When it comes to finding a mortgage lender or broker, it can be a daunting task. But don’t worry, I’m here to provide you with some tips on how to find the right one for you. As an 18 year old student, the key is to do your research, ask the right questions and make sure you understand the process. With this article, I’m going to provide you with the resources you need to make sure you are getting the best mortgage broker or lender for your needs. Keep reading to learn more about how to find a mortgage lender or broker.

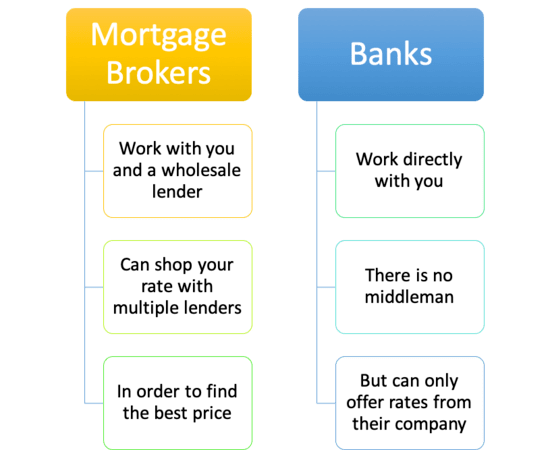

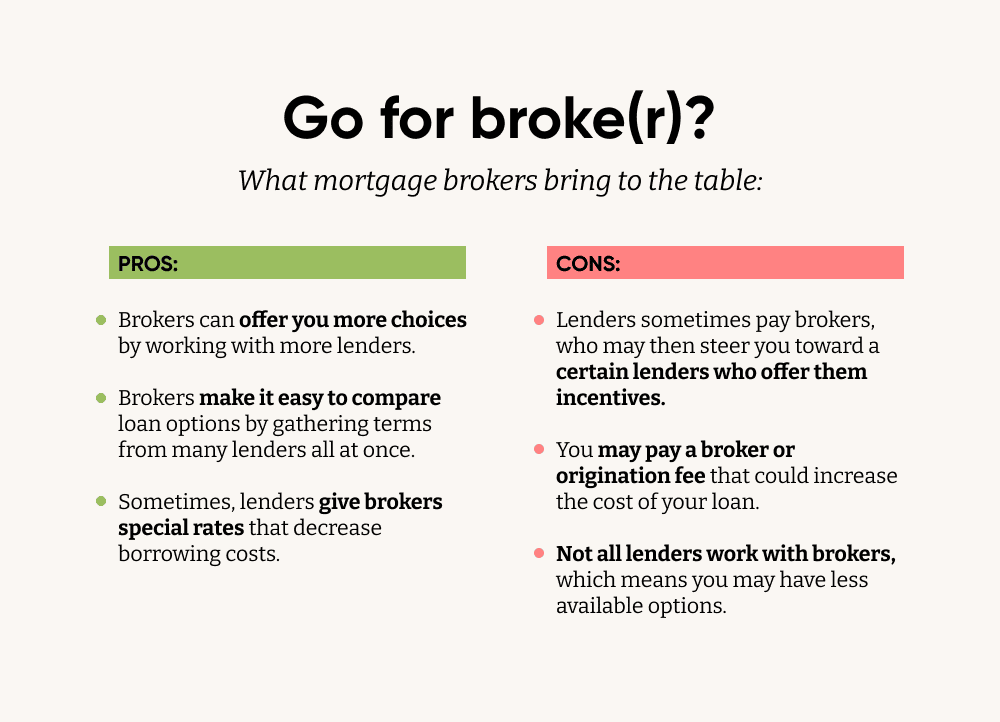

Research mortgage lenders/brokers

Finding the right mortgage lender or broker is a crucial step in the home buying process. It’s important to do your research, ask questions, and compare the options available. Start by reading online reviews, talking to friends or family members who have recently gone through the process, and attending home buying seminars or events to get a better understanding of the different lenders and brokers. With the right knowledge and resources, you’ll be able to find the perfect mortgage lender or broker for you!

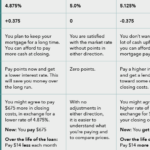

Compare rates/fees

If you’re looking for a mortgage lender or broker, comparing rates and fees is an important step. It’s not always easy to compare apples to apples, but taking the time to compare different lenders’ rates and fees can save you thousands in the long run. To compare rates and fees, ask each lender for a Good Faith Estimate, which will break down the rates and fees for each loan option. It’s also important to ask about any additional costs like points, origination fees, and closing costs. Taking the time to compare lenders’ rates and fees can help you find the best deal for you.

Ask family/friends

Asking family and friends is a great way to find a reliable mortgage broker or lender. I recently asked my big sister for advice and she was able to provide me with the name of a trusted lender she used for her own mortgage. It was great to be able to get the insider scoop from someone I trust, and I was able to get the best rate possible for my mortgage.

Check reviews/references

Searching for reviews and references from previous customers of a mortgage lender or broker is a great way to assess their credibility. I personally read reviews from reliable sources, like Google, Yelp and the Better Business Bureau, to make sure I’m working with a reputable company. As an 18-year-old student, I also asked around for word-of-mouth references from people I trust, like family and close friends. Doing research ahead of time can save you from a lot of headaches in the future!

Contact lenders/brokers

Contacting a mortgage lender or broker is relatively easy. The internet is full of resources to help you find the right company. You can look up reviews and ratings, compare fees, and even apply directly online. Don’t be afraid to reach out and ask questions, they’ll be more than happy to help you find the best option for your situation. You can also find lenders or brokers through social media, word of mouth, and even your local bank.

Make decision/apply

Once you’ve chosen the best mortgage lender or broker for you, it’s time to make the decision and apply. It’s important to be well-informed and confident in your choice, so be sure to read all of the documents, ask questions, and check reviews. If you’re still unsure, it’s a good idea to talk to a financial advisor. Applying is easy; just fill out the paperwork and sign the documents. Don’t forget to check in periodically with your lender or broker.