Private mortgage insurance (PMI) is a type of insurance that protects lenders from potential losses when borrowers default on their home loan. It is typically required for those with a down payment of less than 20% when purchasing a home. PMI can also be beneficial for borrowers who can’t make a large down payment but wish to purchase a home. In this article, we’ll discuss what private mortgage insurance is, how it works, and why it’s important.

What is Private Mortgage Insurance and How Does it Work?

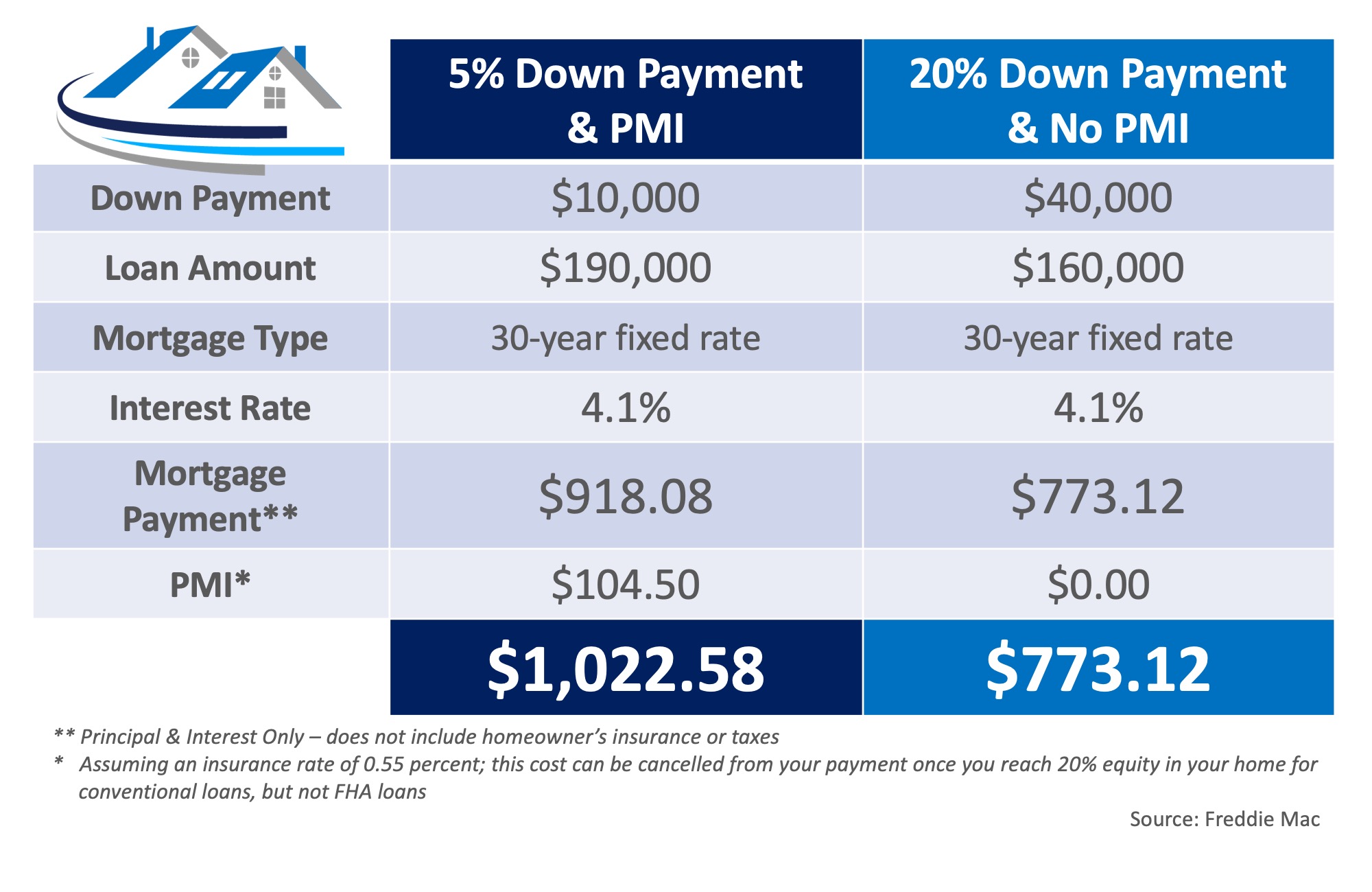

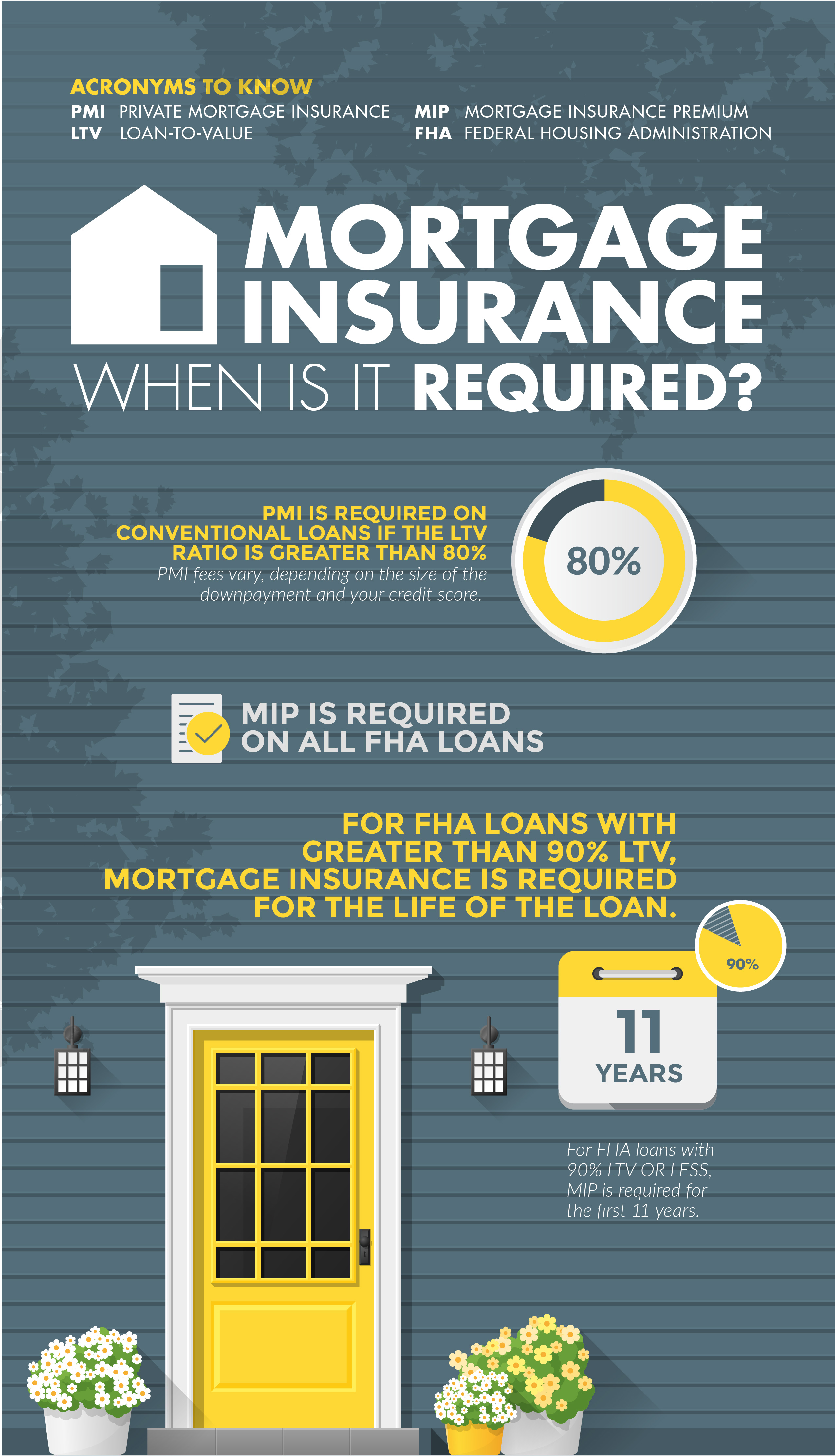

Private Mortgage Insurance, or PMI, is an insurance policy that homebuyers are required to pay if they are putting down less than 20 percent of the purchase price of the home. This type of insurance helps lenders protect their investment in case the borrower defaults on their loan. PMI can be paid monthly or up front, depending on the loan structure, and the amount of PMI depends on the amount of the down payment, the loan amount, and the borrower’s credit score. PMI works by protecting lenders from losses that might occur if a borrower defaults on their mortgage. If the borrower defaults, PMI will cover the difference between what the lender is owed and the amount they can recoup from the sale of the home. This type of insurance is a great way for lenders to reduce their risk and allow more people to get a loan. It also allows borrowers to get a loan despite having a lower down payment, making it easier to purchase a home.

Benefits of Private Mortgage Insurance

Private mortgage insurance (PMI) is an important part of home ownership, and it can provide many benefits to home owners. One of the biggest benefits of private mortgage insurance is that it can help home owners get into a home that they may not have qualified for otherwise. PMI can provide you with a lower down payment option and make it easier to afford your monthly mortgage payments. Additionally, PMI can help you save money in the long run by decreasing the amount of interest you pay on the loan. This can be especially beneficial if you plan on staying in the home for a long period of time. Finally, PMI can give you peace of mind knowing that you are protected if you are unable to make your payments. All in all, private mortgage insurance can be a great way to make homeownership more affordable.

What Factors Determine the Cost of Private Mortgage Insurance?

When it comes to the cost of private mortgage insurance, there are a few factors that determine this cost. One of the primary factors is the size of the down payment you make on the house. The larger the down payment, the lower the PMI cost will be. The type of loan you choose also affects the cost of PMI. For example, an adjustable-rate mortgage (ARM) will typically have a higher PMI cost than a fixed-rate mortgage. Your credit score is also taken into consideration when determining the cost of your PMI. A higher credit score will usually result in a lower PMI cost. Lastly, the lender’s PMI rate can also affect the overall cost of private mortgage insurance. Different lenders offer different PMI rates, so be sure to shop around to get the best rate possible.

When Can You Stop Paying Private Mortgage Insurance?

When it comes to private mortgage insurance (PMI), many homeowners want to know when they can stop paying for it. PMI is typically required when you don’t have a 20% down payment, and it can add to your monthly mortgage payments. The good news is that you don’t have to pay PMI forever, and you can stop paying it once you reach a certain amount of equity in your home. You can reach this equity by making regular payments on your mortgage or by increasing the value of your home. When the value of your home reaches 80% of the original purchase price, you can request that your lender have the PMI removed from your payments. Homeowners can also look into refinancing their loan to have the PMI removed. Refinancing can be beneficial as it can often result in lower monthly payments as well. Ultimately, it is important to do your research and to work with your lender to make sure you are paying the least amount of PMI for as short of a period of time as possible.

How to Shop For Private Mortgage Insurance?

Shopping for private mortgage insurance can seem daunting, but it doesn’t have to be. Doing your research beforehand and knowing which factors to consider when comparing policies can help make the process much smoother. There are a few key things to look out for when shopping for private mortgage insurance. Firstly, consider the cost of the policy and make sure that you’re getting the best value for your money. Also, check to see what type of coverage the policy provides, as some policies may not offer the full range of coverage that you need. Finally, look into the reputation of the insurer and make sure that they have a good track record of paying out claims. Taking the time to research the different policies available can help ensure that you get the best private mortgage insurance policy for your needs.