Are you ready to embark on your journey towards homeownership but unsure of how much house you can afford? Look no further! Freedom Mortgage’s Home Affordability Calculator is here to help you navigate the exciting process of planning your dream home purchase. In this comprehensive guide, we will walk you through the ins and outs of using this essential financial tool to determine your ideal budget, ensuring that you make the best decision for your financial future. Say goodbye to the uncertainties and hello to a world of possibilities with Freedom Mortgage’s Home Affordability Calculator!

Access Freedom Mortgage’s website.

Ready to unlock your dream home journey with Freedom Mortgage’s Home Affordability Calculator? Head over to their website and explore the user-friendly interface designed for savvy homebuyers like you. Easily input your financial details and let the calculator work its magic to reveal your purchasing power. Start planning now, and step into your dream home sooner!

Locate Home Affordability Calculator.

Discover the perfect home within your budget by utilizing Freedom Mortgage’s Home Affordability Calculator. This user-friendly tool helps you estimate your ideal house price based on your current financial situation. Navigate to the calculator on our website and experience a seamless journey towards your dream home. Happy house hunting!

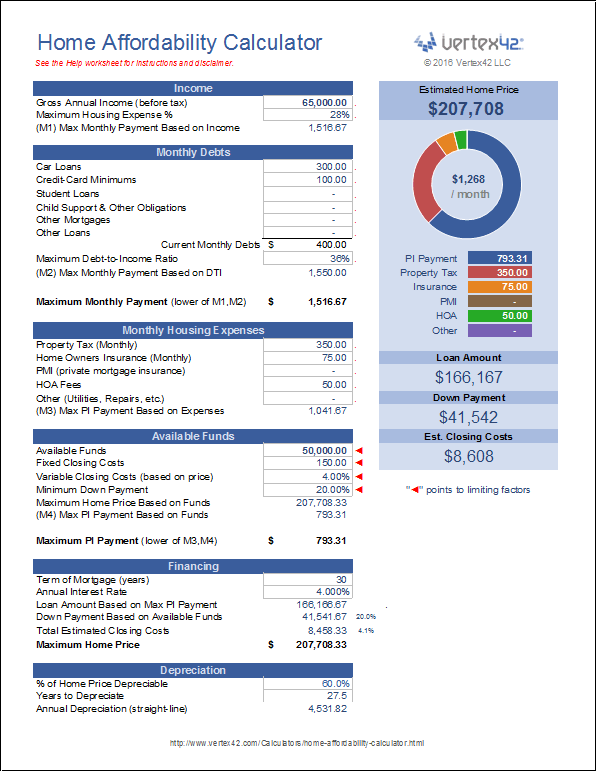

Input income and expense details.

Discover your dream home’s affordability with Freedom Mortgage’s Home Affordability Calculator by simply inputting your income and expense details. This user-friendly calculator helps you accurately estimate your purchasing power, making it easier to plan and budget for your future home. Say goodbye to guesswork and hello to financial confidence!

Adjust loan term and interest rate.

Discover your ideal home budget by tweaking the loan term and interest rate with Freedom Mortgage’s Home Affordability Calculator. Experiment with various scenarios to find the perfect balance between monthly payments and loan duration, giving you a clear understanding of what suits your financial needs. Make informed decisions and conquer the homebuying process like a pro!

Analyze calculated affordability results.

Dive deep into your home-buying journey by analyzing the affordability results from Freedom Mortgage’s Home Affordability Calculator. Unravel the mysteries behind your dream home’s price tag and unlock the potential of a financially secure future. Make informed decisions, compare loan options, and confidently plan your purchase with our user-friendly, intuitive tool.

Plan purchase based on calculations.

Kickstart your home-buying journey by utilizing Freedom Mortgage’s Home Affordability Calculator to strategically plan your purchase. By accurately estimating your budget, you’ll confidently narrow down options, avoid financial strain, and find the perfect fit for your desired lifestyle. Make informed decisions and secure your dream home with ease.