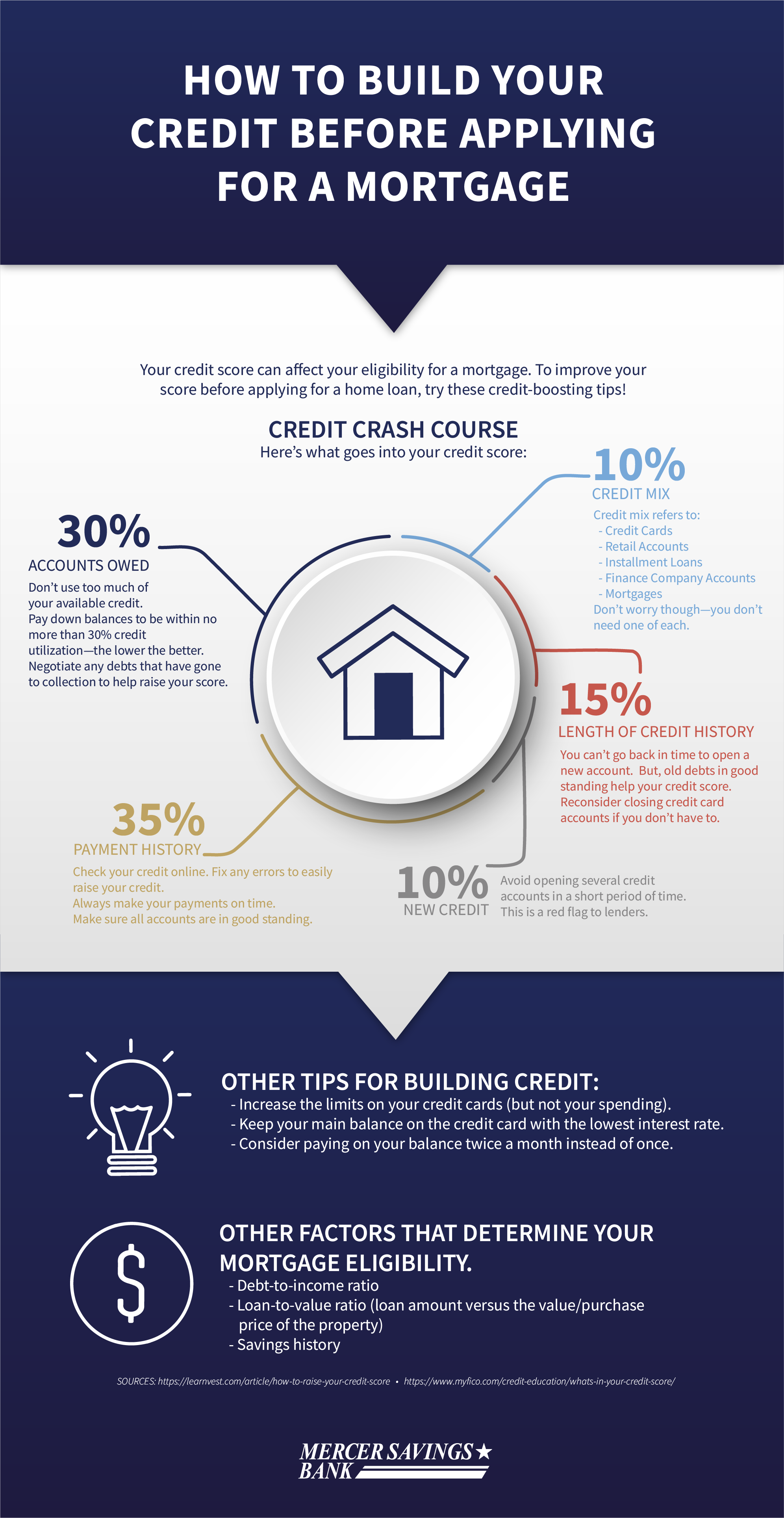

It’s important to stay on top of your credit report. Checking in regularly can help you spot any discrepancies or fraudulent activity, as well as keep an eye on your score. I check mine once a month to make sure everything is accurate and that my score is increasing as I make good financial decisions. Keeping your credit score in good shape before applying for a mortgage is essential.

Pay bills on time.

Paying bills on time is a great way to improve your credit score before getting a mortgage. I know it’s hard to keep track of due dates and ensure you’re always on top of payments, but it’s super important. Setting reminders and automating payments can really help and make sure you stay on top of your finances. Making on-time payments is key for improving your credit score, so make sure you prioritize it!

Pay off debt.

If you’re looking to improve your credit score before getting a mortgage, one of the best things you can do is pay off your debt. It will take a bit of time and effort, but it’s definitely worth it! To do this, create a budget and start making payments on the smallest debts first. You’ll be surprised to see how quickly you can get out of debt and how much your credit score can improve in the process.

Check credit utilization.

As someone in my early twenties, I know how important it is to start building a good credit score as soon as possible. Check your credit utilization ratio – this is the amount you owe compared to your total available credit. Keeping this ratio low is key to building a good score. Pay attention to it and make sure you’re not using too much of your available credit.

Dispute mistakes on report.

If you’re looking to improve your credit score before applying for a mortgage, make sure to dispute any mistakes on your credit report. I recently found out that an old debt had been reported twice on my report which was hurting my score. I contacted the credit bureau and was able to get the mistake corrected. It was a hassle but it was worth it to have my score back on track.

Increase credit limit.

If you want to increase your credit score, one way to do so is to increase your credit limit. This can be done by asking your credit card issuer to raise it or by applying for a new credit card. You should also try to pay your bills on time and not exceed your credit limit. By doing so, you can build your credit and eventually get that mortgage you need.