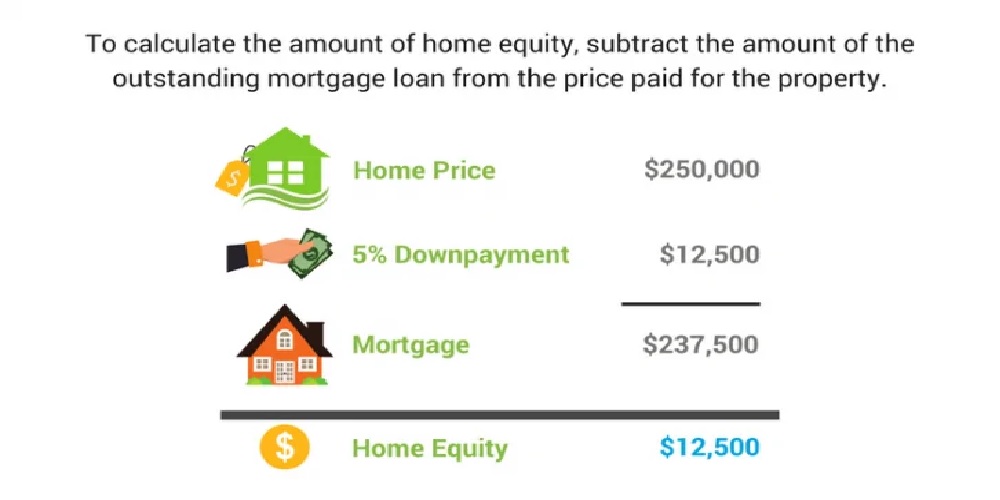

A Growing Equity Mortgage (GEM) is an innovative home loan that allows you to build equity faster. With a GEM, your monthly payments increase at a predetermined rate, resulting in higher equity in your home over a shorter period of time. This type of loan offers a unique way to increase your home’s equity and could be a great option for new homeowners who are looking for ways to build equity quickly. Read on to learn more about Growing Equity Mortgages and how they work.

Introduction to Growing Equity Mortgages: What They Are and How They Work

A growing equity mortgage is a type of home loan that allows the borrower to pay off their debt faster than a traditional mortgage. With this type of loan, the monthly payments increase periodically, usually every year. This allows the borrower to pay off the loan faster because they are paying a larger amount each month and the loan’s principal balance is decreasing faster. It’s a great option for borrowers who want to pay off their mortgage as quickly and cost-effectively as possible. The benefits of a growing equity mortgage include lower interest rates and lower monthly payments, as well as the ability to pay off the loan faster. However, the downside is that your monthly payments will increase each year, so it’s important to make sure you can afford the higher payments before taking out this type of loan.

Benefits of Growing Equity Mortgages

Growing equity mortgages offer a great way to build equity and save up for a home. With a growing equity mortgage, your monthly payments increase over time, allowing you to pay off your mortgage faster while also building equity in your home. The benefits of this type of mortgage are numerous: you can take advantage of lower initial payments, enjoy tax deductions, and use the extra money saved to invest in other areas. Additionally, since your payments increase over time, you can count on having a larger amount of equity in your home when you sell. Growing equity mortgages can be a great way to ensure your home will appreciate in value over time and provide a great return on your investment.

Disadvantages of Growing Equity Mortgages

When it comes to a Growing Equity Mortgage (GEM), there are a few potential drawbacks to consider. One such disadvantage is that the borrower may not be able to keep up with the payments as the amount owed increases. Since the payments are higher with a GEM than with a traditional mortgage, this could cause financial strain on the borrower if their income doesn’t increase accordingly. Additionally, GEMs are usually offered with a fixed rate, meaning that if interest rates drop, the borrower is stuck paying the same amount. This could also lead to difficulty making payments if their income isn’t enough to cover the cost. Finally, it’s important to note that if you decide to pay off the loan early, you may incur additional fees. In short, GEMs can be a great option for some people, but it’s important to weigh the potential drawbacks before making a final decision.

How to Qualify for a Growing Equity Mortgage

If you’re looking to buy a home and want to use a growing equity mortgage to make that dream a reality, there are a few things to consider. First, you’ll need to make sure you have a good credit score, as this will help you qualify for a lower interest rate on the loan. You’ll also need to have a steady income and be able to make your payments on time each month. Finally, you’ll need to make sure you can afford the increasing payments that come with a growing equity mortgage. By ensuring you meet the above criteria, you’ll be well on your way to qualifying for this type of loan and making your homeownership dreams come true.

Tips for Choosing the Right Growing Equity Mortgage

When it comes to choosing the right growing equity mortgage, there are a few important tips to keep in mind. First and foremost, you should make sure you understand exactly how a growing equity mortgage works and how it will affect your payments. Second, you should compare different lenders and rates to find the best deals. Third, it’s important to understand the different fees and closing costs associated with the loan. Finally, make sure you understand the terms of the loan and how long it will take to pay off. Taking the time to research your options and understand the ins and outs of a growing equity mortgage can help you make an informed decision and save you money in the long run.