Having a good credit score is one of the most important steps in securing a mortgage. A good credit score gives lenders confidence that a borrower can make their payments on time and in full. It also allows borrowers to secure lower interest rates on their mortgage, resulting in significant savings over the life of the loan. In this article, we’ll discuss the importance of a good credit score for securing a mortgage, and how you can improve your credit score to give yourself the best chance of securing the mortgage you need.

A Good Credit Score Helps to Get the Best Interest Rate: A good credit score is essential in order to get the best interest rate on a mortgage

Having a good credit score is one of the most important things you can do when it comes to securing a mortgage. A good credit score can help you get the best interest rate on your mortgage, saving you thousands of dollars in the long run. Lenders consider a variety of factors when determining your interest rate on a mortgage, and your credit score is one of the most important. A high credit score indicates to lenders that you are responsible with money and have a strong payment history. A good credit score can result in a lower interest rate and more favorable terms for your mortgage. It is important to know your credit score and do your best to maintain it. This can be done by making on-time payments, keeping credit utilization low, and regularly monitoring your credit report. A good credit score can make a big difference in the cost of your mortgage, so it is important to be aware of it and work to keep it in good standing.

The higher your credit score, the better your chances of qualifying for a lower interest rate.

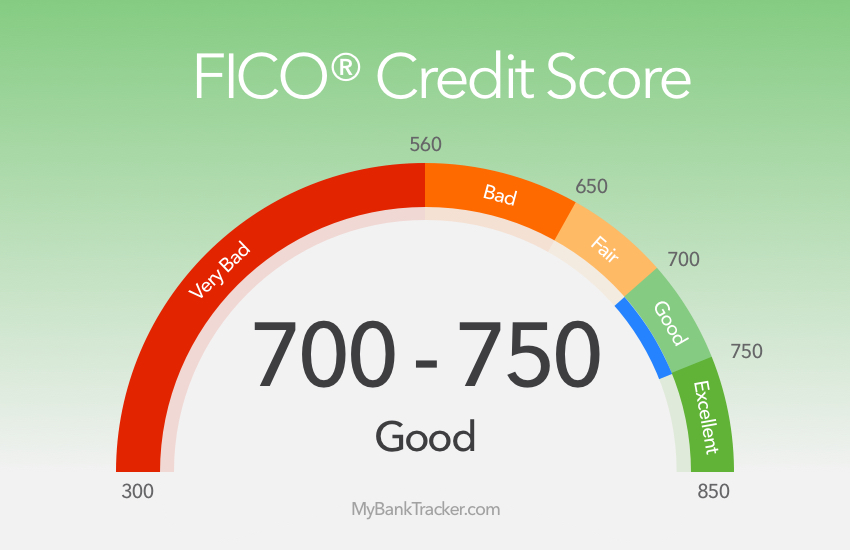

Having a good credit score is essential for securing a mortgage. The higher your credit score, the better your chances of qualifying for a lower interest rate. A lower interest rate will have a significant impact on the total cost of your mortgage, as you will save a considerable amount of money over the life of the loan. A good credit score is also often essential for being approved for a mortgage in the first place. Lenders will take into account your credit score when determining whether or not to approve your application. A credit score of 700 or higher is typically considered to be the minimum for being approved for a mortgage. In addition to helping you qualify for a lower interest rate, having a good credit score can also help you get approved for a mortgage faster. Lenders will be more likely to approve your application quickly if they know you have a good credit score. Keeping your credit score in good standing is essential for securing a mortgage with a competitive interest rate and fast approval.

A Good Credit Score Can Help You Qualify for a Larger Mortgage: Lenders often use credit scores to determine how much money they are willing to loan a borrower

A good credit score can be the difference between securing a large mortgage or being forced to settle for a smaller one. Lenders use credit scores to determine how much money they are willing to loan a borrower, so having a good credit score can give you an edge. A good credit score can enable you to qualify for a larger loan, allowing you to purchase the home of your dreams. It can also give you access to more attractive interest rates, saving you money over the life of the loan. Having a good credit score may even give you the opportunity to avoid private mortgage insurance, which can add thousands of dollars to the cost of your loan. A good credit score is a fundamental part of securing a mortgage, and it should not be taken lightly.

The higher your credit score, the larger the mortgage loan you may be able to qualify for.

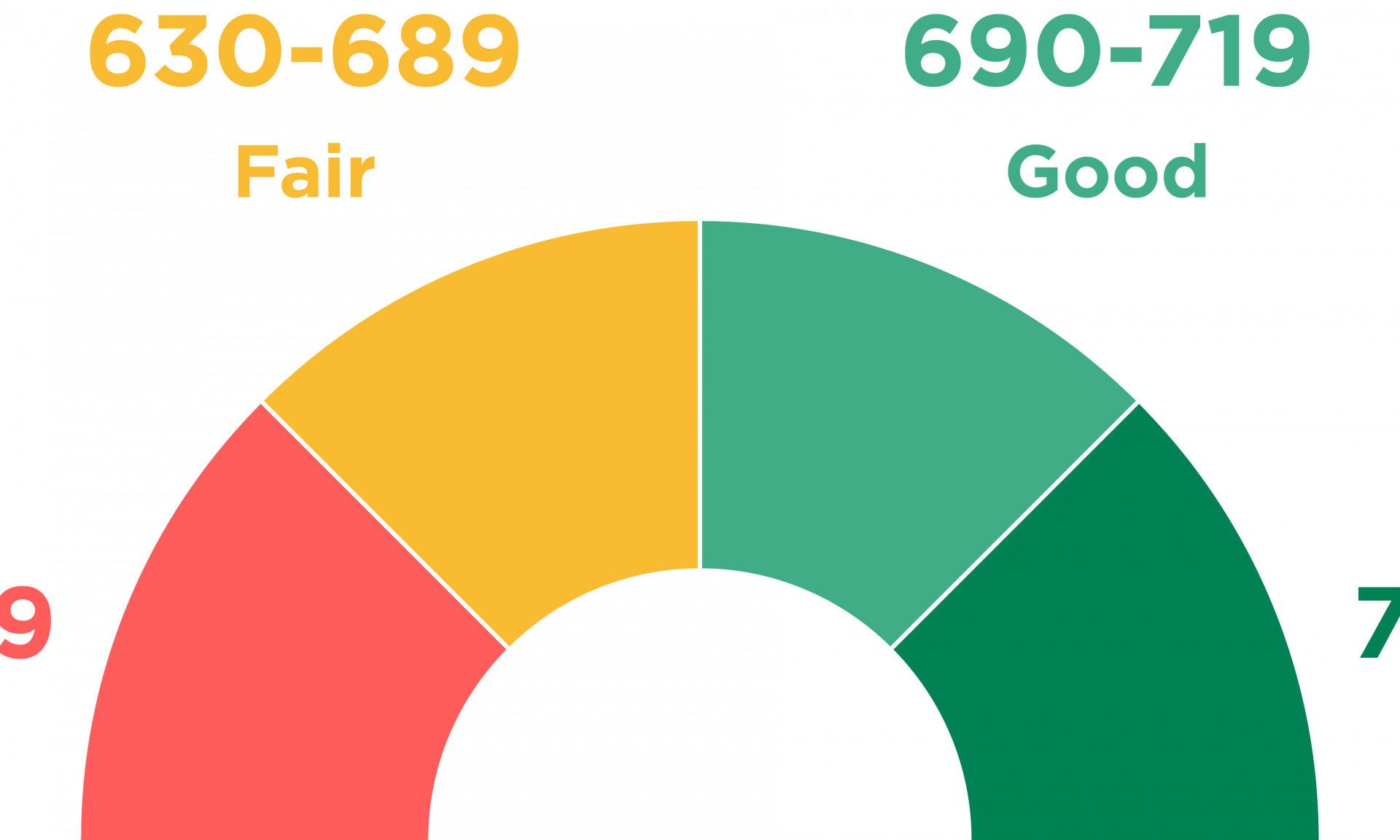

Having a good credit score is essential for securing a mortgage loan, as it will determine the size of the loan you qualify for. The higher your credit score, the greater the loan size you may be able to qualify for. A good credit score is typically defined as a score of 670 or higher, and the higher your score, the better the terms and rates you will be able to secure. A good credit score can open up a world of opportunities when it comes to getting a mortgage loan. Individuals with a higher credit score may be able to qualify for larger loan sizes, as well as lower interest rates, which can save them thousands of dollars in the long run. Additionally, having a high credit score can help you get approved for a mortgage loan quicker, as lenders are more likely to trust someone with a good credit score. A good credit score is essential for securing a mortgage loan, and it’s one of the most important steps when it comes to purchasing a home.

A Good Credit Score Can Help You Save Money on Closing Costs: Lenders often offer better terms to borrowers with higher credit scores, which can mean lower closing costs.

When it comes to mortgages, having a good credit score can help you save money on closing costs. Lenders are likely to offer borrowers with higher credit scores better terms, which can translate to lower closing costs. It’s important to keep in mind that closing costs can include things like appraisal fees, title search and insurance, loan origination fees, and taxes. By maintaining a good credit score, you may be able to take advantage of better rates and lower closing costs. Taking the time to improve your credit score before applying for a loan can help you save a substantial amount of money in the long run. Additionally, it’s important to remember that different lenders may have different criteria for what constitutes a good credit score. Therefore, it’s important to do your research to ensure you meet the requirements of the lenders you’re considering. With a good credit score, you can take advantage of better terms and lower closing costs when applying for a mortgage.

A Good Credit Score Can Help You Get Approved for a Mortgage: Having a good credit score can help you get approved for a mortgage

A good credit score is an essential factor when it comes to getting approved for a mortgage. A high credit score demonstrates your ability to pay off and handle debt responsibly, which is an essential factor when it comes to mortgage lenders. A good credit score can help you get approved for a mortgage and potentially qualify for a lower interest rate. This can save you thousands of dollars over the life of the loan. Additionally, having a good credit score can give you more options when it comes to finding a lender, as many lenders look for borrowers with good credit scores. It is also important to remember that lenders will look at other factors when it comes to approving you for a mortgage, such as your income, debt-to-income ratio, and employment history. However, having a good credit score is an important first step in the process of getting approved for a mortgage.

Lenders use credit scores to determine how likely you are to make payments on time and to assess how much of a risk they are taking in loaning you money.

When it comes to securing a mortgage, having a good credit score is essential. Lenders use credit scores to evaluate your creditworthiness and determine how likely you are to make payments on time. A good credit score helps to demonstrate to lenders that you can be trusted to make your mortgage payments on time and as agreed. It also helps lenders to assess the risk they are taking in loaning you money. The higher your credit score, the more likely it is that you will be approved for a mortgage and receive favorable terms and a lower interest rate. With a good credit score, mortgage lenders are more likely to trust that you are a responsible borrower who will make timely payments and honor your loan obligations. Taking steps to maintain a good credit score is essential for getting a mortgage with favorable terms and interest rates.

A Good Credit Score Can Help You Get Approved for a Better Mortgage Product: Lenders may offer better mortgage products to borrowers with higher credit scores, such as adjustable-rate mortgages or interest-only

Having a good credit score is important when it comes to securing a mortgage. A good credit score can help you get approved for a better mortgage product, such as an adjustable-rate mortgage or an interest-only loan. These types of mortgage products can be beneficial to borrowers as they often offer more flexible repayment terms and lower interest rates. Furthermore, borrowers with higher credit scores may also be able to negotiate better terms with lenders, such as lower origination fees or closing costs. It is important to note that lenders may require a minimum credit score in order to qualify for these more favorable mortgage products, so it is essential to maintain a good credit score if you are looking to secure a mortgage. Additionally, it is important to shop around and compare different lenders in order to find the best mortgage product for your needs. Taking the time to research and compare different lenders can help you find a better deal and save you money in the long run.