A Home Equity Line of Credit (HELOC) is a great way to use the equity in your home to access funds for a variety of needs. It allows you to access funds when needed, making it a great solution for those who need to pay for renovations, make large purchases, or consolidate debt. With a HELOC, you can borrow up to a certain amount of money, without having to go through the process of taking out a loan. A HELOC offers a great deal of flexibility and can be used in any situation that requires extra cash. In this article, we will discuss what a HELOC is, how to get one, and the benefits of using a HELOC.

What is Home Equity Line Of Credit (HELOC) and How Does it Work?

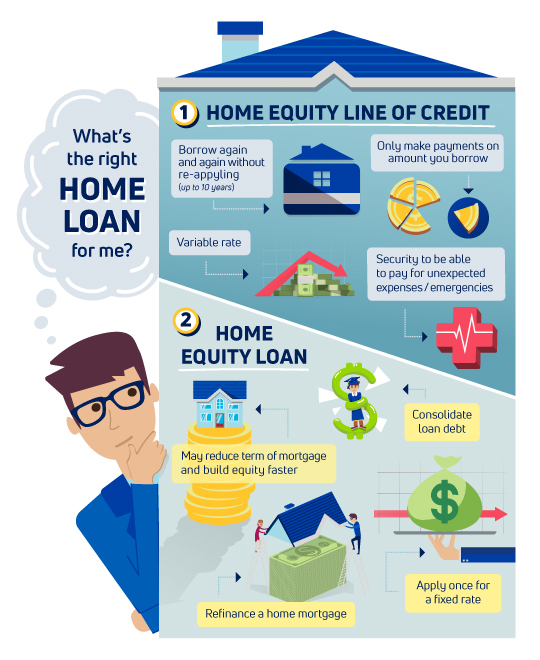

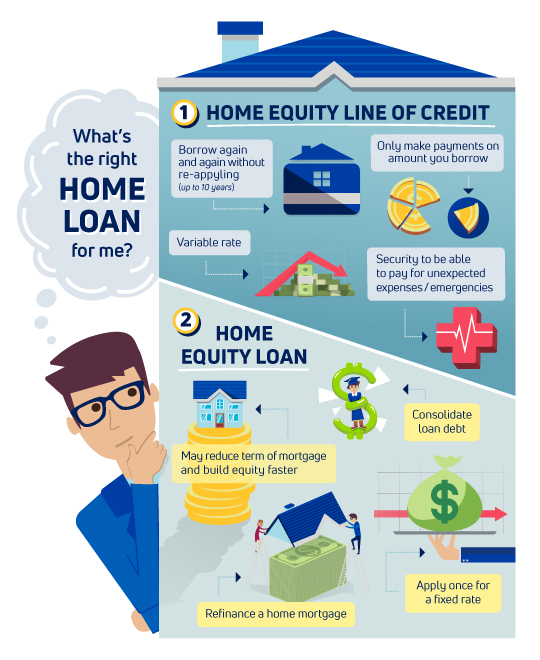

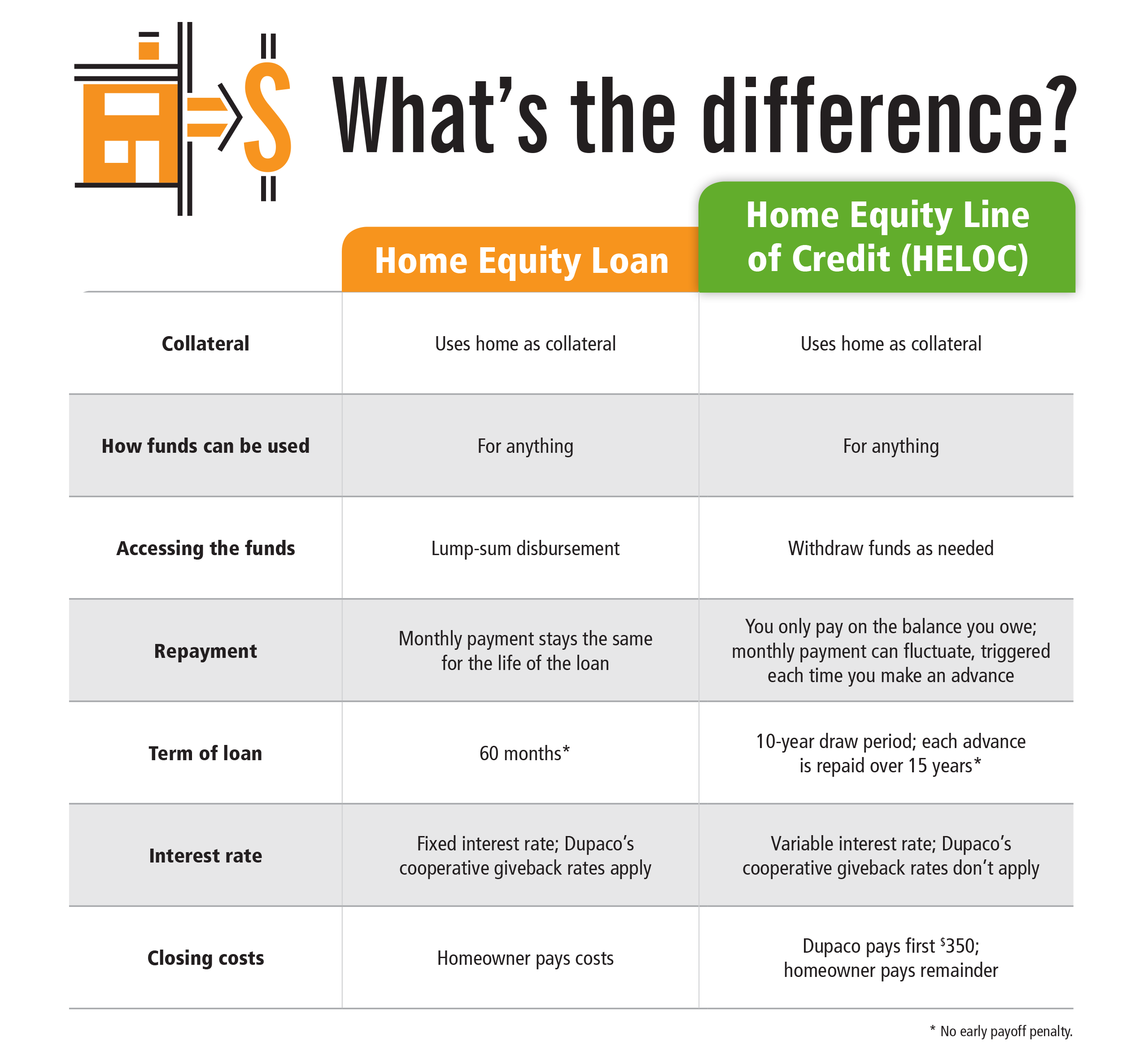

A Home Equity Line of Credit (HELOC) is a great way to access the equity in your home and potentially use it for large purchases or investments. It works like a credit card in that you have access to an amount of money that you can use as you need it. You are able to borrow up to a certain limit and will be required to make payments on the balance. It can be a great tool for those looking to use the equity in their home for large purchases or investments. The interest rate on a HELOC is typically lower than other types of loans, making it a great option for those looking to save money. Once you’ve established a HELOC, you’ll have access to the funds when you need them without having to reapply each time. So if you’re looking for a way to access the equity in your home and use it for investments or large purchases, a HELOC might be the right option for you.

Benefits of a Home Equity Line Of Credit (HELOC)

A home equity line of credit, or HELOC, is a great way to access the equity in your home and use it to make improvements, pay off debts, or even just cover everyday expenses. With a HELOC, you get access to a revolving line of credit that you can use as often as you want and the interest rate is often lower than many other loan options. The benefits of a HELOC are plenty: you can access the funds when you need them, manage them easily, and interest rates are generally lower than other loan options. With a HELOC, you can also use the money for whatever you need it for, from home renovations to paying off debt. Plus, the interest you pay on HELOCs may be tax-deductible, so you can save even more money. A HELOC is a great way to take advantage of the equity in your home and make it work for you.

The Risks of Taking Out a Home Equity Line Of Credit (HELOC)

Taking out a HELOC can be a great way to access cash quickly, but it also comes with some risks. One of the biggest risks is that you could end up owing more than you are able to pay back. If you take out a HELOC, you will be obligated to pay back whatever amount you borrow on top of the interest that accumulates over time. If you’re not able to make payments, you could end up with late fees, a damaged credit score, and even foreclosure. It’s important to be mindful of your budget and only borrow what you can comfortably pay back.

How to Qualify for a Home Equity Line Of Credit (HELOC)

Qualifying for a Home Equity Line of Credit (HELOC) can be a great way to access some extra cash. Although the requirements for qualification can vary from lender to lender, some of the general requirements are the same. To qualify for a HELOC, you must have at least 20% equity in your home, have good credit, have a sufficient income, and have a satisfactory debt-to-income ratio. Additionally, the bank will require an appraisal of your home to determine the equity. If you meet all the criteria, you can be approved for a HELOC in no time!

How to Choose the Right Home Equity Line Of Credit (HELOC) for You

When it comes to choosing the right HELOC for you, there are a few important points to consider. First, you need to decide how much you can afford to borrow and how much you can realistically pay back. You’ll also need to consider the interest rate and fees associated with the loan. Additionally, you should look at the repayment terms of the loan and check to see if there are any prepayment penalties. Finally, make sure to read the fine print and understand all the conditions of the loan before signing the contract. Taking the time to compare different lenders and their offers will help you make the best decision for your financial situation.