Shared appreciation mortgages (SAMs) are an innovative form of home financing that can help homeowners unlock the equity in their home without taking on additional debt. SAMs offer the opportunity to benefit from an increase in home value without paying any interest on the loan. This makes them a great financial solution for homeowners who want to access their home’s equity without taking on more debt. With SAMs, homeowners can receive a lump sum of money while still owning the house and benefiting from any future increase in its value. Read on to learn more about the details of shared appreciation mortgages and how they can help you access the equity in your home.

Overview of a Shared Appreciation Mortgage

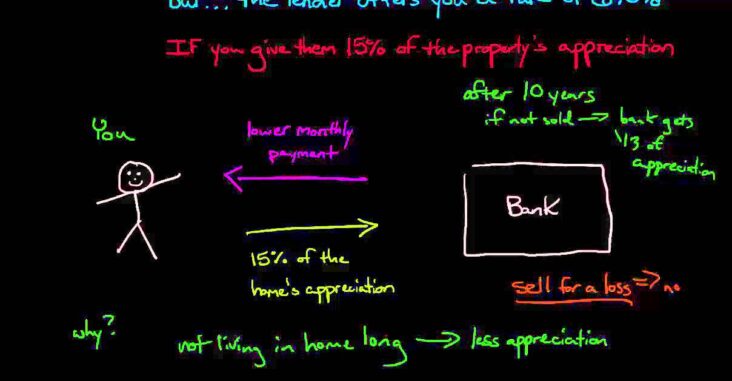

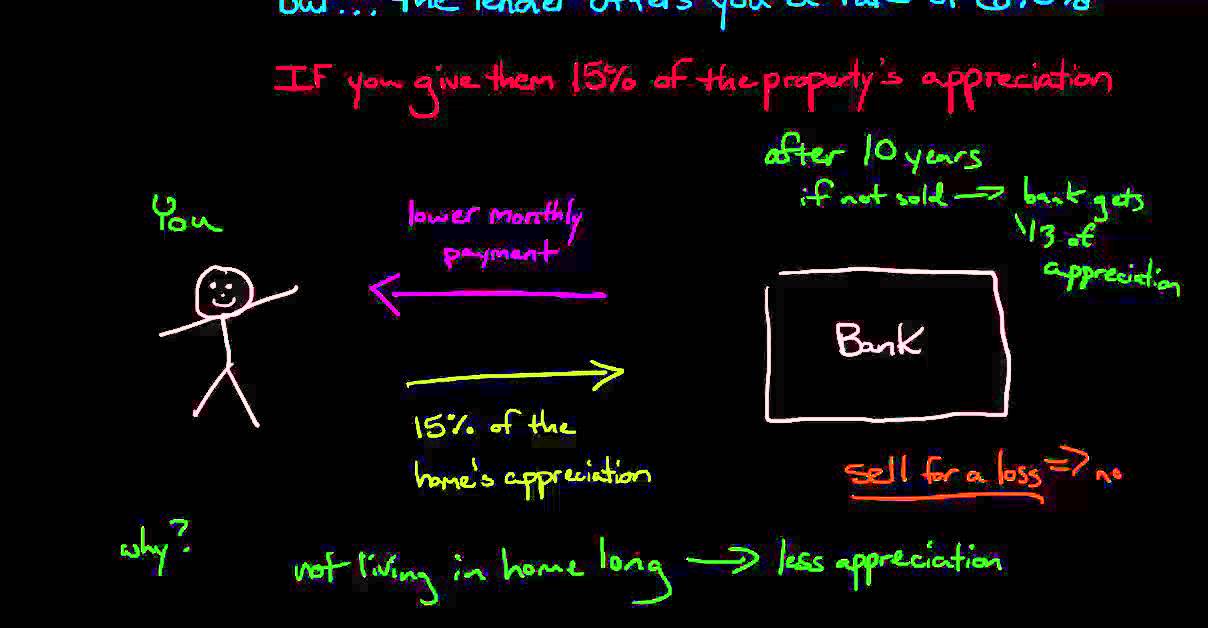

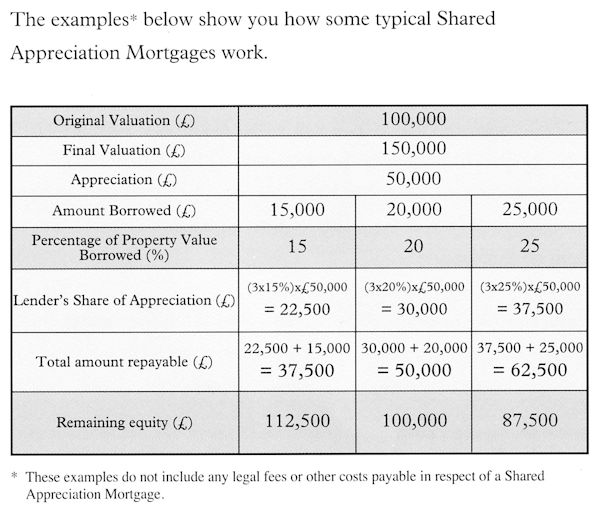

A Shared Appreciation Mortgage (SAM) is an innovative way for homeowners to get financial assistance with their mortgage payments. It’s a type of loan in which the homeowner agrees to give the lender a portion of the equity in their home in exchange for a one-time payment to cover the mortgage. The lender then keeps the appreciation of the home over time and shares it with the homeowner as a way to reduce the homeowner’s monthly mortgage payments. This type of loan is a great way for homeowners who need financial assistance but don’t necessarily qualify for a traditional loan. A Shared Appreciation Mortgage can be a great way to get the help you need without taking on too much debt.

Types of Shared Appreciation Mortgages

Shared Appreciation Mortgages (SAMs) are a great way to get extra cash when you need it. They are a type of loan that allows borrowers to tap into the equity they have in their home in exchange for a share of the appreciation when the home is eventually sold. SAMs are used by borrowers who want to access cash without taking out a traditional mortgage loan. These loans are most often used by people who have a home with a lot of equity but don’t want to take out a traditional loan and add more debt to their portfolio. With SAMs, the lender will give the borrower a lump sum of cash in exchange for a portion of the appreciation the home has experienced when it’s eventually sold. This can be a great way to get some extra cash without having to take out a traditional loan, so be sure to consider it when you’re looking for ways to finance your home.

Benefits of a Shared Appreciation Mortgage

Shared appreciation mortgages offer a range of benefits for homeowners. They can provide an option for those who are unable to qualify for a traditional mortgage, allowing them to purchase a home without having to put down a large down payment. Additionally, the monthly payment on a shared appreciation mortgage is typically much lower than a traditional mortgage, allowing borrowers to save on their monthly expenses. The shared appreciation mortgage also offers the benefit of allowing the homeowner to build equity in their home, as the lender shares in the appreciation of the property over time. Finally, shared appreciation mortgages are a great option for borrowers who are looking to purchase a home quickly, as they do not require the borrower to wait for the traditional mortgage approval process. With all these benefits, it’s easy to see why shared appreciation mortgages are becoming increasingly popular among homeowners.

Considerations When Choosing a Shared Appreciation Mortgage

When it comes to choosing a shared appreciation mortgage, there are certain things that you should take into consideration. For starters, you should always make sure that you understand the terms and conditions of the mortgage before signing any documents. It is important to know the length of the loan and the interest rate, as well as any other fees that you may be responsible for. Additionally, you should always be aware of the risks associated with this type of loan, as you may be required to give up a portion of the appreciation in your home if the value increases over time. It is also important to understand the tax implications of a shared appreciation mortgage, as it could potentially have an effect on your overall financial situation. By doing your research and making sure that you are fully aware of the details of the loan, you can help ensure that you are making the best decision for your financial future.

Best Practices for Repaying a Shared Appreciation Mortgage

When it comes to paying off a shared appreciation mortgage, there are a few best practices to follow. First and foremost, it’s important to make sure you are making your payments on time and in full. Failing to make your payments on time can lead to higher interest rates and potentially the foreclosure of your property. Additionally, you should be sure to check the terms of your agreement, as some lenders may require a minimum payment each month or have other restrictions that you should be aware of. Another important best practice is to make sure you are aware of any prepayment penalties associated with your loan. Some lenders may charge a fee if you decide to pay off your loan ahead of schedule, so make sure to check for any fees before making a payment. Finally, you should always consult with a financial advisor before entering into any loan agreement, especially one with an unfamiliar lender. A financial advisor can help you understand the terms and conditions of your loan, as well as provide advice on how best to manage your payments. Taking the time to understand the terms of your loan and following best practices when paying it off can help you make the most of your shared appreciation mortgage.