Are you looking to buy a house but feeling a little confused by all the terms and conditions? One of the most important elements of a mortgage is hazard insurance, and it’s essential to understand exactly what it is and how it can protect you and your home. In this article, we’ll explain what hazard insurance is and why it’s so important for those with a mortgage.

What is Hazard Insurance and How Does it Protect Homeowners?

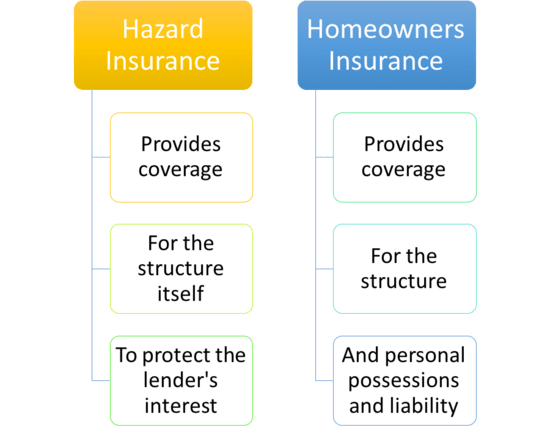

If you’re a homeowner, you’re probably aware of the importance of hazard insurance. Hazard insurance protects your home from losses due to certain types of natural disasters. It covers physical damage to your home such as fire, wind, hail, and lightning. It also covers personal belongings, like furniture, electronics, and clothing, that may be damaged in a disaster. It can also provide coverage for additional living expenses if you’re unable to live in your home due to damage from a disaster. To protect your home and belongings, you should consider purchasing a hazard insurance policy in addition to your basic homeowners insurance policy. With hazard insurance, you can rest easy knowing your home is protected in case of a disaster.

Exploring the Different Types of Hazard Insurance Coverage

It’s important to understand the different types of hazard insurance coverage when it comes to your mortgage. There are three main types of coverage: dwelling fire, special form, and comprehensive form. Dwelling fire coverage is the most basic and covers losses from fire, lightning, and explosions. Special form coverage includes losses from these perils, as well as from wind, hail, smoke, and vandalism. Comprehensive form coverage provides the most complete coverage and includes losses from these perils, as well as from theft, water damage, and personal liability. It’s important to understand the differences between each coverage and what it covers so you can make sure you’re getting the right coverage for your mortgage.

Understanding How Hazard Insurance Affects Mortgage Rates

Hazard insurance can play a big role in determining the mortgage rate you get. It’s important to understand how it works and the different factors that go into it. The type of property, the area, and the lenders all have an effect on the rate of hazard insurance. Knowing these things can help you get the best rate for your mortgage. It’s also important to know the basic coverage of hazard insurance so you know what you’re getting into and can negotiate a better rate if needed. Understanding how hazard insurance can affect your mortgage rate can help you get the best deal possible.

The Benefits of Purchasing Hazard Insurance for Mortgage Protection

Hazard insurance is a must-have for homeowners with a mortgage. Not only does it provide protection for your property in the event of a natural disaster, it also provides peace of mind knowing that you’re covered in case of any unexpected catastrophes. With hazard insurance, you’ll be protected from many of the common risks to your home, such as fires, windstorms, hail, and even theft. Plus, if your home is damaged or destroyed, you’ll have coverage to help you rebuild or replace your home and belongings. Having the proper hazard insurance coverage can even help protect you from potential legal issues, like if someone is injured while on your property. All in all, purchasing hazard insurance for mortgage protection is a smart investment that can save you money in the long run. Don’t take the risk – make sure you’re covered!

What to Consider When Shopping for Hazard Insurance for Your Mortgage

When shopping for hazard insurance for your mortgage, there are a few important things to consider. First, make sure the coverage you purchase is sufficient to protect your home and belongings in the event of a disaster. You should also consider the cost of the policy and make sure it fits your budget. Additionally, it’s important to look for a policy that offers a wide range of coverage for different types of hazards, such as fire, wind, hail, and water damage. Finally, make sure the insurance company you choose has a good reputation and is financially sound. Doing your research before buying a policy can save you money and help you get the coverage you need.