Discover the crucial link between student loan forgiveness and student loan repayment plans in this comprehensive guide that’ll transform your financial future. Learn how to navigate the often-confusing world of higher education financing, uncover the secrets to reducing your debt burden, and unlock the potential for a brighter tomorrow. Say goodbye to feeling overwhelmed and hello to expert insights that’ll empower you to make informed decisions about your student loans. This is your one-stop-shop for understanding how repayment plans can pave the way to loan forgiveness, ultimately leading to financial freedom and peace of mind. Don’t miss out on this game-changing information – dive in now!

Exploring the Relationship between Student Loan Forgiveness Programs and Repayment Plans: A Comprehensive Guide

Discover the intricate link between student loan forgiveness programs and repayment plans in our comprehensive guide. Learn how various income-driven repayment plans can affect your eligibility for loan forgiveness and how to maximize your benefits. Familiarize yourself with the Public Service Loan Forgiveness (PSLF) program and its requirements, as well as other forgiveness options available to borrowers. Navigate the complexities of student loan repayment with confidence and make informed decisions that can positively impact your financial future. This in-depth exploration will help you understand the connection between repayment options and loan forgiveness, empowering you to make the best choices for your unique situation.

Navigating the Maze of Student Loan Forgiveness and Repayment Options: Strategies for Borrowers to Maximize Savings

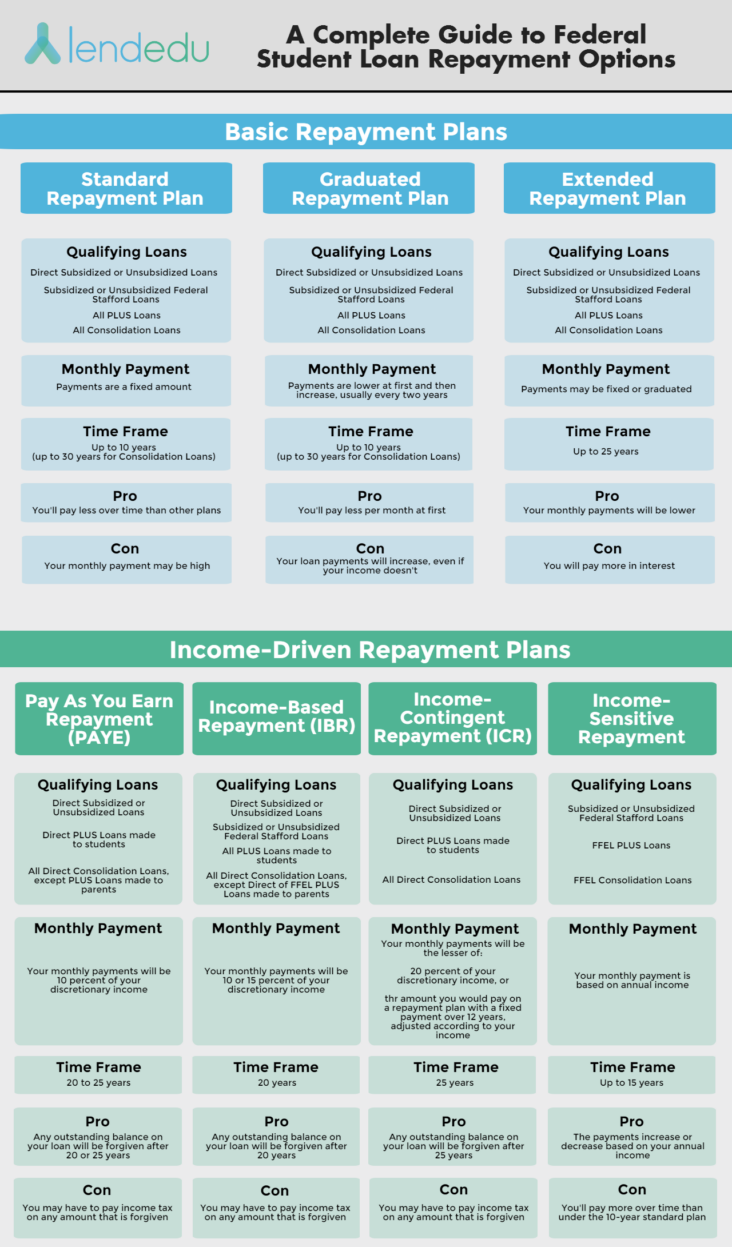

Navigating the complex web of student loan forgiveness and repayment options can be overwhelming for borrowers seeking to maximize their savings. By understanding the different repayment plans available, such as Income-Driven Repayment (IDR) plans, and loan forgiveness programs like Public Service Loan Forgiveness (PSLF), borrowers can make informed decisions to reduce their debt burden. Staying up-to-date with the latest changes in federal student loan policies and seeking advice from professional financial counselors can also be beneficial. Implementing these strategies can help borrowers effectively manage their student loans and potentially save thousands of dollars over time.

The Intersection of Student Loan Forgiveness and Repayment Plans: How to Effectively Leverage these Tools for Financial Success

The Intersection of Student Loan Forgiveness and Repayment Plans plays a crucial role in achieving financial success for borrowers. By understanding and strategically leveraging these tools, you can significantly reduce your debt burden and expedite your journey towards financial freedom. It’s essential to carefully evaluate various repayment options, such as Income-Driven Repayment (IDR) plans or Public Service Loan Forgiveness (PSLF), to find the best fit for your financial situation. Stay informed about changes in federal policies, and proactively adjust your strategy to maximize the benefits of loan forgiveness programs. Remember, effectively managing your student loans is a key component of long-term financial stability and success.

The Synergy between Student Loan Forgiveness and Loan Repayment Plans: Unraveling the Secrets to Minimize Debts and Maximize Benefits

Discover the powerful synergy between student loan forgiveness and loan repayment plans to minimize debts and maximize benefits for borrowers. In this blog post, we delve into the secrets of various repayment options and their potential impact on loan forgiveness eligibility. By strategically selecting the best-suited repayment plan for your individual circumstances, you can not only reduce your monthly payment burden but also work towards qualifying for the ultimate financial relief – student loan forgiveness. Empower yourself by staying informed about the latest developments and strategies in the world of student loan management, and reap the rewards of expertly navigating the complex landscape of student debt.

Demystifying the Link between Student Loan Forgiveness and Repayment Plans: Key Insights to Empower Borrowers in Managing their Educational Debts

In this blog post, we delve into the crucial connection between student loan forgiveness programs and various repayment plan options. By demystifying the link between these two elements, we aim to empower borrowers with essential insights to efficiently manage their educational debts. Our objective is to help you navigate the complex world of student loans and make informed decisions that align with your financial goals. To achieve this, we will discuss the eligibility criteria for forgiveness programs, explore the advantages of different repayment plans, and provide valuable tips for reducing your loan burden. By understanding these critical aspects, borrowers can unlock the potential to achieve a debt-free future.