Are you looking for an affordable and efficient way to pay your mortgage? Biweekly mortgages are an attractive option for homeowners looking to save money and reduce the length of their mortgage. By making payments every two weeks, instead of monthly, you can save thousands of dollars in interest and pay off your mortgage faster. In this article, we’ll explain what biweekly mortgages are and how they work, so you can decide if this type of mortgage is right for you.

An Overview of Biweekly Mortgage

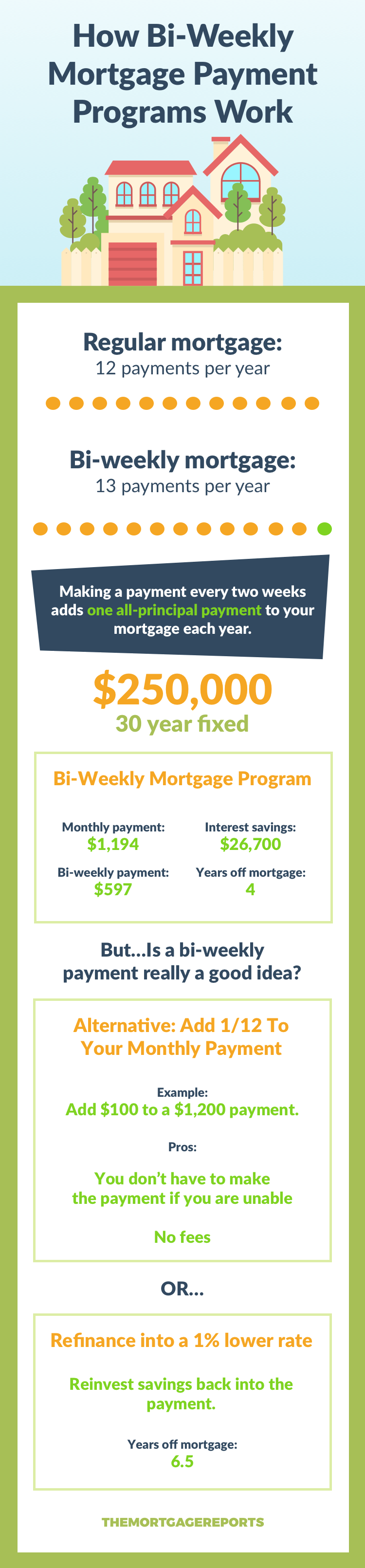

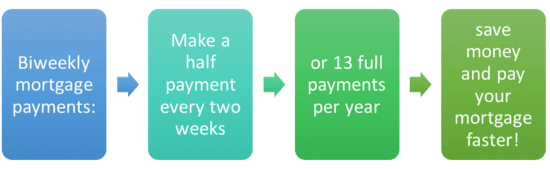

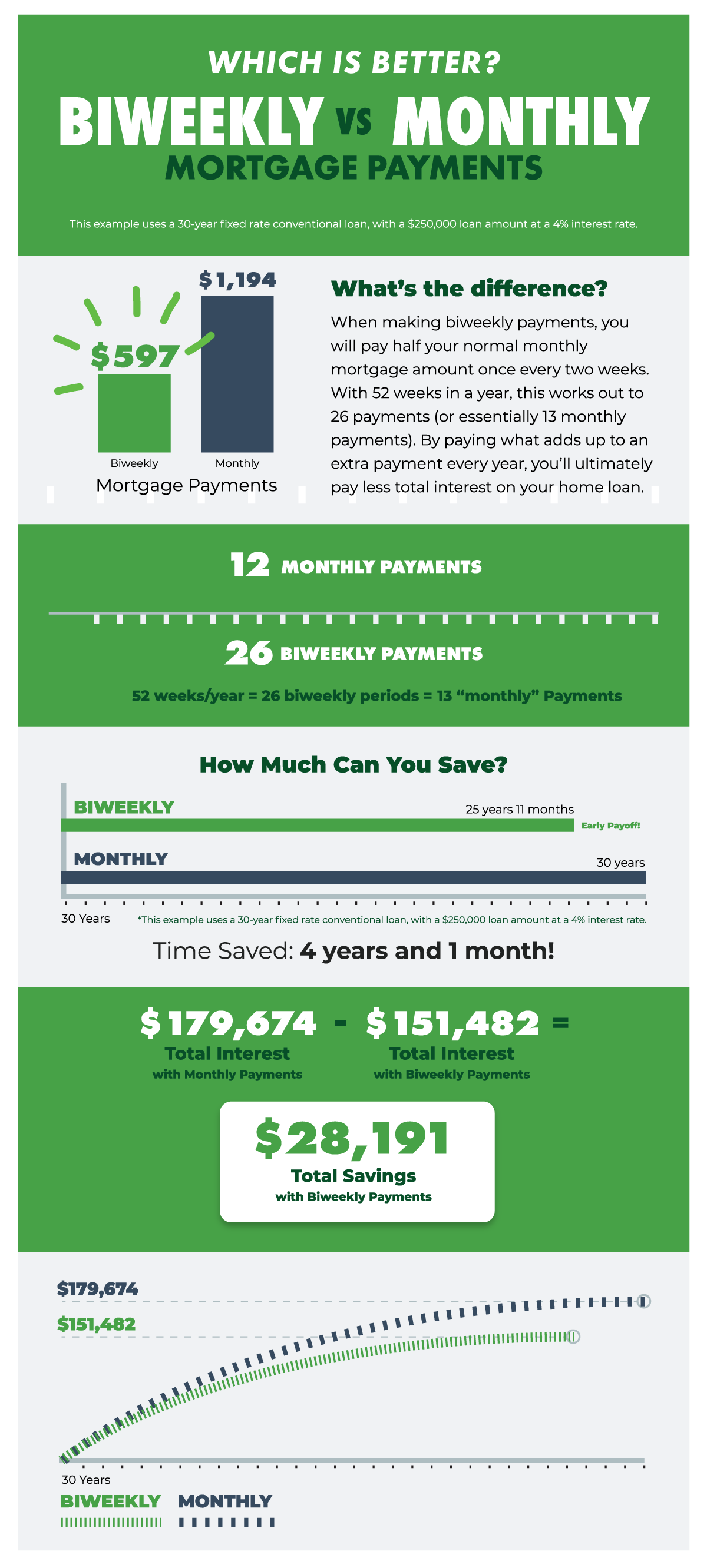

If you’re looking for a way to save money and pay off your mortgage quicker, a biweekly mortgage might be the perfect solution for you. Biweekly mortgages are mortgages that are paid every two weeks, instead of once a month. By making biweekly payments, you can reduce the term of your mortgage by up to 12 years and save thousands of dollars in interest. With a biweekly mortgage, you’ll end up making one extra principal payment a year and reduce the amount of interest you pay over the life of the loan. It’s an easy way to get ahead on your mortgage and put more money in your pocket.

Advantages and Disadvantages of Biweekly Mortgages

Advantages of Biweekly Mortgages Biweekly mortgages can be a great way to save money in the long run. One of the main benefits of biweekly mortgages is that they allow borrowers to essentially pay off their mortgage twice as quickly as with a regular monthly mortgage. This is because biweekly mortgages are set up on a schedule where the borrower pays half of the mortgage amount every two weeks. By doing this, the borrower is essentially making one extra payment per year, which can significantly reduce their overall mortgage debt. Additionally, biweekly mortgages can also result in lower interest rates since the borrower is paying off the loan faster. Disadvantages of Biweekly Mortgages Although biweekly mortgages can be a great way to save money in the long run, there are also some potential drawbacks. One of the main disadvantages of biweekly mortgages is that they often come with additional fees. Many lenders require borrowers to pay an upfront fee to set up a biweekly mortgage. Additionally, some lenders may also charge a fee each time a payment is made, which can add up over the life of the loan. Furthermore, biweekly mortgages can be difficult to manage, as borrowers need to keep track of their payments and make sure they are paid

Calculating a Biweekly Mortgage Payment

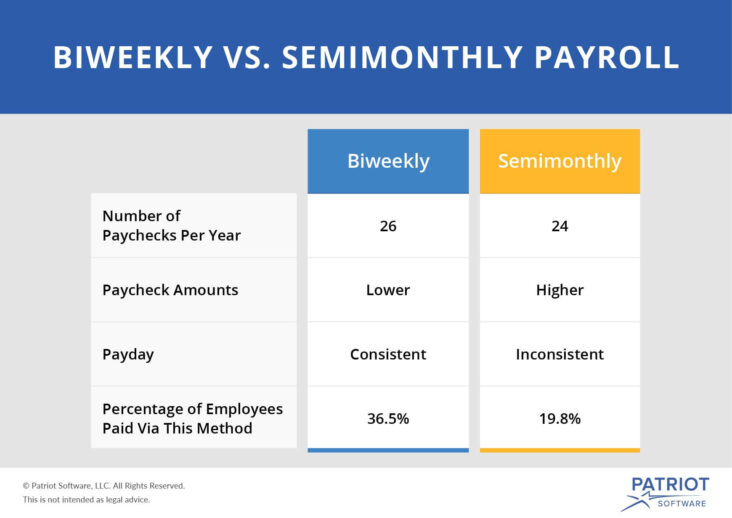

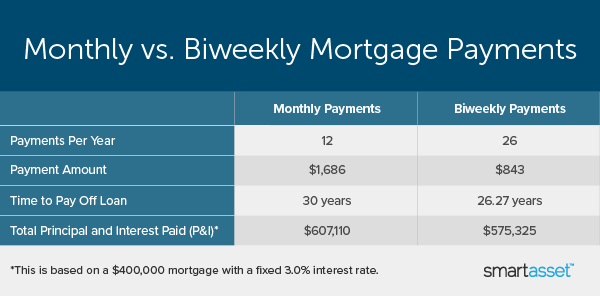

Calculating a biweekly mortgage payment is relatively simple and can be a great way to save money over the life of your loan. To calculate your biweekly mortgage payments, you’ll need to know the total amount of your mortgage loan and the interest rate. Once you have these two pieces of information, you’ll need to divide the loan amount by 26, as there are 26 biweekly periods in a year. This will give you the amount of each biweekly payment. You’ll then need to multiply this by the interest rate, which will give you the total amount of interest you’ll pay over the course of the loan. Finally, you’ll need to add the interest amount to the biweekly payment to get your total biweekly mortgage payment. By calculating your biweekly payments, you can adjust your budget accordingly and save money in the long run.

Tips for Making Biweekly Mortgage Payments

Biweekly mortgage payments can help you save money and pay off your mortgage faster. Here are some tips for making biweekly payments: 1. Set up automated payments. Setting up automated payments is the easiest way to make sure you never miss a biweekly payment. You can set up a recurring payment from your bank account or credit card and have it taken care of every two weeks. 2. Budget for the smaller payments. Biweekly payments are usually half the size of your monthly payments, so it’s important to make sure you budget for the smaller payments. This can help you avoid unpleasant surprises when your payment is due. 3. Keep track of your payments. It’s important to keep track of your biweekly payments to make sure they’re being received and applied correctly. This can help you avoid any problems with your mortgage or any late fees.Making biweekly mortgage payments can be a great way to save money and pay off your mortgage faster. By setting up automated payments, budgeting for the smaller payments, and keeping track of your payments, you can make sure your biweekly payments are taken care of without any problems.

Common Questions About Biweekly Mortgages

Biweekly mortgages are becoming increasingly popular among homeowners as they offer an easy way to save money. But with all the different types of mortgages out there, it’s easy to get confused about what biweekly mortgages entail. To help clear up some common questions about biweekly mortgages, I’ve put together some of the most frequently asked questions. The first common question is, what is a biweekly mortgage? A biweekly mortgage is a type of loan that is paid off in half-monthly installments. Instead of making one payment a month, you make two payments every two weeks. This results in you making 26 payments a year, or the equivalent of 13 monthly payments. Another common question is, how does a biweekly mortgage save money? By making biweekly payments, you’ll pay off your mortgage faster, which means you’ll save money in the long run. This is because you’ll ultimately pay less interest on the loan. Additionally, you can potentially reduce the amount of interest you pay by making a lump sum payment every year. Finally, is a biweekly mortgage right for me? Ultimately, the answer depends on your individual financial situation. If you’re looking