An adjustable rate mortgage with a fixed period is an attractive choice for many homebuyers, as it allows them to take advantage of lower interest rates while still providing protection against rate increases. With an adjustable rate mortgage, borrowers can enjoy the security of a fixed interest rate for the first few years of their loan and then have the option to adjust the rate to adjust to the current market. The fixed period on an adjustable rate mortgage also provides a way to manage risk, as it provides a period of time where borrowers can plan financially and make payments without fear of rate increases. This article will provide an overview of adjustable rate mortgages with a fixed period and explain the benefits and risks associated with this type of loan.

What is an Adjustable Rate Mortgage with a Fixed Period?

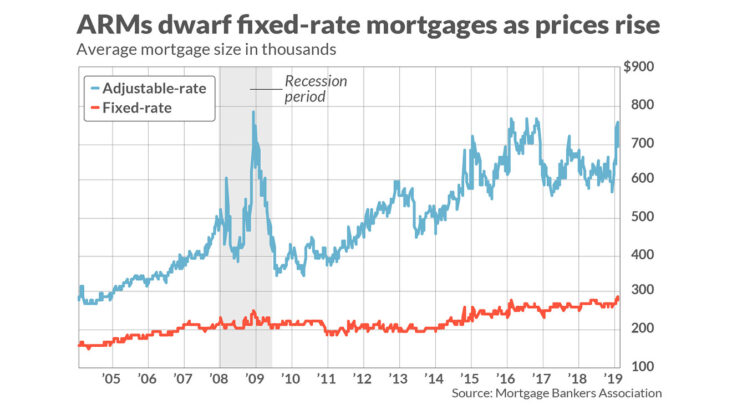

Adjustable Rate Mortgages with a Fixed Period (ARMs) are becoming increasingly popular among homeowners. ARMs allow homeowners to have a fixed interest rate for a certain period of time, typically five to ten years. After that period of time, the interest rate will adjust each year based on the market. This type of mortgage can be beneficial for those who plan to stay in their home for a shorter period of time, as it can offer more flexibility and the potential of saving money on interest over the life of the loan. Although ARMs can be beneficial, they also come with risks, so it’s important to understand how they work before taking one out. An ARM with a fixed period may be a good option for those who are looking to save money on their mortgage payments.

Advantages of an Adjustable Rate Mortgage with a Fixed Period

Adjustable rate mortgages with a fixed period offer a number of advantages for those looking to purchase a home or refinance a mortgage. The most obvious advantage is that the initial interest rate on the loan is fixed for the first several years, allowing borrowers to lock in lower interest rates. This can be a great way to save money over the long term, as the fixed rate period can help shield borrowers from market fluctuations. Additionally, this type of mortgage allows borrowers to take advantage of lower interest rates in the future if the market allows, giving them the potential to save even more money. Furthermore, adjustable rate mortgages with a fixed period can provide more flexibility when it comes to budgeting, as the payments are fixed for a set period of time. This can be especially helpful for those who are uncertain as to how long they will be living in the home or may have a fluctuating income. All in all, adjustable rate mortgages with a fixed period can be a great option for those looking to buy a home or refinance a mortgage.

Disadvantages of an Adjustable Rate Mortgage with a Fixed Period

Adjustable Rate Mortgages with Fixed Periods can be a tricky thing to navigate. While they offer the potential for lower interest rates, they also come with some risks. One of the biggest disadvantages of an Adjustable Rate Mortgage with a Fixed Period is that it can be hard to predict how much your monthly payments will be. You’ll likely find yourself locked into a rate for a certain amount of time, but after that period ends, the rate could jump up or down significantly. This unpredictability can be a major problem for those who are on a tight budget, as it can be hard to plan for such drastic changes in interest rates. Another disadvantage is that, since the rates can be quite high, you may end up paying more in the long run than you would with a fixed-rate mortgage. On top of that, if you choose to refinance, you could end up with even higher rates. All of these factors should be taken into consideration before deciding if an Adjustable Rate Mortgage with a Fixed Period is the best option for you.

Factors to Consider Before Choosing an Adjustable Rate Mortgage with a Fixed Period

When picking an adjustable rate mortgage with a fixed period, there are some important factors to consider. First, you’ll want to look at the interest rate. This will tell you how much you’ll be paying in interest over the course of the loan. You’ll also want to consider the length of the fixed period, since this will determine how long the rate will stay the same before it adjusts. Additionally, you’ll want to look at the terms of the loan, including the maximum rate adjustment and any special features like caps and initial rate discounts. Finally, you’ll want to make sure you understand any fees associated with the loan, such as closing costs, origination fees, and discount points. Taking all these factors into account can help you determine if an adjustable rate mortgage with a fixed period is the right choice for you.

Tips for Finding the Best Adjustable Rate Mortgage with a Fixed Period

If you’re looking for the best adjustable rate mortgage with a fixed period, there are a few tips that can help you get the best deal. First, make sure you compare different lenders to find the best rates. You should also consider the fees and closing costs associated with the loan. Additionally, you’ll want to make sure you understand the loan terms before signing any paperwork. Finally, it’s important to factor in the potential for the interest rate to increase once the fixed period ends. Doing your research and shopping around can help you find the best adjustable rate mortgage with a fixed period for your needs.