Discover the remarkable impact of student loan forgiveness on your financial future in this eye-opening article. As countless graduates struggle under the weight of mounting student debt, forgiveness programs offer a breath of fresh air and a chance to regain control of their financial lives. Uncover the life-changing benefits, potential drawbacks, and eligibility requirements of student loan forgiveness, and learn how it can pave the way to a more secure and prosperous future. Don’t miss out on this essential guide to unlocking financial freedom and transforming your wealth-building potential.

Understanding the Basics of Student Loan Forgiveness Programs: A Comprehensive Guide

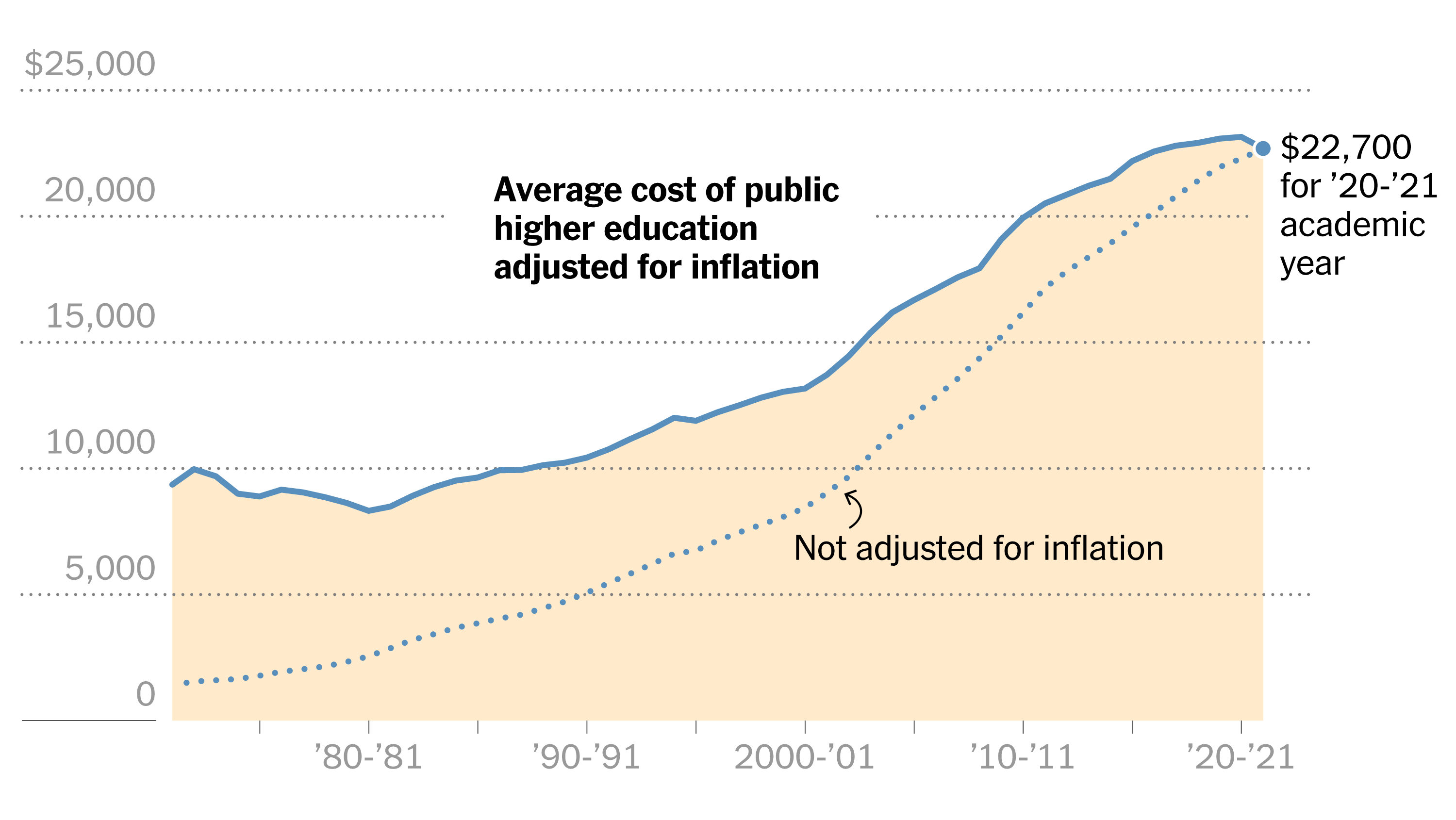

Dive into the world of Student Loan Forgiveness Programs with our comprehensive guide, designed to help you navigate the complexities of these beneficial initiatives. As a crucial step in shaping your financial future, understanding the basics of these programs is vital for those seeking relief from student loan debt. Explore the various types of forgiveness options, eligibility criteria, and application processes, as well as potential tax implications. By equipping yourself with this knowledge, you’ll be better prepared to make informed decisions about your student loan repayment journey and secure a brighter financial future.

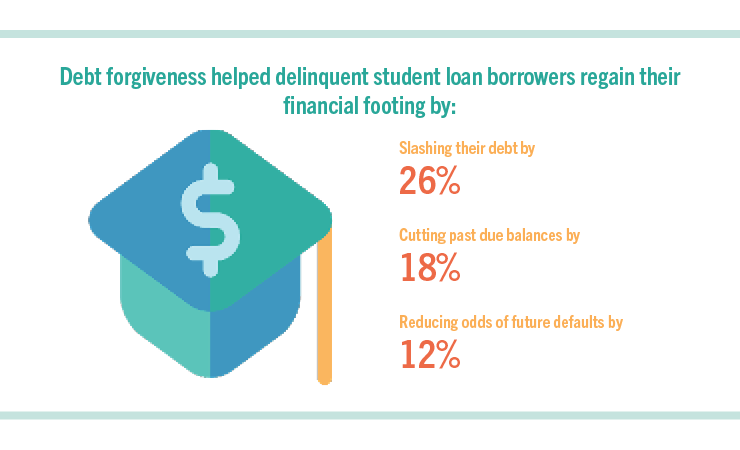

The Surprising Effects of Student Loan Forgiveness on Your Credit Score and Financial Stability

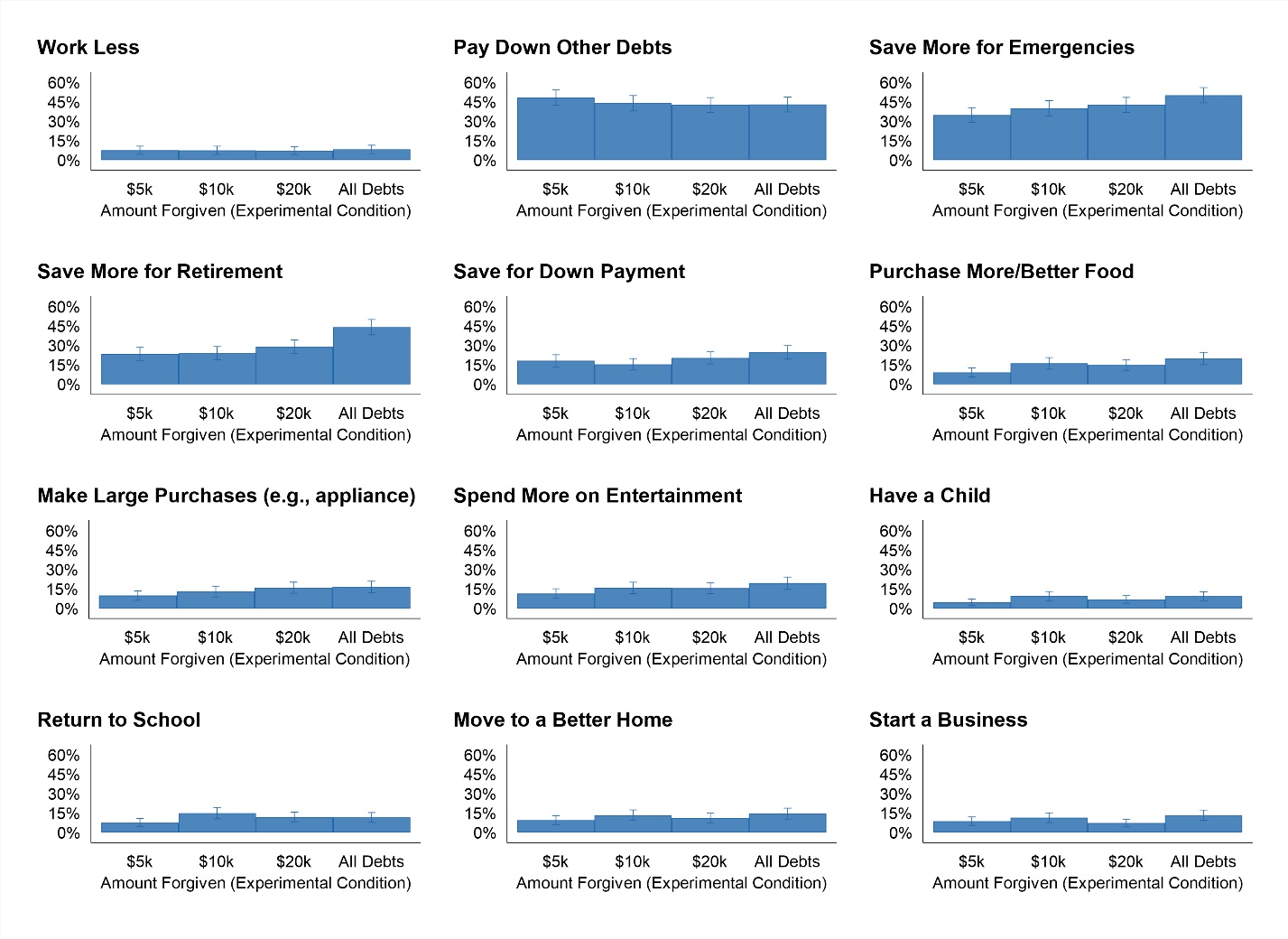

The Surprising Effects of Student Loan Forgiveness on Your Credit Score and Financial Stability reveal that erasing student debt can have a positive impact on your financial future. When your loans are forgiven, it can lead to an improved credit score, as your credit utilization ratio decreases and your overall debt burden is reduced. This enhanced credit standing can open doors to better borrowing opportunities, such as lower interest rates and more favorable loan terms. In turn, this financial stability can empower you to make significant life decisions, like purchasing a home or investing in your career. Harness the potential of student loan forgiveness and secure a brighter financial future.

Student Loan Forgiveness vs

When considering Student Loan Forgiveness, it’s essential to weigh the potential benefits against the long-term financial implications. For many borrowers, forgiveness programs can provide a much-needed reprieve from overwhelming debt, allowing them to pursue their chosen career paths without the burden of unmanageable monthly payments. On the other hand, forgiveness may not always be the most cost-effective solution, as it might extend your repayment period and increase the total interest paid. Therefore, it’s crucial to thoroughly research and compare forgiveness options with alternative repayment strategies, such as refinancing or income-driven repayment plans, to make an informed decision that best supports your financial future.

Income-Driven Repayment Plans: Weighing the Pros and Cons for Your Financial Future

When considering Income-Driven Repayment (IDR) plans for managing student loan debt, it’s essential to weigh the pros and cons for your financial future. On the one hand, these plans offer more manageable monthly payments, which can help alleviate short-term financial stress and prevent default. Additionally, IDR plans may qualify you for eventual student loan forgiveness, potentially saving you thousands of dollars. However, extending your repayment period can increase the overall interest paid, making your loan more expensive in the long run. Furthermore, forgiven loan amounts under IDR plans are typically considered taxable income, which could impact your future tax liabilities. Carefully evaluate how IDR plans align with your financial goals before committing to this repayment strategy.

The Connection Between Student Loan Forgiveness and Tax Implications: What You Need to Know

Understanding the connection between student loan forgiveness and tax implications is crucial for effectively planning your financial future. When your loans are forgiven, the IRS may consider the forgiven amount as taxable income, which could potentially increase your tax liability. This additional tax burden may come as a surprise, especially if you’re unprepared for it. In some cases, like Public Service Loan Forgiveness (PSLF), the forgiven amount is not considered taxable income, providing a more favorable outcome. Being aware of these tax consequences, and consulting with a tax professional, can help you better navigate the financial complexities of student loan forgiveness and make informed decisions for your long-term financial wellbeing.

Navigating the Complex World of Public Service Loan Forgiveness (PSLF): A Roadmap to a Brighter Financial Future

Navigating the Complex World of Public Service Loan Forgiveness (PSLF) can be a daunting task, but with the right guidance and resources, it can lead to a brighter financial future for eligible borrowers. PSLF is a federal program that forgives the remaining balance on Direct Loans after making 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. By understanding the eligibility criteria, choosing the right repayment plan, and staying up-to-date with the latest developments in the PSLF program, borrowers can secure a financially stable future and get one step closer to a debt-free life.