Are you considering a financial makeover for your home? Refinancing your mortgage might be the perfect solution to achieve your goals. In this comprehensive guide, we’ll explore the pros and cons of refinancing your mortgage, making it easier for homeowners like you to make informed decisions. From lowering monthly payments to tapping into your home’s equity, we’ve got all the essential details covered. So, let’s dive into the world of mortgage refinancing and unlock its potential for your financial future.

Lower interest rates: One of the main advantages of refinancing is the opportunity to secure a lower interest rate on your mortgage

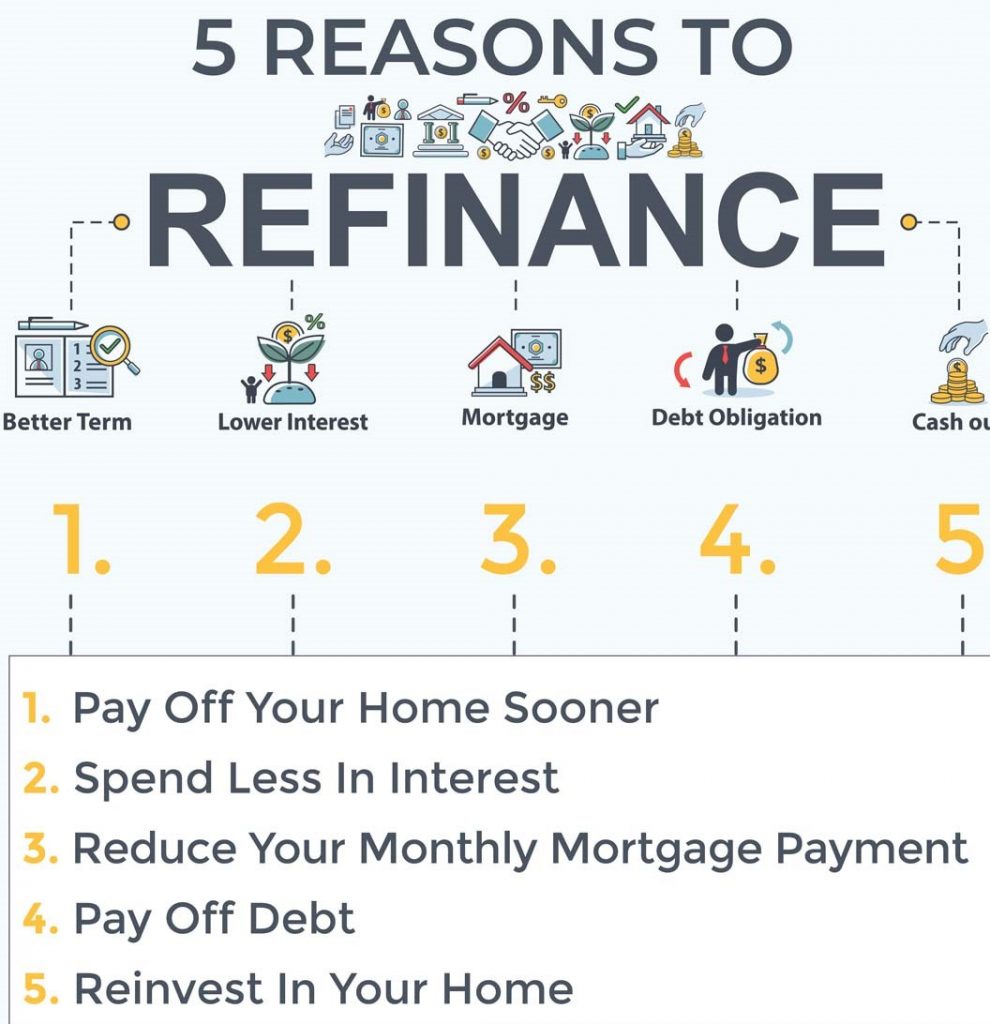

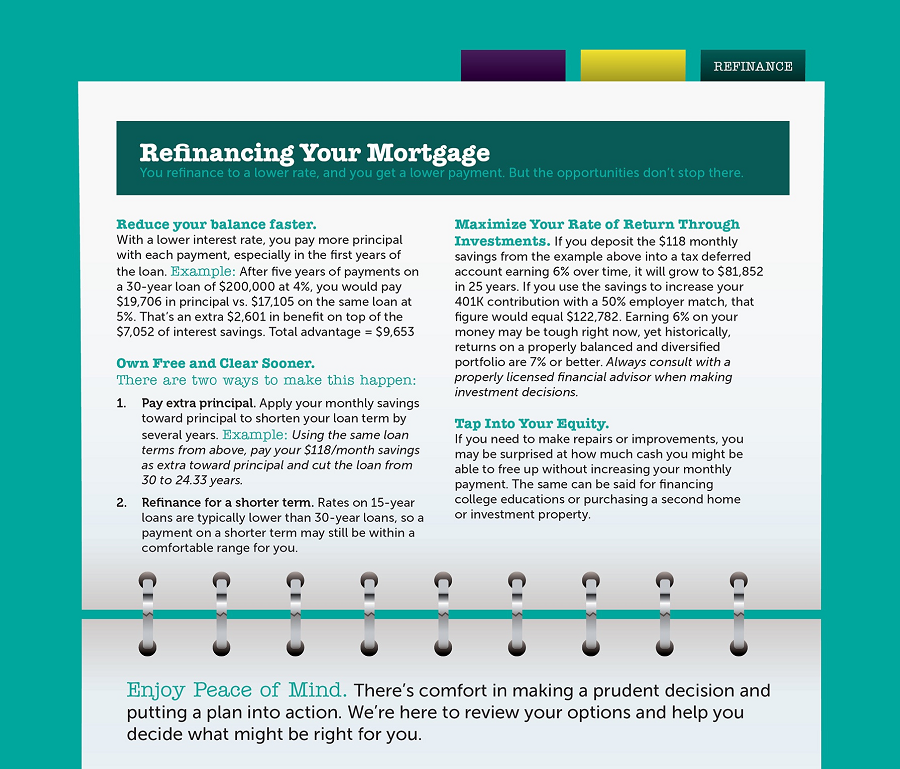

Lower interest rates: One of the primary benefits of refinancing your mortgage is the potential to secure a more favorable interest rate. Lower interest rates can significantly reduce your monthly mortgage payments and save you thousands of dollars over the life of your loan. This advantage is especially attractive to homeowners who initially took out their mortgage when interest rates were higher or those who have improved their credit scores since purchasing their home. By refinancing at a lower rate, you can increase your financial flexibility and potentially allocate those savings towards other financial goals, such as investing, paying off debt, or saving for the future.

This can help save you money in the long run, as lower interest rates typically mean lower monthly payments and less money spent on interest over the life of the loan.

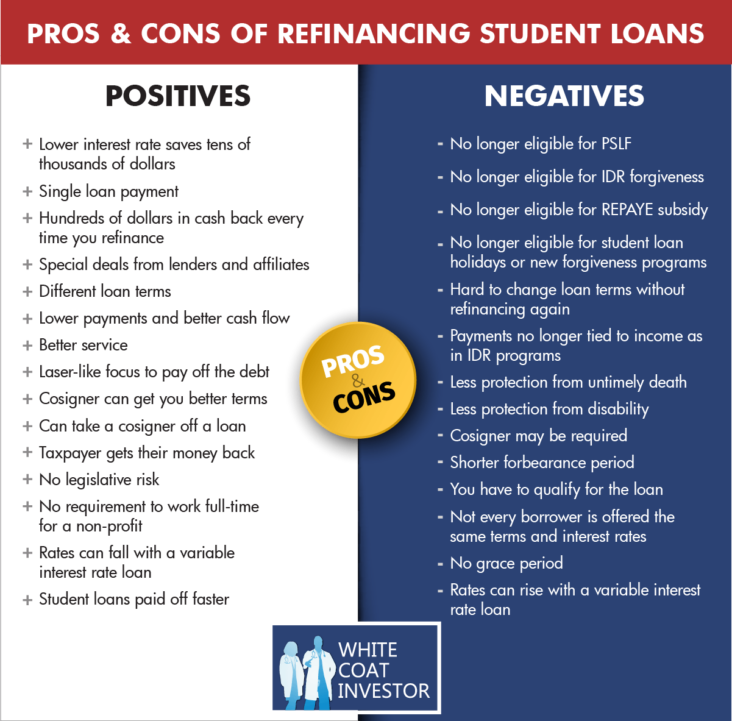

Refinancing your mortgage can be a smart financial move, as it often leads to significant savings in the long run. By securing a lower interest rate, you can enjoy reduced monthly payments, which can free up cash for other expenses. Additionally, a lower rate means you’ll spend less money on interest throughout the life of the loan, potentially saving thousands of dollars. However, it’s crucial to analyze your specific situation and consider factors such as your credit score, current mortgage terms, and the potential costs of refinancing before making a decision. By carefully weighing the pros and cons, you can determine if refinancing your mortgage is the right choice for your financial future.

Shortening the loan term: Refinancing can also allow you to shorten the term of your mortgage, which can help you pay off your home faster and save money on interest

One significant advantage of refinancing your mortgage is the opportunity to shorten your loan term, allowing you to pay off your home more quickly and save substantially on interest payments. By opting for a shorter loan term, you can build equity in your property at a faster rate and potentially transition from a 30-year to a 15-year fixed-rate mortgage. This financial strategy not only accelerates your journey to full homeownership but also reduces the overall cost of borrowing. However, it’s essential to assess your financial situation and ensure that you can comfortably manage the increased monthly payments that come with a shorter loan term before making this decision.

For example, if you currently have a 30-year mortgage and refinance to a 15-year loan, you may be able to pay off your home in half the time.

Refinancing your mortgage to a shorter loan term, such as transitioning from a 30-year to a 15-year mortgage, presents a significant opportunity to pay off your home in a shorter time frame. This accelerated payoff schedule can potentially save you thousands of dollars in interest payments over the life of the loan. Additionally, a shorter loan term often comes with lower interest rates, which further enhances your savings potential. However, it is essential to consider the increased monthly payments that come with a shorter mortgage term. Ensure that you can comfortably afford these higher payments before committing to a refinance, as it could strain your budget and limit your financial flexibility.

Switching loan types: If you currently have an adjustable-rate

Switching Loan Types: Opting for a mortgage refinance presents an opportunity to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage (FRM), or vice versa. Adjustable-rate mortgages may offer lower initial rates, but they can increase over time, leading to uncertainty in your monthly payments. On the other hand, fixed-rate mortgages provide stability with consistent payments throughout the loan term. If you’re looking to gain predictability in your financial planning or take advantage of a favorable interest rate environment, refinancing your mortgage to switch loan types can be a strategic move that aligns with your financial goals.