Graduated payment mortgage (GPM) is an attractive option for those looking to purchase a home with a lower initial payment. For buyers who need to stay within a budget, GPM is a great opportunity to get into the housing market with a reasonable monthly payment that increases gradually over time. With a GPM loan, you can enjoy the security of a fixed-rate mortgage while making smaller payments at the start of the loan, which can help you save money, build equity faster, and get a head start on other financial goals.

Introduction: What is a Graduated Payment Mortgage?

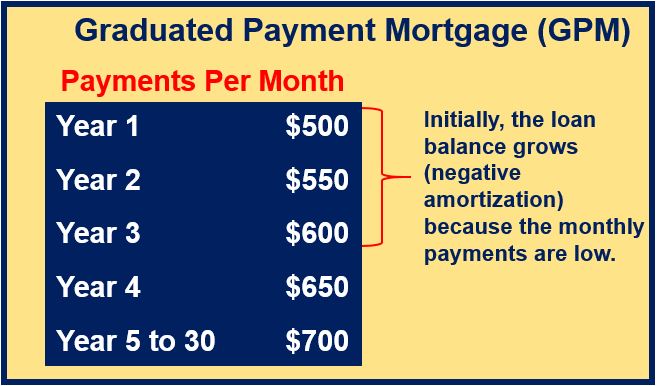

A Graduated Payment Mortgage (GPM) is a type of mortgage loan that starts with a lower payment amount and then increases over time to cover the remaining balance of the loan. Unlike other types of mortgages, GPMs are designed to work with a borrower’s changing financial situation and help make home ownership more affordable. This type of loan is great for those who may not qualify for a traditional mortgage, or those who are expecting their income to increase over time. With a GPM, the borrower can take advantage of the lower initial payments, and then the payments increase gradually as the borrower’s income rises. This makes it easier for borrowers to plan their finances and budget for a home purchase.

Benefits of a Graduated Payment Mortgage

A Graduated Payment Mortgage, or GPM, is a great option for young homebuyers because of the unique benefits it offers. This type of mortgage lets you start off with a lower monthly payment and then gradually increase your payments as your income increases over time. This means that you can get into a larger home than you could afford at the beginning and still make a manageable payment. Additionally, this type of mortgage can help you build equity faster, as your monthly payments increase over time. This is an especially attractive option for young buyers who are just starting out and don’t want to be stuck with a huge mortgage payment that they can’t afford. GPMs are also an especially great option if you want to be able to pay off your mortgage sooner. With the smaller payments up front, you can save more money to put towards the principal balance, helping you pay off your mortgage faster.

Qualifying for a Graduated Payment Mortgage

Qualifying for a Graduated Payment Mortgage (GPM) is one of the most important steps involved in getting approved for a GPM loan. To qualify, you must have a steady income, a good credit score, and enough money saved up for a down payment. Lenders will also look at your debt-to-income ratio to make sure your monthly mortgage payments will fit comfortably within your budget. Before applying for a GPM, it’s important to review your credit report and make sure it is up to date and accurate. You should also have a good idea of how much you can afford to spend each month on a mortgage payment. Taking these steps will help you get the best possible deal on a GPM, and make sure you’re able to make your payments on time.

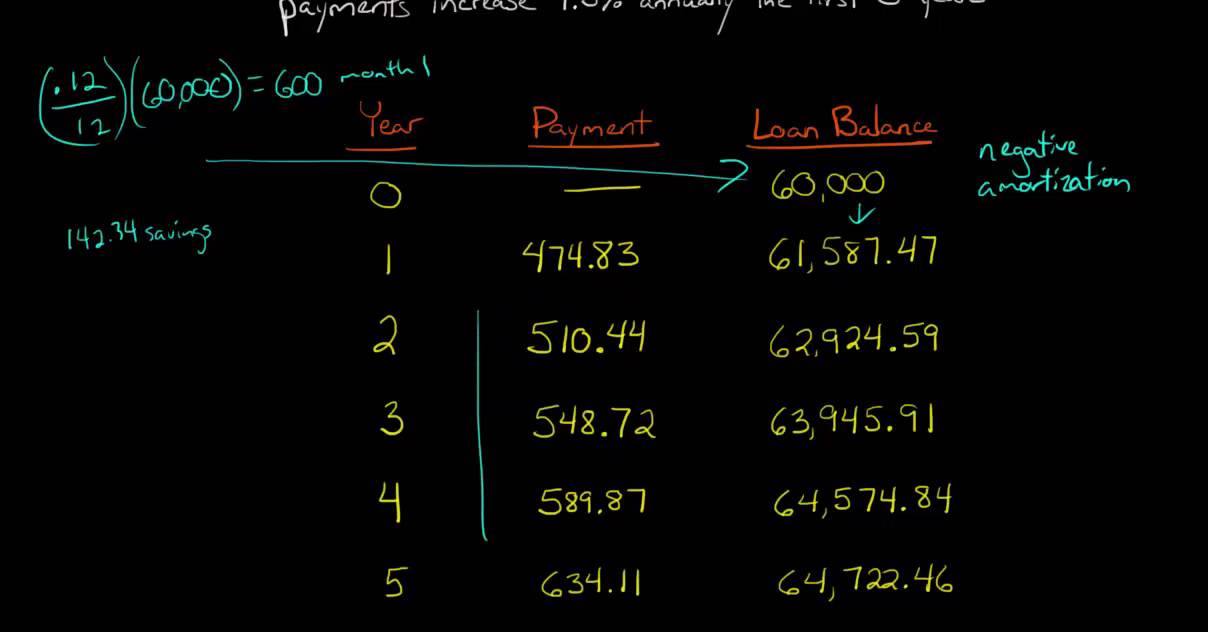

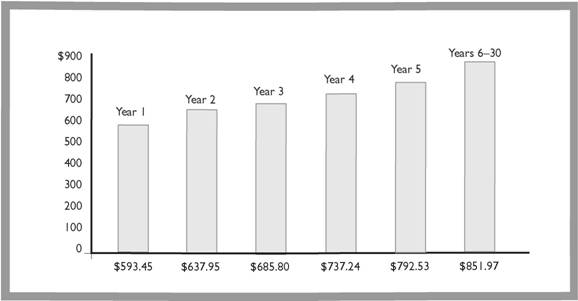

Payment Schedules for Graduated Payment Mortgages

It’s important to understand the payment schedule of a graduated payment mortgage (GPM) if you’re considering taking one out. A GPM is a mortgage with an initial low interest rate that gradually increases over time. This means that your monthly payments will start off low and then increase as the interest rate rises. It’s important to take into account your current financial situation and what you can handle before signing up for this type of loan. Your payment schedule should be tailored to your specific needs in order to ensure that you can meet the payments as they increase over time. Depending on the particular GPM you choose, your payment schedule might be graduated over a period of 5, 7, 10, or 15 years. Be sure to do your research and compare the different GPMs available to you before making your decision.

Considerations When Choosing a Graduated Payment Mortgage

When it comes to selecting a Graduated Payment Mortgage, there are a few things you should consider. First, you should be aware of the terms of the loan. Is the interest rate fixed or adjustable? Also, you should consider the length of the loan and the amount you will have to pay each month. Additionally, you should look at the additional fees that may be charged with the loan such as origination fees, closing costs, etc. Finally, you should make sure that you understand the repayment schedule and any potential penalties for late payments. Taking the time to evaluate all of these factors can help you make the most informed decision when selecting a Graduated Payment Mortgage.