Are you ready to purchase your first home but unsure of the role of down payment and closing costs in the mortgage and home buying process? You’re not alone! Many first-time home buyers are unfamiliar with the importance of down payment and closing costs and how they can affect their mortgage and the overall cost of buying a home. In this article, we will explore the role of down payment and closing costs in the mortgage and home buying process and how to best navigate them.

Down Payment: The down payment is an important part of the home buying process

The down payment is an essential part of the home buying process and is typically the largest cost associated with purchasing a home. It is the amount of money that the buyer has to pay upfront in order to purchase the property and is usually a percentage of the total purchase price. The amount of the down payment can vary depending on the loan program and the buyer’s individual circumstances. Generally, buyers should strive to put down as much as they can afford in order to reduce the amount of their monthly mortgage payments. Additionally, a larger down payment can also help buyers qualify for more favorable loan terms and lower interest rates. It is important for homebuyers to research their options and understand the impact of the down payment on their overall mortgage costs. Understanding the down payment requirements of each loan program and how they can impact the overall purchase price and loan terms is key to finding the right mortgage for their needs.

It is the initial amount of money that a home buyer pays towards the purchase of the home

When it comes to home buying, the down payment and closing costs are two of the most important aspects to consider. The down payment is the initial amount of money that a home buyer pays towards the purchase of a home and typically ranges from 5-20% of the total cost. It is important to plan ahead and set aside money for the down payment to ensure that the home buying process goes smoothly. The closing costs are the additional fees that must be paid before the sale of a home can be finalized. This includes things like loan origination fees, appraisal fees, title search and insurance fees, and other administrative costs. It is important to know and understand exactly what is included in the closing costs before signing any paperwork to ensure that you are not overpaying for your home. Taking the time to carefully plan for the down payment and closing costs can help to make the home buying process easier and help you to save money in the long run.

This money is usually paid upfront and is usually a percentage of the total purchase price.

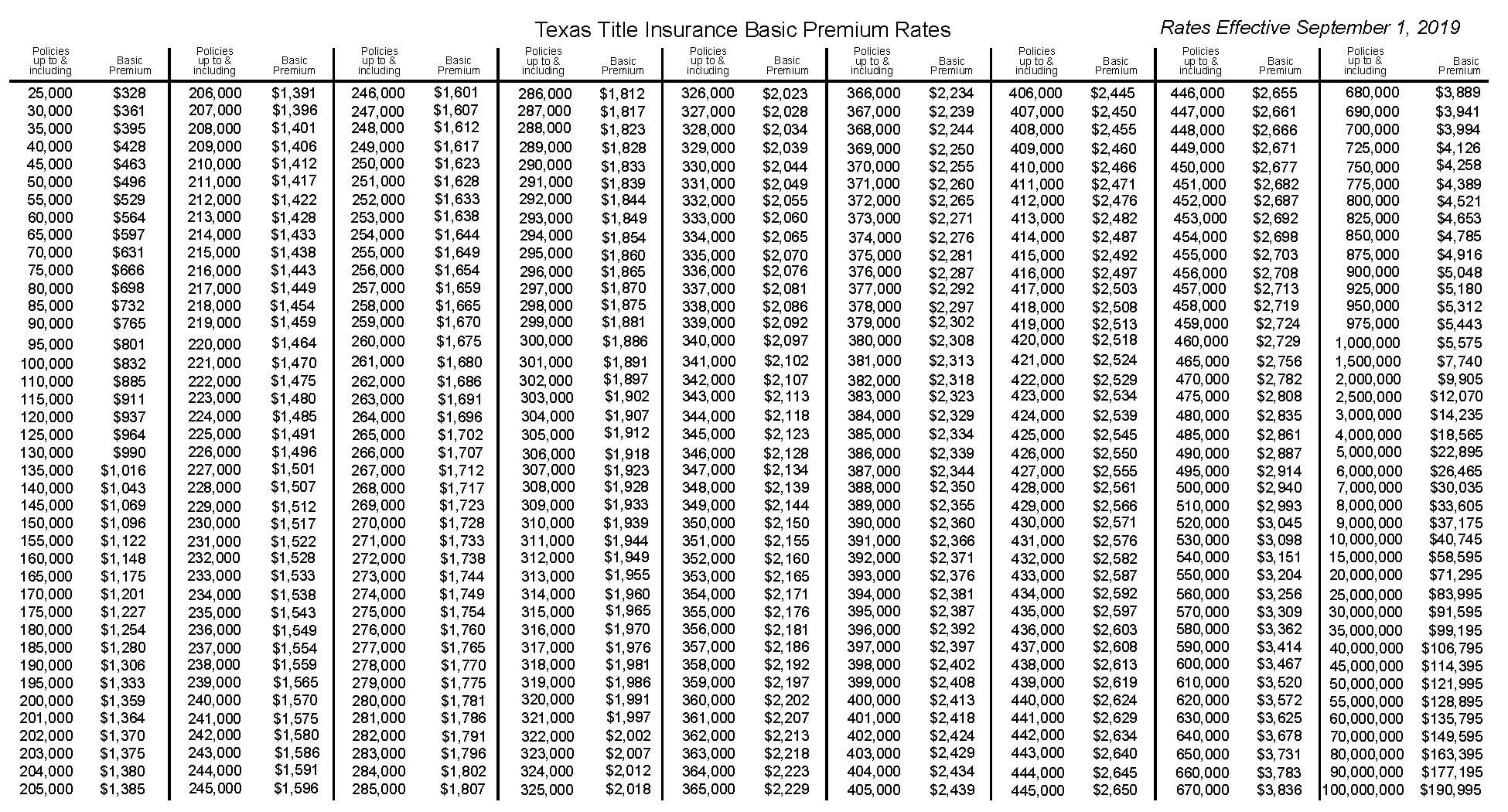

When you are in the process of buying a home, one of the most important financial decisions you will make is how much to put down as a down payment. Down payments are generally a percentage of the total purchase price of the home and are typically paid upfront. Generally, the more you can put down as a down payment, the better. Putting down a larger down payment will result in a lower monthly mortgage payment and can even help you to get access to more favorable loan terms and interest rates. In addition to the down payment, home buyers must also prepare to pay closing costs. Closing costs are the fees associated with obtaining a mortgage and closing on your new home. These costs can vary depending on the lender, loan type, and other factors, but can typically range from 2-7% of the total loan amount. Examples of closing costs include appraisal fees, title fees, and credit report fees. It’s important to factor in the closing costs when budgeting for your new home, as they can add up quickly and will need to be paid at the time of closing.

Closing Costs: Closing costs are fees associated with the purchase of a home

Closing costs are the fees associated with purchasing a home and can add up to thousands of dollars. These costs are typically paid for by the buyer, though in some cases the seller may agree to pay for some or all of them. The most common closing costs include loan origination fees, appraisal fees, title search fees, recording fees, and prepaid interest. It is important to be aware of these costs and budget accordingly when purchasing a home. Additionally, it is important to understand the various types of closing costs and how they can affect your total mortgage payment. Knowing this information can help you make an educated decision and find the best deal for your home.

They include things like loan origination fees, title insurance premiums, appraisal fees, recording fees and other costs

Buying a home is a major financial commitment and understanding the role of down payment and closing costs is key to making this commitment. Down payments are the initial lump sum payment required to secure a mortgage loan. Generally, the more money put down as a down payment, the lower the interest rate and monthly payments on the loan. Closing costs are the costs associated with obtaining the loan, such as loan origination fees, title insurance premiums, appraisal fees, and recording fees. Although they are usually included in the mortgage loan and paid at the time of closing, these costs can add up and may affect the total amount of money needed to close on the loan. It is important to understand the role of down payment and closing costs in order to make an informed decision when buying a home. Knowing the amount of money needed to secure the loan and the associated costs will help potential buyers make the best decision for their financial situation.

These fees can add up quickly and should be factored into the total cost of the home.

The costs of buying a home can quickly add up, and it is important to factor in closing costs and down payments when calculating the total cost of the home. Closing costs include items like appraisal fees, title fees, and lender fees, and can range from 2-5% of the home’s cost. These costs can be paid by the buyer, the seller, or split between both parties, so it is important to discuss payment options with your real estate agent and lender. Additionally, the down payment is the amount of money that is paid upfront to secure the loan and can range from 3-20% of the purchase price. Saving up for a down payment and closing costs can be challenging and time consuming, but it is an important step in the home-buying process. It is important to budget for these costs and plan ahead in order to ensure a smooth home-buying process.

Impact on Your Mortgage: The amount of the down payment and the closing costs are typically factored into your mortgage loan

The down payment and closing costs are a major factor when obtaining a mortgage loan. Your down payment is the amount of money you pay upfront to purchase your home, while the closing costs are all the fees associated with the loan, including title and appraisal fees. The higher your down payment is, the lower your monthly mortgage payments will be. On the other hand, closing costs can add up quickly and can have an impact on your mortgage loan. When purchasing a home, it is important to factor in both your down payment and closing costs to make sure that your mortgage loan is affordable. Additionally, having a larger down payment can also lower the mortgage insurance premiums and the loan-to-value ratio, which can help to secure a better interest rate. It is important to consider all of these factors when deciding on how much money to put down on a home.

A larger down payment and lower closing costs can significantly lower the overall cost of your mortgage loan.

Making an informed decision when it comes to your mortgage loan and home buying is essential. One of the most important decisions you’ll make is the size of your down payment and the amount of closing costs you’ll pay. Although there are exceptions, in general, a larger down payment and lower closing costs can significantly lower the overall cost of your mortgage loan. A larger down payment can reduce the amount you borrow, therefore reducing the interest rate charged on your loan. This can result in hundreds or thousands of dollars in savings over the life of your loan. In addition, a larger down payment can reduce the need for private mortgage insurance, or PMI. PMI is an insurance policy that protects the lender in the event of a borrower’s default, and it can add thousands of dollars to your mortgage cost. Closing costs can also add up to a significant amount of money. The amount can vary depending on the lender and other factors, but typically include items such as appraisal fees, title fees, and attorney fees. To reduce the amount of closing costs, it’s important to shop around and compare rates. You may also be able to negotiate with the seller and have them cover part or all of the closing costs.

Impact on Your Home Buying Budget: When deciding how much home to buy, it’s important to factor in both the down payment and the closing costs

When budgeting for a home purchase, both the down payment and the closing costs should be taken into consideration. The down payment is the portion of the purchase price that is paid up front and is typically a percentage of the total cost. Closing costs include administrative costs, taxes, and other fees associated with the purchase and can vary greatly depending on the home and the state. Both the down payment and closing costs can have a significant impact on the overall budget for a home purchase. It is important to factor in both the down payment and closing costs when determining the maximum home price that can be afforded. Additionally, there are loan programs available that can help with the down payment and closing costs. It is important to research all available options to ensure that the best possible loan program is chosen. By taking the time to understand the impact of the down payment and closing costs on the budget, home buyers can ensure that they are getting the best possible deal on their new home.

These costs can add up quickly and can have a major impact on your monthly budget.

When buying a home, it is important to take into account the costs associated with the process, such as down payments and closing costs. These costs can add up quickly and can have a significant impact on your monthly budget. A down payment is the initial payment you make when purchasing a home. It is typically a percentage of the total purchase price and can range from 3% to 20%. On the other hand, closing costs are the expenses associated with the closing of a home loan. These costs can include appraisal fees, title insurance, attorney fees, and other costs. It is important to be aware of these costs and budget for them in advance to ensure that you can afford the monthly mortgage payment. Understanding the role of down payments and closing costs can help you make wise decisions when buying a home.

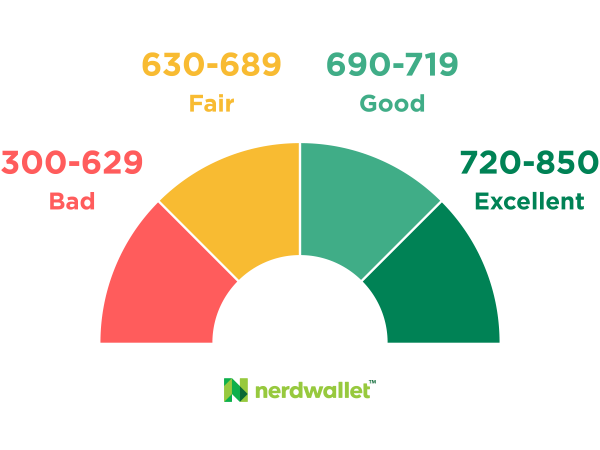

Impact on Your Credit Score: Making a large down payment and having low closing costs can have a positive impact on your credit score

When you make a large down payment and have low closing costs on a mortgage, it can have a positive impact on your credit score. This is because it reduces the amount of money you need to borrow from the lender, which in turn reduces the amount of risk the lender is taking on. Additionally, it can demonstrate to the lender that you are financially responsible and have the ability to make payments on time. By having a better credit score, you can also get lower interest rates on your loans, which can save you money in the long run. Finally, having a good credit score can make it easier to get approved for a loan and can lead to better loan terms. Ultimately, making a large down payment and having low closing costs can be beneficial for your credit score and can help you save money and get better loan terms.

A higher credit score can give you access to

Having a higher credit score can give you access to many different types of home loans and mortgage options. It can be especially beneficial when it comes to the down payment and closing costs associated with your mortgage and home buying process. A higher credit score can give you access to lower down payment and closing costs options, which can save you a significant amount of money. Additionally, a higher credit score can give you access to better interest rates, which can help you pay off your mortgage faster and ultimately save you money in the long run. A higher credit score can also give you access to more favorable terms when it comes to the closing costs associated with your mortgage and home buying process. Higher credit scores can give you access to more competitive terms, such as lower origination fees and other closing costs. Having a higher credit score can also give you access to more loan products and better loan terms, which can help you get the best deal possible on your mortgage and home buying process.